1. If the employee who holds the policy is the patient, his or her insurance is the primary insurance for any services obtained. The spouse’s or partner’s insurance becomes the secondary insurance and can be used to pay only for any portion of the charge not covered by the primary insurance. The deductible for the primary insurance may not be covered by the secondary insurance. 2. If a child is the patient, in most states the “birthday rule” applies. Under the birthday rule, the primary insurance for the child of parents who both have a family health plan is the insurance belonging to the working adult whose birthday comes first in the year. The insurance of the adult whose birthday is later is the secondary insurance. 3. When the patient is a child of divorced parents, the rules can get somewhat complicated. If a court has decreed that one parent is the “responsible party,” that parent’s policy provides the primary insurance. A responsible party ruling is often made in cases of joint custody, although the responsible party can also be a noncustodial parent. If no court ruling is in place, the custodial parent’s policy is primary if the custodial parent has remarried. If there is no court ruling in place and the custodial parent has not remarried, the birthday rule remains in effect. 4. If the patient is a Medicare recipient who also is covered by an employer’s policy, the employer’s policy is the primary insurance and Medicare is the secondary insurance. Patients with Medicare may also have supplemental insurance to cover what would normally be a patient responsibility. These plans, which are clearly defined as Medicare supplemental insurance, are considered secondary insurance. The insurance company determines the allowed charge in two ways: 1. Through a fee schedule. A fee schedule says the insurance company will pay the specified percentage of a particular amount for a particular procedure. Any additional charges are the patient’s responsibility. 2. Through service benefits, which define covered services but not the exact payments. Under service benefit plans, the insurance company will agree to pay the specified percentage of charges that are usual, customary, and reasonable (UCR) for the procedure and the state or region of the country in which it was performed. The usual fee is the amount that a physician usually charges or charges most often. The customary fee is the amount charged by physicians in the same specialty in the same geographic area (usually the 90th percentile amount of the charges of all physicians in the area. A reasonable fee meets the two criteria described earlier or is justifiable if there are special circumstances. Based on statistics kept by the insurance company, the fee actually charged by the physician is reviewed. The insurance company’s payment is based on its own determination of what is UCR. 1. Each patient chooses one physician as a primary care provider (PCP), a physician who provides most of the patient’s care and also determines what other medical services the patient requires. 2. Care is usually restricted to specific providers, laboratories, and hospitals that have accepted the insurance plan’s fee schedule or capitation payment plan. 3. The patient may or may not have access to providers and services outside the insurance plan. If there are tiers of providers, the patient must usually pay more for services obtained outside the plan. In addition, the patient may be subject to balance billing if he or she seeks service from a provider who is outside the managed care plan. This means that the patient must pay the difference between the amount allowed by insurance and the amount charged for services. 4. The insurance plan may require referrals from a PCP for services including consultations with specialists, therapy such as physical therapy or speech therapy, care outside of the medical office, and some diagnostic tests. The PCP functions as a “gatekeeper” to limit and approve access to specialty services. (The process of referrals is discussed later in this chapter.) 5. The insurance plan usually requires prior notification and/or utilization review (reviewing proposed or current care to determine medical necessity) before authorizing referral to specialists, certain procedures, therapy, surgery, and other types of care.

Medical Insurance

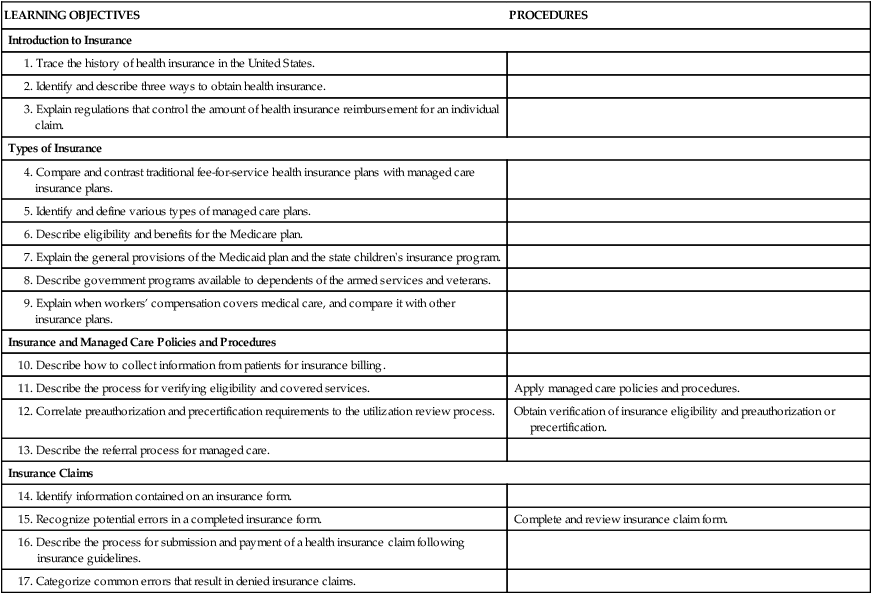

LEARNING OBJECTIVES

PROCEDURES

Introduction to Insurance

Types of Insurance

Insurance and Managed Care Policies and Procedures

Apply managed care policies and procedures.

Obtain verification of insurance eligibility and preauthorization or precertification.

Insurance Claims

Complete and review insurance claim form.

Introduction to Health Insurance

Factors Affecting Insurance Reimbursement

Primary, Secondary, and Tertiary Insurance

Coordination of Benefits

Types of Insurance

Fee-for-Service Plans

Managed Care Plans