Chapter 3

Health Insurance Portability and Accountability Act (HIPAA)

1. Define terms, phrases, abbreviations, and acronyms.

2. Discuss the purpose and content of HIPAA regulations.

3. Demonstrate an understanding of the Administrative Simplification section of HIPAA and how it relates to claims processing.

4. Provide an overview of the HIPAA Privacy Rule and how it relates to patient medical information.

5. Discuss provisions outlined under the HIPAA Security Rule.

6. State the importance of HIPAA compliance.

Authorization for release of medical information

Civil Monetary Penalties Law (CMPL)

Electronic data interchange (EDI)

Employer identification number (EIN)

Health Care Fraud and Abuse Control Program (HCFAC)

Health Information Technology for Economic and Clinical Health Act (HITECH)

Health Insurance Portability and Accountability Act (HIPAA)

Health Insurance Portability and Accountability Act (HIPAA) Title I

Health Insurance Portability and Accountability Act (HIPAA) Title II

Incentive Program for Fraud and Abuse

Individually identifiable health information (IIHI)

Medicaid Integrity Contractor (MIC)

Medicare Integrity Program (MIP)

National Provider Identifier (NPI)

Office of the Inspector General (OIG)

Patient Protection and Affordable Care Act (PPACA)

Program Safeguard Contractor (PSC)

Protected health information (PHI)

Recovery Audit Contractor (RAC)

Tax identification number (TIN)

American National Standards Institute

American Recovery and Reinvestment Act

Accredited Standards Committee

Current Procedural Terminology

Employer identification number

Electronic protected health information

Health Care Common Procedure Coding System

Health Care Fraud and Abuse Control Program

Health Insurance Portability and Accountability Act

Health Insurance Portability and Accountability Act Title II: Administrative Simplification

Health Information Technology for Economic and Clinical Health Act

International Classification of Diseases, 9th Revision, Clinical Modification

International Classification of Diseases, 10th Revision, Clinical Modification

International Classification of Diseases, 10th Revision, Procedure Coding System

Individually identifiable health information

National Plan and Provider Enumeration System

Office of the Inspector General

Patient Protection and Affordable Care Act

HIPAA Legislation

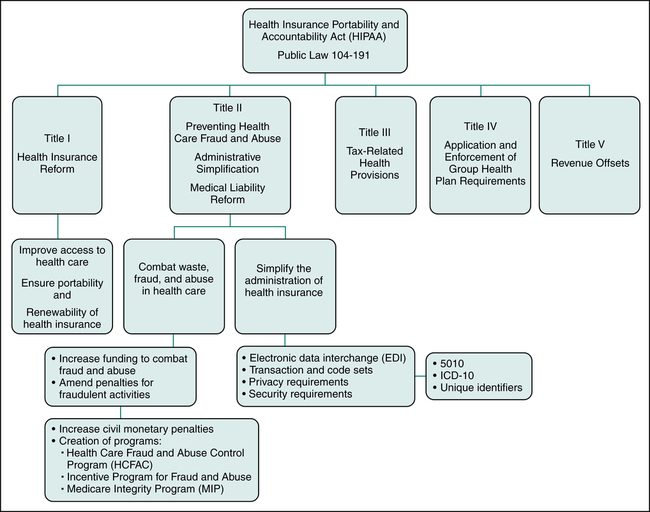

• Title I: Health Insurance Reform (Health Care Access, Portability, and Renewability)

• Title II: Preventing Health Care Fraud and Abuse, Administrative Simplification, and Medical Liability Reform

• Title III: Tax-Related Health Provisions

• Title IV: Application and Enforcement of Group Health Plan Requirements

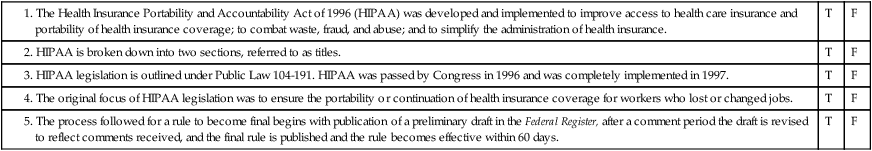

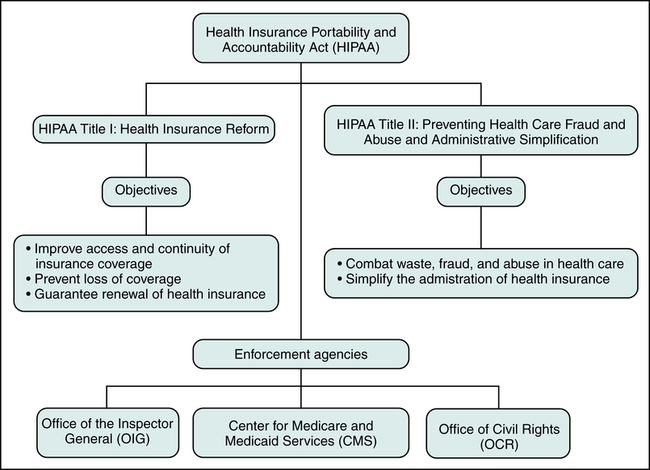

This chapter will focus on HIPAA Titles I and II since they have the most significant impact today on health care providers and health insurers. The Health Insurance Portability and Accountability Act (HIPAA) Title I is referred to as Health Insurance Reform since its purpose is to ensure that individuals have access to health insurance coverage. Title I mandates improved access to health care and health coverage, and it imposes new regulations relating to the underwriting process performed by insurance companies to determine whether they will insure an individual. The Health Insurance Portability and Accountability Act (HIPAA) Title II is labeled Preventing Health Care Fraud and Abuse, Administrative Simplification, and Medical Liability Reform. Title II contains regulations aimed at protecting government programs from fraud and abuse. Another objective of HIPAA Title II is to standardize and simplify the processing of health care transactions. Figure 3-1 illustrates the five sections of HIPAA and provisions under HIPAA Title I and Title II.

HIPAA Title I: Health Insurance Reform (Health Care Access, Portability, and Renewability)

• Improve the continuation and portability of insurance coverage by limiting the use of preexisting condition exclusions in health plans.

• Prevent individuals from losing coverage or being denied coverage based on health status by prohibiting insurance companies from discriminating against individuals based on health status.

• Guarantee individuals the ability to renew insurance coverage in multi-employer plans and multiple employer welfare arrangements.

HIPAA Title II: Preventing Health Care Fraud and Abuse and Administrative Simplification

Combat Waste, Fraud, and Abuse in Health Care

The Health Care Fraud and Abuse Control Program (HCFAC)

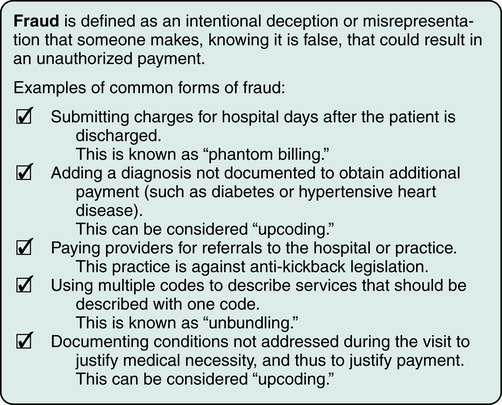

HIPAA also expanded the definition of fraud to include language indicating that providers can be held liable if they knew or should have known that information on a claim was false. Fraud is defined as an intentional deception or misrepresentation that someone makes, knowing it is false, that could result in an unauthorized payment. The Centers for Medicare and Medicaid Services (CMS) outlines the following as the most common forms of fraud as illustrated in Figure 3-2:

• Billing for services not furnished (phantom billing)

• Misrepresenting the diagnosis to justify payment

• Soliciting, offering, or receiving kickbacks

• Unbundling or “exploding” charges

• Falsifying a certificate of medical necessity, plans of treatment, and medical records to justify payment.

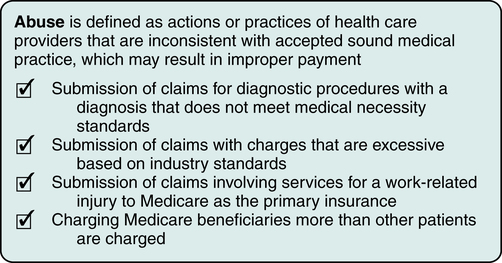

Abuse is defined as actions or practices of health care providers that are inconsistent with accepted sound medical practice, which may result in improper payment. CMS outlines the following as the most common forms of abuse as illustrated in Figure 3-3:

• Claims for services not medically necessary

• Excessive charges for services or supplies

• Improper billing practices, including submission of claims to Medicare instead of third-party payers that are primary insurers

• Unusually large payments in relation to services rendered by lawyers, consultants, agents, and others

• Increasing charges to Medicare beneficiaries but not to other patients.

Medicare Integrity Program (MIP)

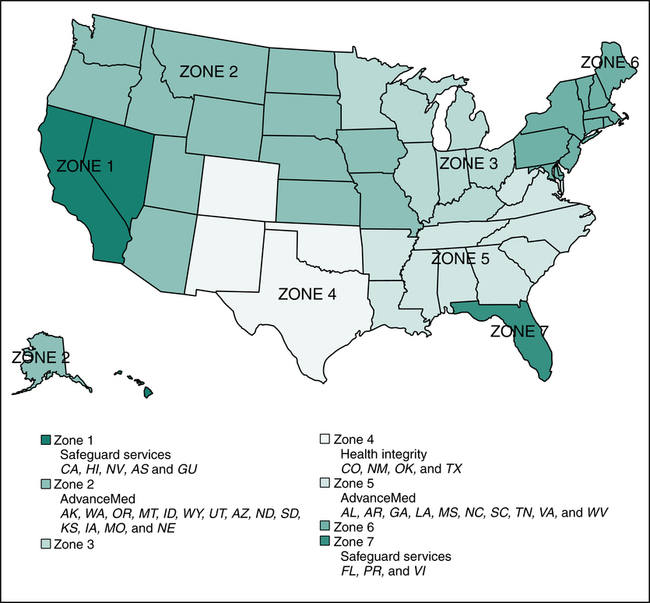

HIPAA legislation also granted CMS authority to hire contractors to perform fraud-fighting functions. CMS developed a program called Program Safeguard Contractor (PSC) in 1999 to carry out audits, to identify cases of fraud and abuse, conduct medical reviews, and perform other essential program integrity activities that were previously performed by Medicare contractors who processed claims. The transfer of fraud and abuse work from Medicare contractors to PSC was completed in 2006. The Program Safeguard Contractors were replaced by Zone Program Integrity Contractors (ZPIC) and these contractors are established in seven zones as illustrated in Figure 3-4. A contractor may be responsible for more than one zone. For example, the contractor for Zones 2 and 5 is AdvanceMed. CMS partners with other audit contractors such as Recovery Audit Contractors (RAC) and Medicaid Integrity Contractors (MIC). Recovery Audit Contractors (RAC) are audit contractors hired by CMS to carry out Medicare audits to identify and correct underpayments and overpayments, conduct medical reviews, and perform other essential program integrity activities. Medicaid Integrity Contractors (MIC) are audit contractors hired by CMS to carry out Medicaid audits, conduct medical reviews, and perform other essential Medicaid program integrity activities. Audits performed by these contractors can result in demands for repayment, civil and criminal penalties, and exclusion from government programs.

Simplify the Administration of Health Insurance

The implementation dates for HIPAA provisions are determined based on the publication date of the final rule. Before a rule (or law) becomes final, a preliminary draft is published in the Federal Register with a time frame for comments. After the comment period, the preliminary draft is revised to reflect the consensus of all comments received, and the final rule is published. Generally, once the final rule is published there is a 2-year plus 60-day period before the rule becomes effective. All covered entities are required to comply with the HIPAA regulations on the effective date published in the Federal Register. The Federal Register can be accessed at http://www.gpo.gov/fdsys/. Table 3-1 outlines implementation dates for various HIPAA regulations.

TABLE 3-1

HIPAA Regulations: Implementation Dates

| Date | Implementation of HIPAA Regulations |

| August 21, 1996 | HIPAA passed by Congress. |

| April 14, 2001 | Privacy rule final implementation |

| October 16, 2003 | Electronic Health Care Transactions and Code Sets (Medicare will only accept paper claims under limited circumstances) |

| April 14, 2003–April 20, 2006 | Privacy Standards, Employer Identifier Standard, Security Standards (all covered entities and small health plans) |

| May 23, 2008 | National Provider Identifier (all covered entities except small health plans) |

| January 1, 2012 | ASC X12N Version 5010 Standards—replace Version 4010/4010A |

| January 1, 2013 | Effective date for operating rules for eligibility for health plan and health claims status transactions |

| October 1, 2014 | ICD-10-CM and ICD-10-PCS Code Sets for medical diagnosis and inpatient procedures. The original implementation date was October 1, 2013. The DHHS published a final rule that delays the ICD-10 compliance date to October 1, 2014. |

| December 31, 2013 | Certification, Part 1—Health plan must certify data and information systems are in compliance with applicable standards and operating rules for health plan eligibility, health claims status, electronic funds transfer and health care payment and remittance advice. |

| January 1, 2014 | Effective date of operating rules and standards for electronic funds transfers (EFT) and remittance advice |

| April 1, 2014 | Penalties may be assessed against a health plan that has failed to meet the certification and compliance requirements for standards and operating rules. |

| December 31, 2015 | Certification, Part 2—Health plan must certify that its data and information systems are in compliance with applicable standards and operating rules for: health claims or equivalent encounter information; enrollment and disenrollment in a health plan; health plan premium payments; referral certification and authorization and health claims attachments |

| January 1, 2016 | Effective date of operating rules for health claims or equivalent encounter information, enrollment and disenrollment in a health plan, health plan premium payments, referral certification and authorization, health care claims attachments Effective date of standard for health care claims attachments |

(Revised data from Centers for Medicare and Medicaid Services, http://www.cms.gov/HIPAAGenInfo/.)

HIPAA Regulations

• A penalty of up to $10,000 for each item or service wrongfully listed on a claim submitted to Medicare or Medicaid.

• An assessment of up to triple the total amount improperly claimed.

• Suspension from government programs for a period defined by the Department of Health and Human Services (DHHS).

Enforcement and Penalties

• Knowingly obtaining or disclosing individually identifiable health information (IIHI): $50,000 and imprisonment for up to 1 year.

• Offenses committed under false pretenses: $100,000 and up to 5 years in prison.

• Offenses committed with the intent to sell, transfer, or use IIHI for commercial advantage, personal gain, or malicious harm: $250,000 and imprisonment for up to 10 years.

Compliance requirements including the date of compliance, are published in the Federal Register. Figure 3-5 illustrates HIPAA objectives and enforcement agencies that can impose penalties for non-compliance. Three agencies responsible for enforcing standards and provisions are the Office of the Inspector General (OIG), the Centers for Medicare and Medicaid Services (CMS), and the Office of Civil Rights (OCR).

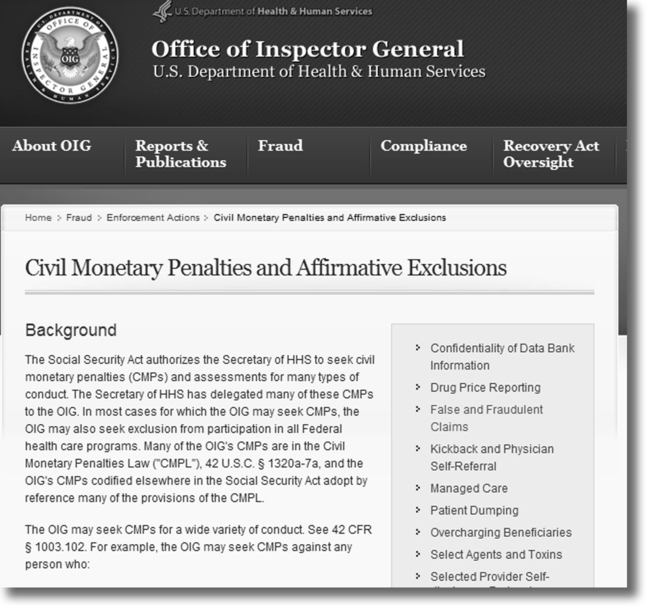

Office of the Inspector General (OIG)

The Office of the Inspector General (OIG) is an agency under the Department of Health and Human Services (DHHS) that is responsible for the detection and prevention of fraud and abuse. The OIG monitors compliance and enforces laws related to fraud and abuse (Figure 3-6). When a Medicare provider allegedly commits fraud, an investigation is conducted by the OIG. If evidence of fraud or abuse is found by the OIG, the case is referred to the Department of Justice (DOJ) for prosecution. Criminal, civil, and/or administrative sanctions for fraud convictions may include:

• Civil penalties of up to $10,000 for each service or item falsely reported on the claim plus triple damages under the Federal False Claims Act.

• Criminal fines and/or imprisonment of up to 10 years if there is a conviction of the crime of health care fraud as outlined under HIPAA, or for violations of federal antikickback statutes, imprisonment of up to 5 years and/or criminal fines of up to $50,000.

• Administrative sanctions such as exclusion from participation in Medicare and state programs may be imposed in addition to civil monetary penalties.

Office of Civil Rights (OCR)

• Civil penalties for HIPAA privacy violations can be up to $100 for each offense, with an annual cap of $25,000 for repeated violations of the same provision.

• Criminal penalties based on the type of violation:

For covered entities who knowingly obtain or disclose individually identifiable health information (IIHI): up to $50,000 and 1 year in prison

For covered entities who knowingly obtain or disclose individually identifiable health information (IIHI): up to $50,000 and 1 year in prison

For misuse under false pretenses: up to $100,000 and 5 years in prison

For misuse under false pretenses: up to $100,000 and 5 years in prison

For offenses committed with the intent to sell, transfer, or use individually identifiable health information (IIHI) for commercial advantage, personal gain, or malicious harm: up to $250,000 and 10 years in prison

For offenses committed with the intent to sell, transfer, or use individually identifiable health information (IIHI) for commercial advantage, personal gain, or malicious harm: up to $250,000 and 10 years in prison

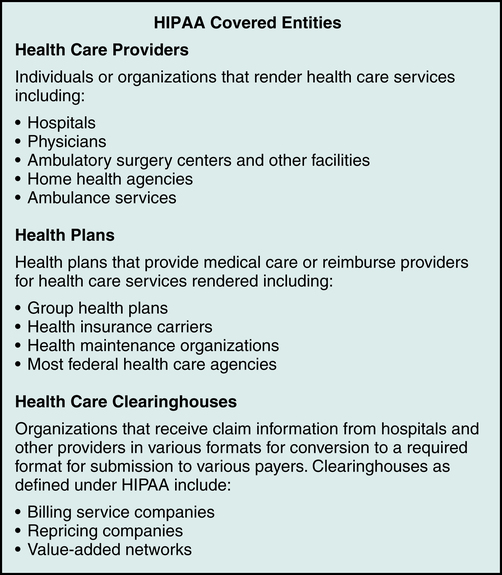

Covered Entities

A covered entity is an organization involved with health care delivery that provides health care services, submits claims for services, or provides health care coverage. HIPAA identifies three types of covered entities that must follow the regulations as illustrated in Figure 3-7:

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree