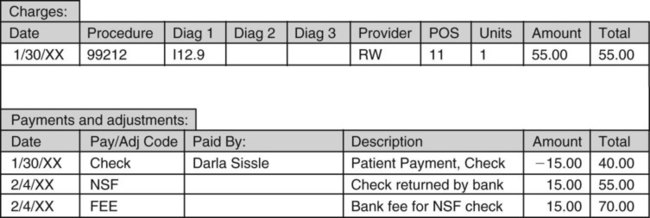

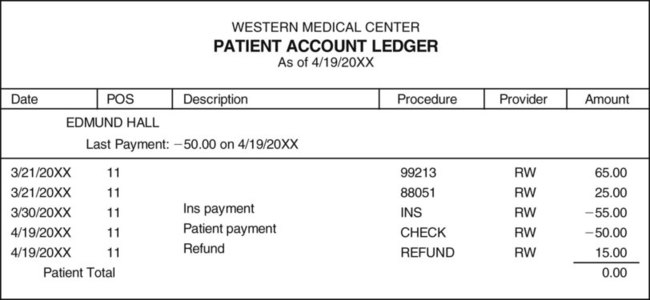

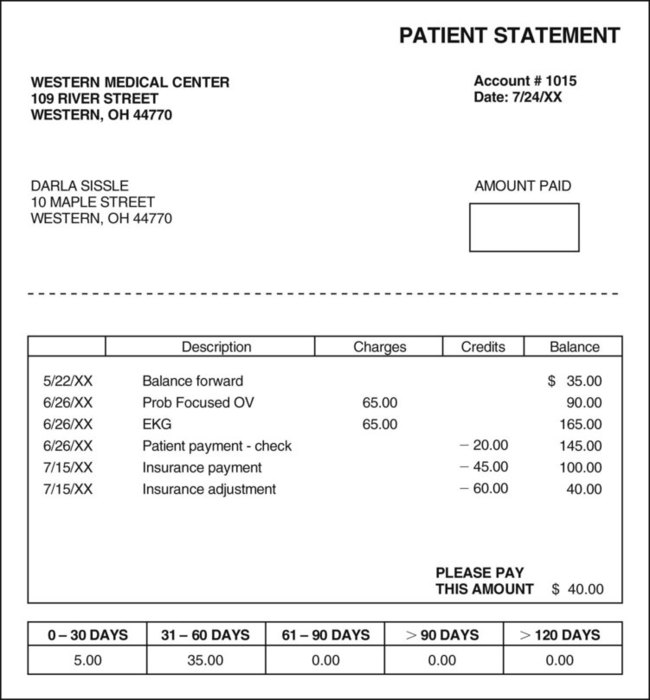

Bills can be produced manually using a word processing program and billing template, but in almost all medical offices they are produced using the medical office practice management program (Figure 47-1). If an outside billing service is used, the service can either send a paper record of all of the bills sent out at the end of each cycle or can transfer billing information from its computer to the office’s computer, linking the information into the patient’s financial record and the office’s bookkeeping software. A patient may have a credit agreement with the practice, which allows the patient to pay bills off over time, along with interest on the balance due. This is important because in such situations, even though an outstanding balance may become old, it should not be considered delinquent and sent out of the office for collection (Procedure 47-1). The bank may not honor a check deposited by the practice because a patient’s account has insufficient funds. If a check is returned marked NSF, do not hesitate to call the patient and tell him or her of the problem. This may be the first of many checks that are being returned, and it is important for the person to find out why he or she is writing checks against insufficient funds. The bank usually charges fees both to the individual who wrote the check and to the medical office that tried to deposit the check. The amount of the NSF check must be added back to the balance owed by the patient as a positive adjustment that increases the amount owed. The fee charged by the bank is also added to the patient’s balance, usually as a separate fee. As an example, assume that the patient paid a copayment of $20.00 at the time of the visit. The bank returned the check for insufficient funds and charged the medical office checking account a $15.00 fee. The medical assistant would charge the patient’s account $35.00 to cover both the amount of the returned check and the additional fee charged by the bank. Most offices have a sign posted in the waiting room notifying patients of the additional charge for each returned check (Procedure 47-2). If the total of patient payments and insurance payments exceeds the allowed charge, it is called an overpayment. This might happen, for example, if a patient thought that he had not yet paid his annual deductible, when in fact he had. After all the payments have been posted, the balance on the account will be a negative number, or credit balance, indicating that the medical office owes money to the patient. Sometimes a small credit balance is left in place when a patient has a visit scheduled in the near future because new charges will be applied. Usually, however, the medical assistant will process a refund for the patient. The amount of the refund is posted to the patient’s account, bringing the account balance to zero. The medical assistant sends a letter and a check to the patient with a brief explanation about the overpayment (Procedures 47-3 and 47-4).

Billing and Collections

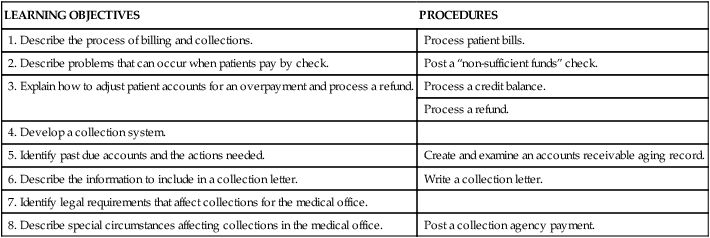

LEARNING OBJECTIVES

PROCEDURES

1. Describe the process of billing and collections.

Process patient bills.

2. Describe problems that can occur when patients pay by check.

Post a “non-sufficient funds” check.

3. Explain how to adjust patient accounts for an overpayment and process a refund.

Process a credit balance.

Process a refund.

4. Develop a collection system.

5. Identify past due accounts and the actions needed.

Create and examine an accounts receivable aging record.

6. Describe the information to include in a collection letter.

Write a collection letter.

7. Identify legal requirements that affect collections for the medical office.

8. Describe special circumstances affecting collections in the medical office.

Post a collection agency payment.

Introduction to Billing

Billing Process

Billing Problems

Problems with Checks

Insufficient Funds in a Patient Account

Overpayments and Refunds

Billing and Collections

Get Clinical Tree app for offline access