Chapter 13

Accounts Receivable (A/R) Management

1. Define terms, phrases, abbreviations, and acronyms.

2. Demonstrate an understanding of the life cycle of a claim and the hospital billing process.

3. Provide an overview of key information found on a remittance advice (RA).

4. Discuss elements related to patient transactions.

5. Demonstrate an understanding of AR management reports and procedures.

6. List common reasons for claim denials and delays.

7. State the relationship between credit and collection laws and collection activities.

Accounts receivable (A/R) aging report

Advance Beneficiary Notice (ABN)

Electronic remittance advice (ERA)

Fair Debt Collection Practices Act

Hospital-Issued Notice of Non-Coverage (HINN)

National Correct Coding Initiative (NCCI)

Life Cycle of a Hospital Claim

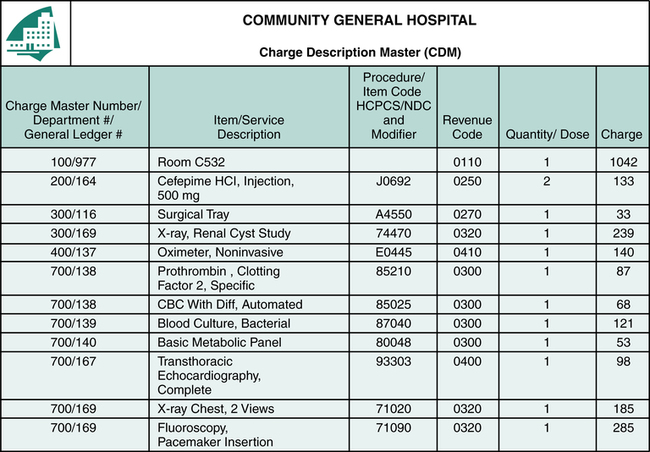

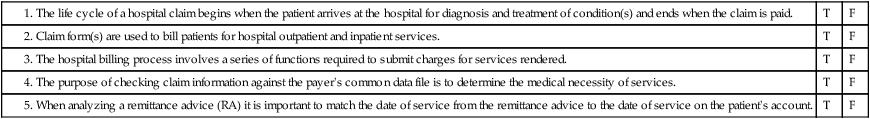

The life cycle of a hospital claim begins when a patient arrives at the hospital for diagnosis and treatment of a condition(s) and ends when the claim is paid, as illustrated in Figure 13-1. The Admissions Department is responsible for obtaining required demographic, financial, and insurance information from the patient. When the patient has more than one insurance hospital personnel must collect information regarding all insurance coverage to determine what payer is primary. Another function that is equally important is obtaining appropriate referrals and authorizations. Information obtained by the Admissions Department is entered into the computer on the patient’s account. Patient care services are rendered and documented by various departments within the hospital, and charges are generated. Most charges are posted at the department level through the Charge Description Master (CDM) during the patient stay (Figure 13-2). The CDM is also referred to as the chargemaster.

Hospital Billing Process

Patient statements are generated and sent to the patient. It is common practice to hold statements until the insurance has processed the claim unless a copayment is due. The hospital generally has a schedule for batch mailings of patient statements. For example, the hospital’s batch schedule may indicate that statements for patient accounts A to M should be mailed on Mondays and Wednesdays and N to Z on Tuesdays and Thursdays. Patient statements include the patient’s name, address, account number, and medical record number; service dates; service descriptions; charges; payments and adjustments; and the balance owed as illustrated in Figure 13-3.

Payer Processing

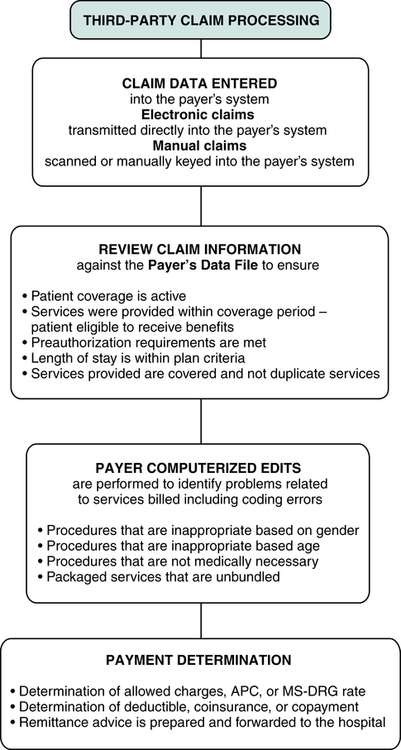

Third-party payer claim processing involves receiving claim data into the payer’s system, review of the payer’s data file, performance of payer edits, and payment determination (Figure 13-4). It is important to remember that most payers require electronic claims submission in accordance with HIPAA regulations. However, there may be circumstances that require submission of a paper claim. Electronic claims are transmitted directly to the payer’s computer system. Paper claims are scanned or entered manually into the payer’s computer system. The payer’s computer system performs a detailed review and electronic edits on each claim. The computerized review and edits are performed to check information on the claim for the purpose of identifying potential problems with the claim. First, the computer checks information on the claim against the payer’s data files to verify patient coverage and eligibility. Then the payer’s system performs computerized edits.

Payer’s Data File

• Patient name and identification number are checked to confirm that the patient is covered under the policy

• The date of service is checked to ensure that the services were provided within the benefit period and that the patient is eligible to receive benefits

• Preauthorization information is reviewed to ensure that plan requirements are met

• Dates of admission and discharge are checked against the plan coverage details to ensure that the length of stay is appropriate

• Procedure code data are reviewed to identify covered and non-covered items

• Services on the claim are also checked against the common data file to identify duplicate services

Computer Edits

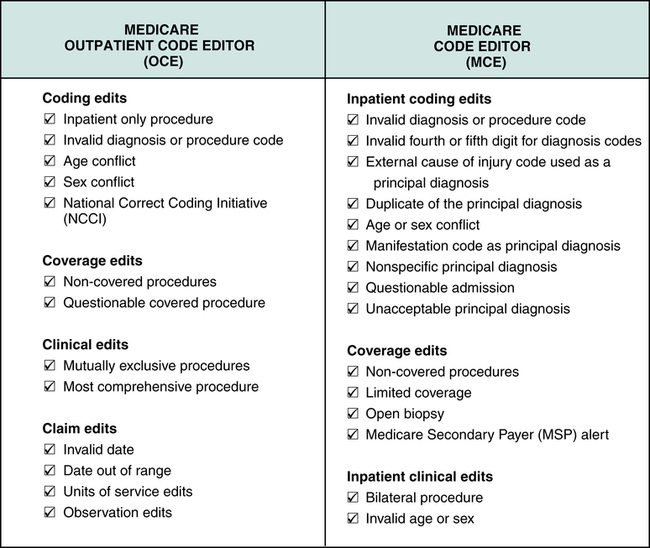

The payer’s system performs computerized edits on claim data for the purpose of identifying problems relating to services billed, such as coding errors or issues involving medical necessity. Payer computer edits vary according to the payer’s criteria and system setup. For example, Medicare’s system contains an Outpatient Code Editor (OCE) and a Medicare Code Editor (MCE). The OCE and MCE are used to identify data inconsistencies on hospital outpatient and inpatient claims. OCE contains edits for hospital outpatient claims. MCE contains edits for hospital inpatient claims (Figure 13-5). The following are examples of computer edits:

• Procedure conflicts with patient’s sex. The procedure code is checked against the patient’s sex to determine whether the procedure is gender appropriate. For example, a hysterectomy would not be performed on a male.

• Procedure conflict with patient’s age. The procedure code is checked against the patient’s age to verify that the procedure is age appropriate. For example, a hysterectomy would not normally be performed on a 10-year-old.

• Medical necessity. All services and items provided must be considered medically necessary to obtain third-party reimbursement. Diagnosis codes are checked against procedure codes to identify problems involving medical necessity.

• Bundled (packaged) services. Services and items billed are reviewed to identify cases of unbundling. Unbundling is the process of coding multiple codes to describe services that should be described with one code.

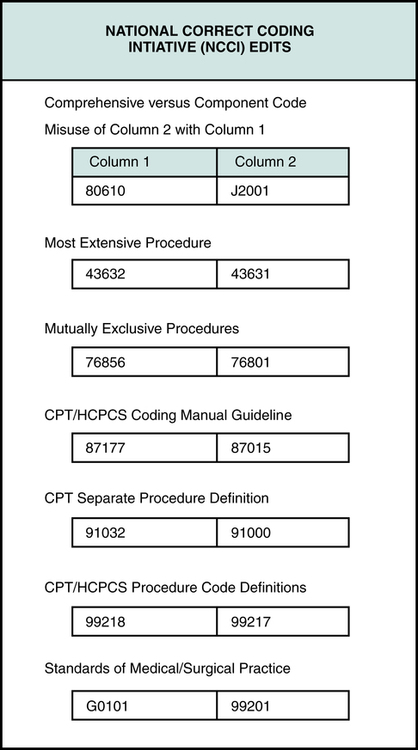

Many payers incorporate the National Correct Coding Initiative (NCCI) edits into their system. The National Correct Coding Initiative (NCCI) was developed by CMS for the purpose of promoting national coding guidelines and preventing improper coding. NCCI outlines code combinations that are inappropriate (Figure 13-6) based on coding guidelines. It is important for hospital personnel to remember that the NCCI is updated quarterly. The National Correct Coding Initiative (NCCI) is often referred to as the Correct Coding Initiative (CCI).

Payment Determination

• Determination of allowed charges, the APC rate, or the MS-DRG rate

• Determination of deductible, coinsurance, or copayment

• Preparation of a remittance advice or explanation of benefits, which is forwarded to the hospital

Payment determination may result in one of the following actions:

Remittance Advice (RA)

Remittance Advice Data Elements

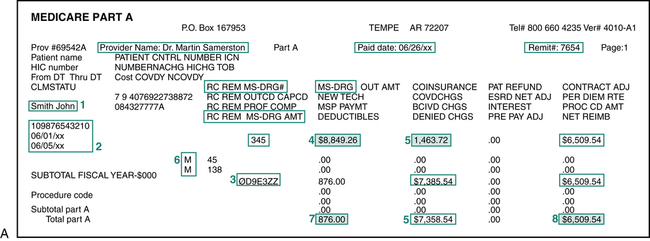

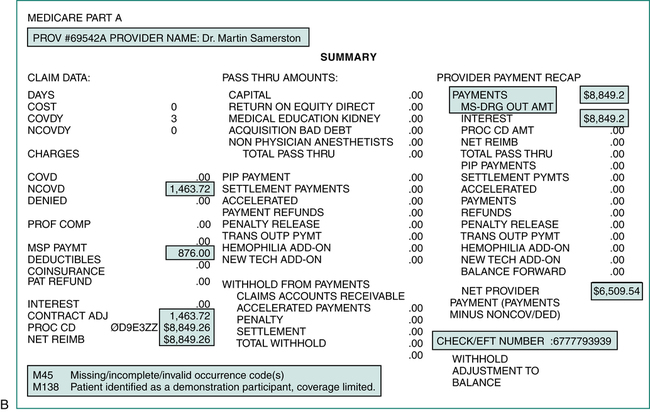

The design and content of an RA will vary by payer. Most include basic data regarding the patient, service provided, charges submitted, and explanation of the payment determination. Figures 13-7A and 13-7B illustrate some of the following data elements listed on a sample Medicare remittance advice:

• Date of the remittance advice, remit number, and check number

• Patient’s name and identification number

• Name of provider performing services, if not the same as the hospital

• Claim control number – a number assigned by the payer as a reference to the claim when the hospital inquires about a claim

• Diagnosis codes, procedure codes, and modifiers describing the billed services or items

• Explanation code or reason code that explains the claim processing, such as whether the claim is denied or reduced

• The amount of deductible the patient is responsible to meet

• The coinsurance amount the patient is responsible to pay

• The payment amount, which is the total amount paid for all claims outlined on the remittance advice

Analyzing a Remittance Advice

It is important for hospital billing professionals to understand the elements of an RA. Information on the RA is carefully analyzed to ensure that the claim was processed appropriately. This task is complicated by the fact that each payer may adopt a different type of form. Information on the RA is used to post payments to the patient’s account. An RA may be several pages long, and it may contain information regarding several patients and several claims (Figures 13-7A and 13-7B). The following is an overview of how to analyze the RA.

1. Identify the patient’s name and identification number for the purpose of opening the correct patient account on the computer system.

2. Match the date of service on the RA to the date of service on the patient’s account.

3. Compare the procedure code indicated on the RA with that listed on the patient’s account to ensure that the claim was paid based on the correct service.

4. Review the charge billed on the RA against the charge listed on the patient’s account.

5. Analyze the approved amount and non-covered charges. The payment is determined based on the approved amount.

6. An explanation of the approved amount is indicated using some type of coding system commonly referred to as explanation or reason codes. Definitions of the reason codes are listed on the bottom or the back of the RA. The reason code M45 on the Medicare remittance advice tells the hospital that there are missing/incomplete/invalid occurrence code(s). M138 tells the hospital that the patient is identified as a demonstration participant and coverage is limited.

7. Information on the RA regarding the deductible and coinsurance explains amounts that are billable to the patient.

8. The payment amount on the bottom of the page is the total payment for all claims listed on the RA.

Patient Transactions

• The payment is posted and a contractual adjustment is applied where applicable

• The balance is billed to the patient or sent to a secondary or tertiary payer when applicable

• Denials and information requests are researched and processed as appropriate

• If the claim is denied appropriately, the claim may need to be submitted to a secondary insurance or it may be appealed.

Third-Party Payer Payments

Incorrect Payment Level

• The diagnosis code(s) submitted does not meet medical necessity criteria for the service level billed.

• Services are billed with more than one code when they should be described with a single code, which is called upcoding or creeping.

• A billed service is considered part of a more comprehensive service and should not be billed separately.

• Service is bundled and considered part of another procedure.

• The payer does not recognize the HCPCS level II Medicare National code; a HCPCS Level I CPT code is required.

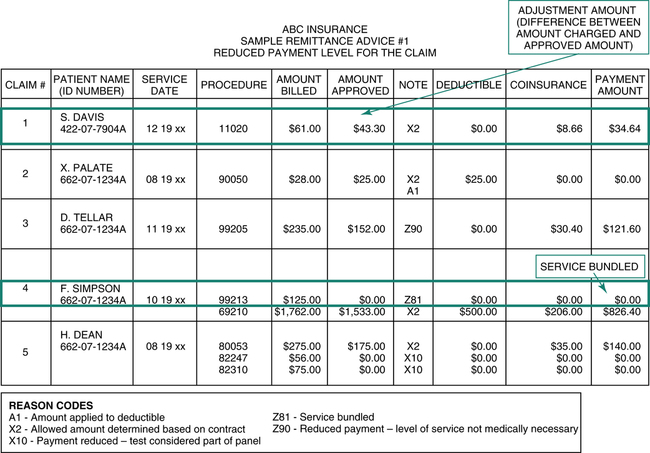

The ABC Insurance remittance advice (RA) illustrated in Figure 13-8 highlights a reduced payment situation. The RA reason, code Z81 on claim number 4, indicates that the payer did not pay on procedure 99213, “Evaluation and Management” (E/M) service. The payer considered the E/M to be part of the surgical package which is the reason for nonpayment. The surgical package outlines services that are bundled into the surgery code.

Adjustments

Contractual Adjustment

The ABC Insurance remittance advice illustrated in Figure 13-8 highlights a contractual adjustment situation on claim number 1. The difference between the billed amount of $61.00 and the approved amount of $43.30 on this claim is $17.70. A contractual adjustment in the amount of $17.70 must be posted to the patient account if the hospital is participating with the insurance company. The reduction of the claim by $17.70 is a contractual adjustment that is made in accordance with the hospital’s contract with the payer.

Balance Billing

• The difference between the original charge and the approved amount

• The amount of hospital charges that are greater than an MS-DRG payment rate

• The amount of hospital charges that are greater than an APC payment rate

Advance Beneficiary Notice (ABN)

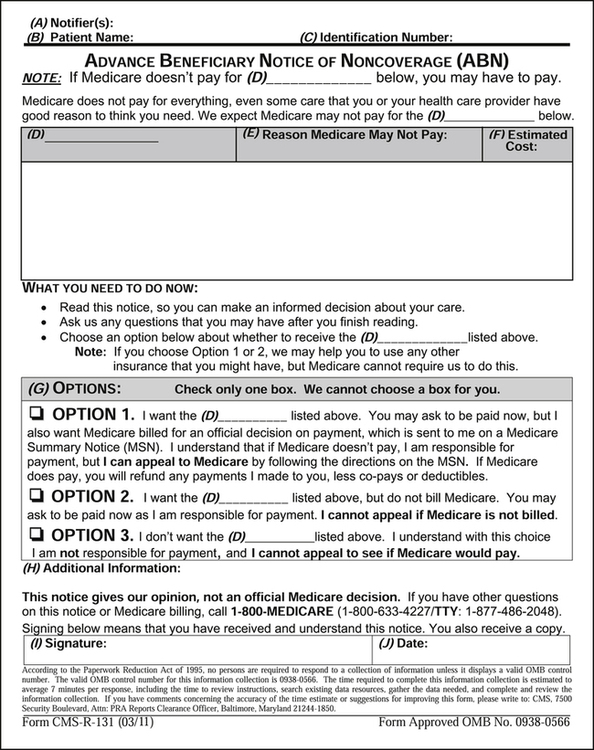

An Advance Beneficiary Notice (ABN) is a written notice that is presented to a Medicare beneficiary before Medicare Part A or Part B services are provided, when the hospital expects the service will not be covered. The ABN is also referred to as a waiver of liability. The purpose of this notice is to inform the beneficiary that the provider believes Medicare will not pay for some or all of the services to be rendered because they are not reasonable and necessary, the services are excluded, or the services are considered non-covered. The information provided on the ABN enables the patient to make an informed decision about accepting financial responsibility because it provides a reasonable description and estimate of the cost of the service. Figure 13-9 illustrates the ABN required by Medicare. Hospitals are required to present this form for signature to the beneficiary before services are rendered. The hospital cannot bill the patient for these services if the ABN is not completed and on file. It is not appropriate to provide patients with a blanket ABN. It is important to remember that an ABN must be provided before each service is rendered. Information and copies of the ABN can be viewed on the CMS Web site at http://www.cms.gov/BNI/02_ABN.asp#TopOfPage.

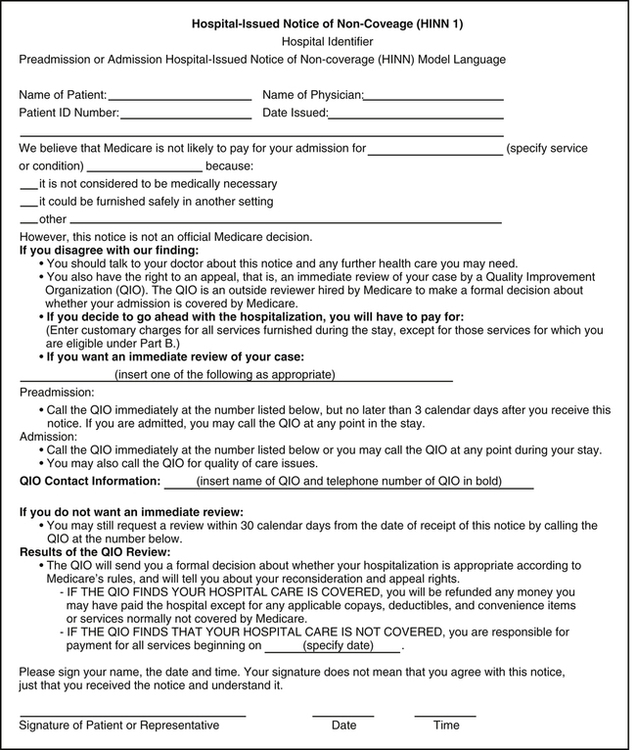

Hospital-Issued Notice of Non-Coverage (HINN)

The Hospital-Issued Notice of Non-Coverage (HINN) is a written notice that is presented to a Medicare beneficiary before a Part A admission, or during the inpatient stay, to inform the beneficiary that the provider believes Medicare will not pay for some or all of the services to be rendered because they are not reasonable and necessary (Figure 13-10). The purpose of this notice is to inform the beneficiary that the provider believes that Medicare will not pay for some or all of the services based on one of the following:

• Service is not medically necessary

• Service is not provided in the most appropriate setting; or

• Service is custodial in nature (non-medical assistance with daily living activities)

In accordance with Medicare guidelines, as published on the CMS Web site, hospitals are required to provide an HINN prior to admission, at admission, or at any point during an inpatient stay if the hospital determines that the care the beneficiary is receiving, or is about to receive, is not covered. The information provided on the HINN enables the patient to make an informed decision about accepting financial responsibility for the services. The following HINN beneficiary notices are listed on the CMS Web site at http://www.cms.gov/BNI/05_HINNs.asp#TopOfPage.

• HINN 1, The Preadmission/Admission HINN, used prior to an entirely non-covered stay.

• HINN 10, also known as the Notice of Hospital Requested Review (HRR), should be issued by hospitals to beneficiaries in Original Medicare whenever a hospital requests QIO review of a discharge decision without physician concurrence.

• HINN 11, which is used for non-covered items or services provided during an otherwise covered stay. Instructions for the HINN 11 have not yet been incorporated into Chapter 30 of the Online Claims Processing Manual.

• HINN 12 should be used in association with the Hospital Discharge Appeal Notices to inform beneficiaries of their potential liability for a non-covered continued stay.