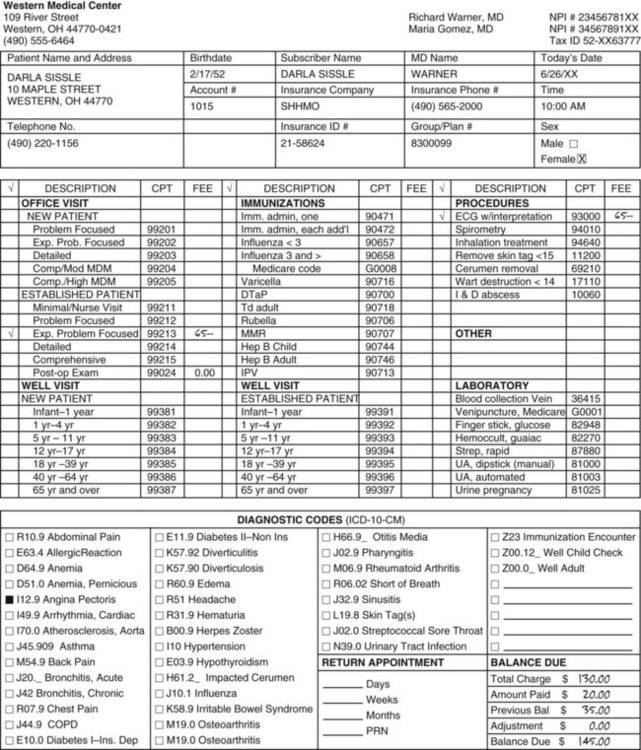

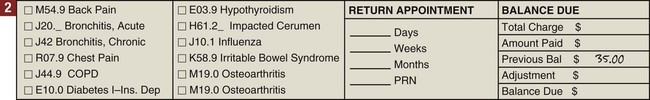

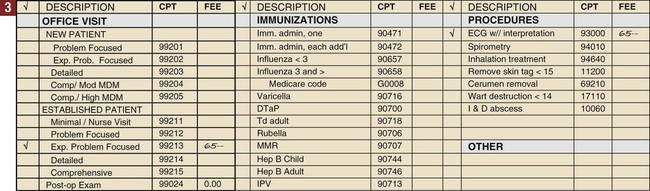

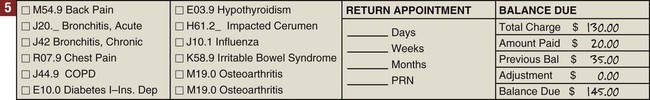

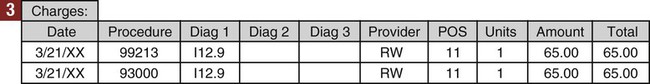

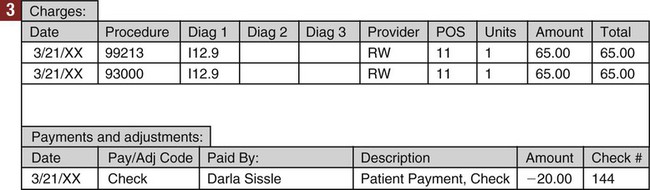

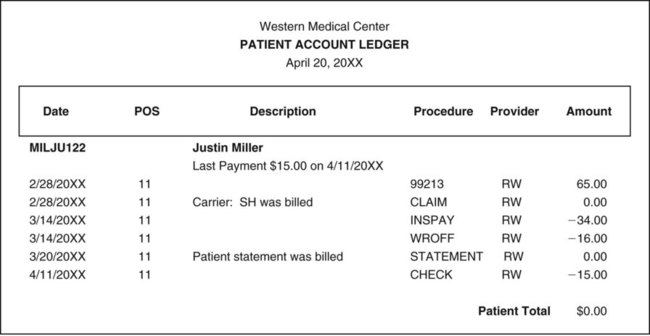

• A daily journal, commonly called a day sheet, to record all transactions that occurred on that day. • An accounts receivable ledger for each patient, to keep a record of transactions related to that patient. • A cumulative record of financial activity for the month, both for the practice as a whole and for each individual physician; this information is recorded on the day sheet, and cumulative totals are carried forward throughout the month. In traditional medical office manual accounting systems, a “one-write” or “write-it-once” system (also called a pegboard system) is used. All necessary forms are held in place on a metal or plastic board by a row of pegs across the left side. In this type of system, information from the top form is transferred to the forms below. Entering information once generates a charge slip and receipt, an entry on the patient’s ledger card, and an entry on the daily journal (day sheet) (Figure 44-1). Although simple charge slips are still sometimes used, most medical offices use a customized superbill as a charge slip. The top section of the form is filled out with patient information by using a printed label, filling it out manually, or printing the information on the form from the computer. Figure 44-2 shows an example of a completed superbill. A fee schedule is a list of charges for the various procedures a physician performs. Years ago, a physician had one set of fees that he or she charged patients for office visits, procedures, and/or treatments. Today, however, a medical practice may have to accept different amounts as payment for each service it performs, depending on which insurance provider is paying for the service. The reimbursement varies from a fixed percentage of the physician’s charges to a set amount for a given service. Insurance is discussed in detail in Chapter 46. The medical office usually has a basic fee schedule, listing the usual charges for office visits and procedures. The fee schedule is used to fill out charges on the charge slip or superbill. When a computer billing program is used, the amount charged for each procedure is linked to the procedure and usually comes up automatically when the correct procedure is selected. Most computer billing programs can link a patient’s fees to his or her specific insurance fee schedules, such as Medicare and Medicaid (Procedure 44-1). Each patient has his or her own account. It is important to verify that all information about the account is current when the patient arrives at the office, because address information and insurance information can change between visits. A cumulative record of charges and payments is kept, usually using a computer program. It is also possible to keep account records manually. This record of charges and payments is called the patient account ledger. In a computer billing program, the patient account ledger is linked to the patient demographic and insurance information so that periodic bills and insurance claims can be generated. Information about services provided to an individual patient and payments received for that patient show up in chronologic order on the patient ledger (Figure 44-3). After the charge slip has been completed, the charges are posted to the patient ledger (Procedure 44-2). Payment for services performed can be received in four ways: 1. The patient pays at the time of service, in full, or in part (e.g., a copayment for managed care insurance). The office will accept cash and checks, and most offices also accept credit and debit cards. 2. The patient may make a payment through the mail in response to a bill. 3. The patient may make an online payment using a credit or debit card through the medical practice website. 4. An insurance company may make a payment either by mail or, increasingly, by electronic transfer. A change to the patient account that is neither a charge for services nor a payment is called an adjustment. Credit (negative) adjustments are subtracted from the patient balance. Examples of credit adjustments include discounts for payment at the time of service, professional courtesy, and discounts given to insurance companies (also called insurance write-offs). Credit adjustments are usually discounts that are given in specific circumstances. (See Box 44-1 for common terminology used in accounting.) Debit (positive) adjustments are added to the patient balance. Debit adjustments will be discussed in more detail in Chapter 47. When using a computer billing program, the medical assistant selects a code for each charge, payment, or adjustment. The correct mathematical operation is linked to the transaction code so that the computer automatically adds charges and debit adjustments (such as a returned check) to the patient balance and subtracts payments and credit adjustments (such as an insurance write-off). (Procedure 44-3).

Managing Practice Finances

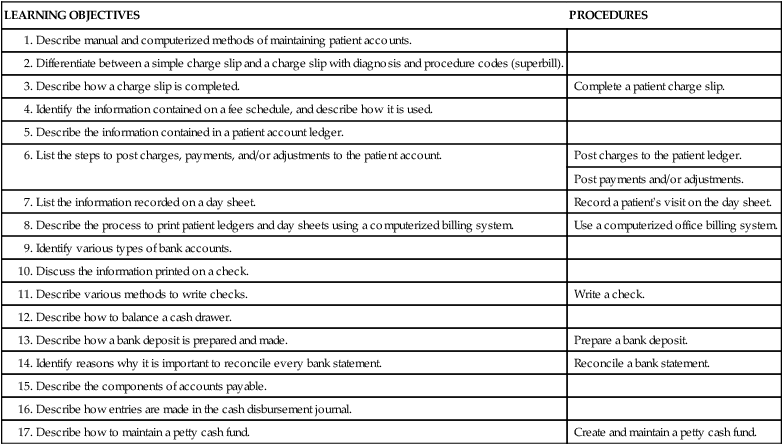

LEARNING OBJECTIVES

PROCEDURES

Complete a patient charge slip.

Post charges to the patient ledger.

Post payments and/or adjustments.

Record a patient’s visit on the day sheet.

Use a computerized office billing system.

Write a check.

Prepare a bank deposit.

Reconcile a bank statement.

Create and maintain a petty cash fund.

Introduction to Daily Financial Activities

Maintaining Patient Accounts

Components of A Patient Account

Charge Slip

Fee Schedule

Patient Account Ledger

Posting Payments to the Patient Account

Posting Adjustments to the Patient Account

Managing Practice Finances

Get Clinical Tree app for offline access