Chapter 12

Prospective Payment Systems (PPS)

1. Define terms, phrases, abbreviations, and acronyms.

2. Demonstrate an understanding of the evolution of health care reimbursement from cost-based systems to Prospective Payment Systems (PPS).

3. Describe the relationship between government programs and Prospective Payment Systems (PPS) and discuss payment systems implemented under PPS.

4. Demonstrate an understanding of Inpatient Prospective Payment System (IPPS) development, payment calculations, structure, and assignment.

5. Demonstrate an understanding of Outpatient Prospective Payment System (OPPS) development, payment calculations, structure, and assignment.

Ambulatory Payment Classifications (APC)

Ambulatory Surgery Center (ASC)

Arithmetic mean length of stay (AMLOS)

Geometric mean length of stay (GMLOS)

Inpatient Prospective Payment System (IPPS)

Major Diagnostic Category (MDC)

Medicare Severity-Diagnosis Related Groups (MS-DRG)

Outpatient Prospective Payment System (OPPS)

Prospective Payment Systems (PPS)

Arithmetic mean length of stay

Ambulatory Payment Classifications

Balanced Budget Reconciliation Act

Centers for Medicare and Medicaid Services

Centers for Medicare and Medicaid Services Diagnosis Related Groups (1983-2007)

Current Procedural Terminology

Employer identification number

Hospital-acquired condition (HAC)

Healthcare Common Procedure Coding System

International Classification of Diseases, 10th Revision, Clinical Modification

International Classification of Diseases, 10th Revision, Procedure Coding System

Inpatient Prospective Payment System

Inpatient rehabilitation facility

Major complication and comorbidity

Medicare Severity-Diagnosis Related Groups

Omnibus Budget Reconciliation Act

Outpatient Prospective Payment System

Prospective Payment System (PPS) Evolution

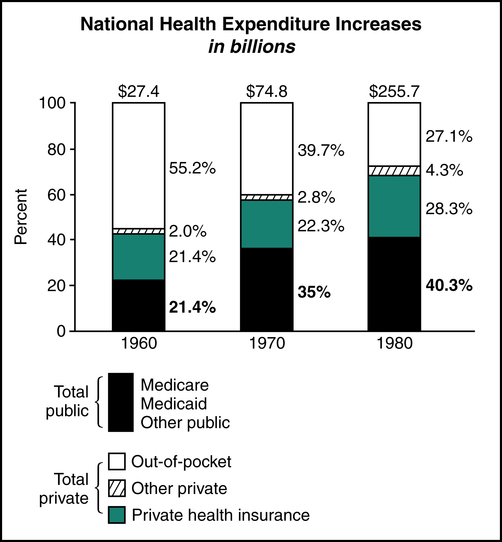

National health care expenditures increased from $27.4 to $255.7 billion during the period from 1960 to 1980. Public sector (Medicare, Medicaid, and TRICARE) health care expenditures increased to 40.3% during the same period, as illustrated in Figure 12-1. In response to the rising health care costs, the government found it necessary to devise reimbursement methods that provided fixed payment amounts for health care services. One of the more significant changes was the implementation of the Medicare Inpatient Prospective Payment System (IPPS).

Outpatient Prospective Payment System (OPPS)

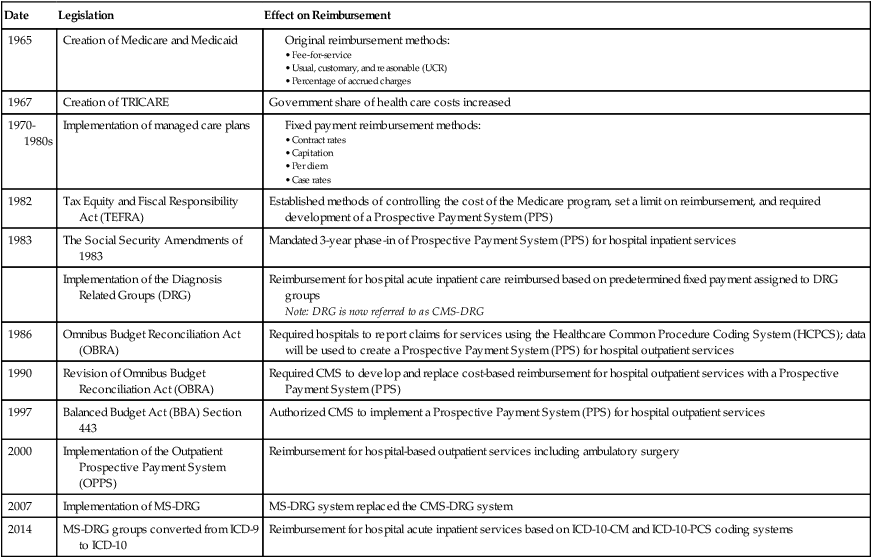

During the 1990s legislation was passed that mandated the implementation of a PPS for hospital outpatient services for members of government-sponsored health plans. The Omnibus Budget Reconciliation Act (OBRA) of 1986 paved the way for development of a PPS for hospital outpatient services. OBRA legislation included a mandate for hospitals to report services provided on an outpatient basis using the Healthcare Common Procedure Coding System (HCPCS). This information was used by the Centers for Medicare and Medicaid Services (CMS) for the development of the PPS. Revisions to OBRA in 1990 mandated CMS to develop a proposal to replace the existing hospital outpatient payment system with a PPS system. The Balanced Budget Act (BBA) of 1997 required CMS to implement the Outpatient Prospective Payment System (OPPS) effective January 1, 1999. The final rule outlining the establishment of an outpatient PPS was published by CMS in the Federal Register. CMS implemented the OPPS, effective August 2000. OPPS provides reimbursement for hospital outpatient services based on predetermined fixed rates. Table 12-1 outlines legislation that contributed to the development and implementation of PPS systems.

TABLE 12-1

Legislation Affecting Reimbursement

| Date | Legislation | Effect on Reimbursement |

| 1965 | Creation of Medicare and Medicaid | |

| 1967 | Creation of TRICARE | Government share of health care costs increased |

| 1970-1980s | Implementation of managed care plans | |

| 1982 | Tax Equity and Fiscal Responsibility Act (TEFRA) | Established methods of controlling the cost of the Medicare program, set a limit on reimbursement, and required development of a Prospective Payment System (PPS) |

| 1983 | The Social Security Amendments of 1983 | Mandated 3-year phase-in of Prospective Payment System (PPS) for hospital inpatient services |

| Implementation of the Diagnosis Related Groups (DRG) | Reimbursement for hospital acute inpatient care reimbursed based on predetermined fixed payment assigned to DRG groups Note: DRG is now referred to as CMS-DRG | |

| 1986 | Omnibus Budget Reconciliation Act (OBRA) | Required hospitals to report claims for services using the Healthcare Common Procedure Coding System (HCPCS); data will be used to create a Prospective Payment System (PPS) for hospital outpatient services |

| 1990 | Revision of Omnibus Budget Reconciliation Act (OBRA) | Required CMS to develop and replace cost-based reimbursement for hospital outpatient services with a Prospective Payment System (PPS) |

| 1997 | Balanced Budget Act (BBA) Section 443 | Authorized CMS to implement a Prospective Payment System (PPS) for hospital outpatient services |

| 2000 | Implementation of the Outpatient Prospective Payment System (OPPS) | Reimbursement for hospital-based outpatient services including ambulatory surgery |

| 2007 | Implementation of MS-DRG | MS-DRG system replaced the CMS-DRG system |

| 2014 | MS-DRG groups converted from ICD-9 to ICD-10 | Reimbursement for hospital acute inpatient services based on ICD-10-CM and ICD-10-PCS coding systems |

Inpatient Prospective Payment System (IPPS)

DRG Development

Medicare Severity-Diagnosis Related Groups (MS-DRG) is the Inpatient Prospective Payment System (IPPS) implemented in 2007 to provide reimbursement for hospital inpatient services. MS-DRG replaced the CMS-DRG system effective October 1, 2007. The MS-DRG system was implemented and transitioned in during a 2-year period with a final implementation date of October 1, 2009. A CMS fact sheet on MS-DRG can be viewed at http://www.cms.hhs.gov/MLNProducts/downloads/AcutePaymtSysfctsht.pdf.

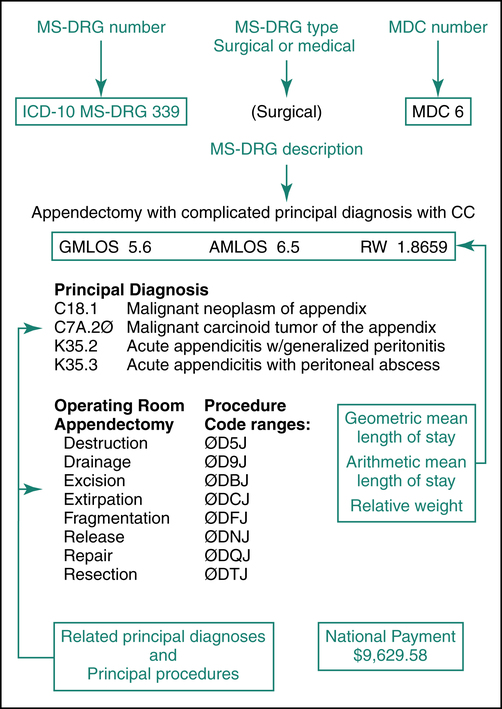

MS-DRG Structure

The MS-DRG system classifies hospital inpatient cases based on the patient’s diagnosis and the procedures required to treat the patient’s condition. There are more than 900 MS-DRG groups classified into categories based on the patient’s diagnosis, referred to as Major Diagnostic Category (MDC). There are two types of MS-DRG payment groups: surgical and medical. Each MS-DRG group contains related principal diagnoses and procedures where appropriate. MS-DRG assignment is determined based on the principal and secondary diagnoses that describe the patient’s condition and complications and comorbidities. The following elements are assigned to each MS-DRG payment group: geometric mean length of stay (GMLOS), arithmetic mean length of stay (AMLOS), and relative weight (RW). Figure 12-2 illustrates the ICD-10 MS-DRG 339 “Appendectomy with complicated principal diagnosis with CC.” The illustration highlights the DRG elements: MS-DRG number, type, and description, Major Diagnostic Category (MDC), principal diagnoses, and procedures for the group. It is important to note that many reference manuals refer to the MS-DRG as DRG.

• Geometric mean length of stay (GMLOS) is a value assigned to each MS-DRG to represent an adjusted value for all cases, making allowances for outliers, transfer cases, and negative outlier cases that normally skew data. GMLOS is used to calculate reimbursement for the MS-DRG.

• Arithmetic mean length of stay (AMLOS) is a value assigned to each MS-DRG to represent the average number of approved inpatient days for the MS-DRG.

• Relative weight (RW) is a value assigned to each MS-DRG to reflect relative resource consumption for the group. The relative weight is used to calculate the total payment for the case. MS-DRG groups with higher relative weights are paid more than those with lower relative weights.

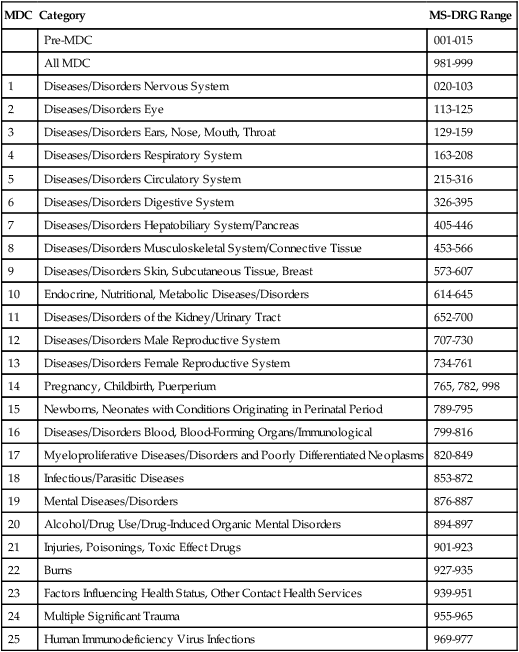

Major Diagnostic Category (MDC)

A Major Diagnostic Category (MDC) is a grouping of hospital inpatient cases based on body system, which is used to further categorize MS-DRG groups. MDCs were developed to further categorize more than 900 MS-DRG groups into smaller groups. Each MDC is based on conditions related to specific organ systems. All principal diagnoses within the MS-DRG system are grouped into 25 MDC categories. Some MS-DRG groups may relate to any of the MDCs, referred to as “All MDC”, such as MS-DRG 981. Table 12-2 illustrates MDC categories along with the related MS-DRG ranges.

TABLE 12-2

MAJOR DIAGNOSTIC CATEGORIES (MDC)

| MDC | Category | MS-DRG Range |

| Pre-MDC | 001-015 | |

| All MDC | 981-999 | |

| 1 | Diseases/Disorders Nervous System | 020-103 |

| 2 | Diseases/Disorders Eye | 113-125 |

| 3 | Diseases/Disorders Ears, Nose, Mouth, Throat | 129-159 |

| 4 | Diseases/Disorders Respiratory System | 163-208 |

| 5 | Diseases/Disorders Circulatory System | 215-316 |

| 6 | Diseases/Disorders Digestive System | 326-395 |

| 7 | Diseases/Disorders Hepatobiliary System/Pancreas | 405-446 |

| 8 | Diseases/Disorders Musculoskeletal System/Connective Tissue | 453-566 |

| 9 | Diseases/Disorders Skin, Subcutaneous Tissue, Breast | 573-607 |

| 10 | Endocrine, Nutritional, Metabolic Diseases/Disorders | 614-645 |

| 11 | Diseases/Disorders of the Kidney/Urinary Tract | 652-700 |

| 12 | Diseases/Disorders Male Reproductive System | 707-730 |

| 13 | Diseases/Disorders Female Reproductive System | 734-761 |

| 14 | Pregnancy, Childbirth, Puerperium | 765, 782, 998 |

| 15 | Newborns, Neonates with Conditions Originating in Perinatal Period | 789-795 |

| 16 | Diseases/Disorders Blood, Blood-Forming Organs/Immunological | 799-816 |

| 17 | Myeloproliferative Diseases/Disorders and Poorly Differentiated Neoplasms | 820-849 |

| 18 | Infectious/Parasitic Diseases | 853-872 |

| 19 | Mental Diseases/Disorders | 876-887 |

| 20 | Alcohol/Drug Use/Drug-Induced Organic Mental Disorders | 894-897 |

| 21 | Injuries, Poisonings, Toxic Effect Drugs | 901-923 |

| 22 | Burns | 927-935 |

| 23 | Factors Influencing Health Status, Other Contact Health Services | 939-951 |

| 24 | Multiple Significant Trauma | 955-965 |

| 25 | Human Immunodeficiency Virus Infections | 969-977 |

Data from Ingenix Encoder ProP 2013, and Centers for Medicare and Medicaid Services Web site, https://www.cms.gov.

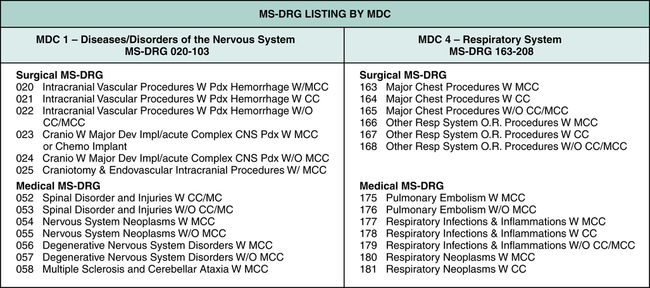

There are many MS-DRG groups associated with each MDC. For example, MDC 1 contains MS-DRG payment groups 020 to 103 that represent diseases or disorders of the nervous system. MDC 4 contains MS-DRG payment groups 163 to 208 that represent diseases or disorders of the respiratory system. Figure 12-3 illustrates examples of MS-DRG groups associated with Major Diagnostic Categories (MDC) 1 and 4.

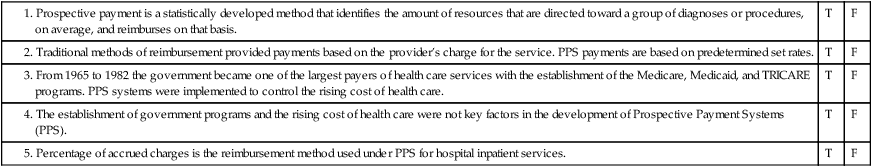

Medical MS-DRG

Principal diagnoses that do not require surgery are assigned to a medical MS-DRG. Medical MS-DRG groups are further classified based on the principal diagnosis, and the presence of complications or comorbidities. Figure 12-4 illustrates the ICD-10 surgical MS-DRG 117, which illustrates the operating room procedures and code ranges categorized within the MS-DRG along with the GMLOS, AMLOS, and RW. The same illustration highlights the medical MS-DRG 122 and the related principal diagnoses along with the GMLOS, AMLOS, and RW.

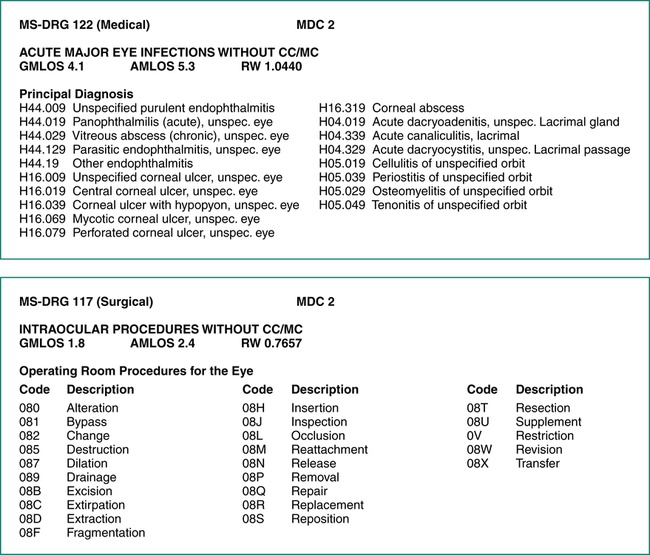

MDC Decision-Making Tree

A decision-making tree was developed for each MDC. The decision tree follows the logic of MS-DRG assignment. Decision trees illustrate the surgical and medical partition. The surgical partition is followed if a surgical “OR procedure” is performed. The medical partition is followed when surgery is not required. The tree branches off to various MS-DRG groups based on the procedure, diagnosis, and the presence of complications and comorbidities. The relative weight (RW) for each MS-DRG is listed on the tree. Figure 12-5 illustrates an MS-DRG decision tree for MDC 2 “Diseases and Disorders of the Eye.”

MS-DRG Variables

Principal and Secondary Diagnoses

The principal diagnosis assigned to a hospital case determines what MDC is used in assigning the MS-DRG. To obtain accurate reimbursement, it is essential to assign the correct principal diagnosis. An incorrect principal diagnosis could lead to an MS-DRG that reimburses the hospital at a lower level. In addition to the principal diagnosis, the admitting and secondary diagnoses may be assigned, including complications and comorbidities, which generally contribute to a higher MS-DRG assignment. For example, the decision tree for MDC 2 indicates that a patient with a principal diagnosis of “Other Disorders of the Eye” with no major comorbidities or complications leads to the assignment of MS-DRG 125, with RW 0.6859. If the disorder of the eye is a neurologic disorder, a principal diagnosis of “Neurological Disorders” in the same MDC leads to an MS-DRG assignment of 123, which carries a relative weight (RW) of 0.7144, as illustrated in Figure 12-5.

Complications and Comorbidities (CC)

1. MCC—major complication/comorbidity, which reflects the highest level of severity;

2. CC—complication/comorbidity, which is the next level of severity;

3. Non-CC—non-complication/comorbidity, which does not significantly affect severity of illness and resources used.

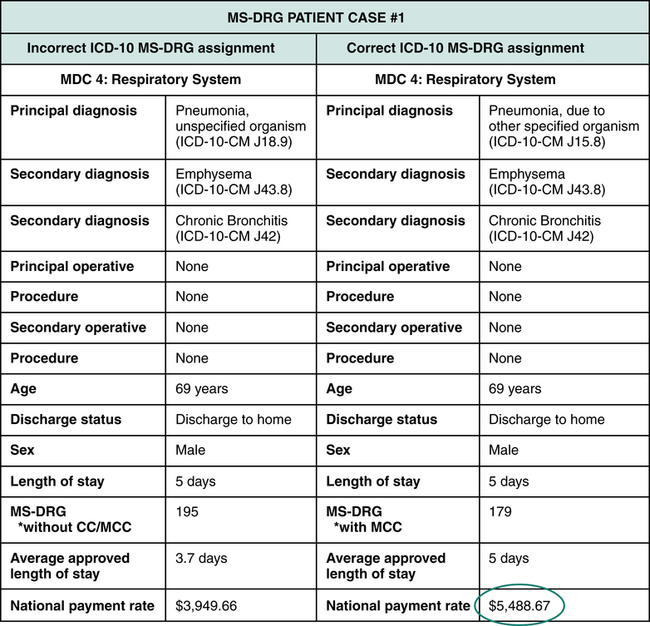

Coding for MS-DRG Assignment

MS-DRG groups were developed based on the patient’s condition and resources required to treat the condition. Accurate diagnosis and procedure coding is critical to ensure the correct MS-DRG is assigned. The principal diagnosis is the condition determined after study to be chiefly responsible for the hospital admission. The principal diagnosis code assigned to the patient case essentially drives the MS-DRG assignment. Inaccurate code selection for the principal diagnosis can lead to an incorrect MS-DRG assignment, resulting in lost revenue. Figure 12-6 illustrates correct versus incorrect MS-DRG assignment for Patient Case 1 using the ICD-10-CM coding system. The case involves a patient who is diagnosed with pneumonia due to anaerobic gram-negative bacilli. Secondary diagnoses emphysema and chronic bronchitis are also documented.

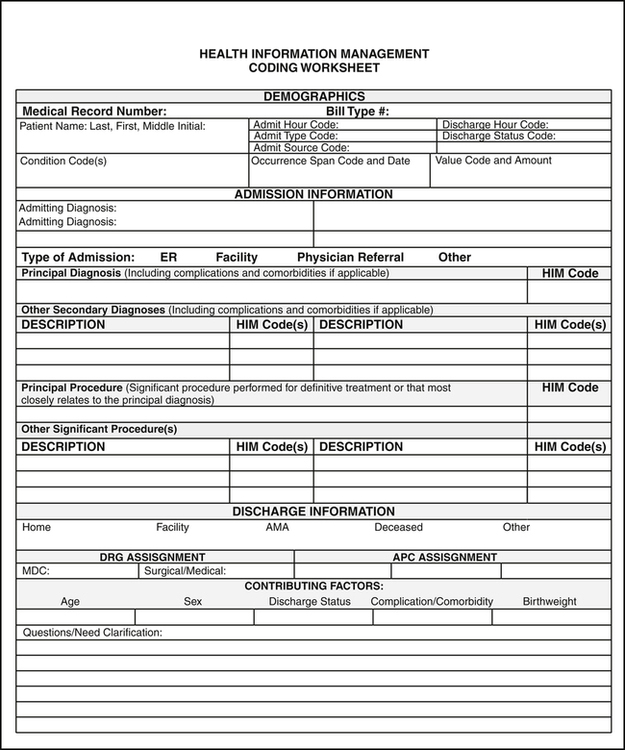

Health Information Management (HIM) coding personnel abstract information from the patient’s medical record for the purpose of coding and MS-DRG assignment. HIM coders must follow inpatient coding guidelines as outlined in the coding manuals. Some facilities use a coding worksheet or other form to abstract and code information in the patient’s record. Figure 12-7 illustrates a sample HIM coding worksheet. Coding worksheets may include the patient’s name, medical record number, race, sex, address, admission date, discharge date, admitting physician, and operating physician name. Most facilities use a computer program called an encoder or grouper for coding and MS-DRG assignment. The steps to coding for MS-DRG assignment are outlined below:

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree