Conquering Medicare’s Challenges

Chapter objectives

After completion of this chapter, the student should be able to:

1. Describe the Medicare program and its structure.

3. Discuss Medicare managed care plans, including their advantages and disadvantages.

4. Outline specific considerations in preparation for the Medicare patient.

5. Recap the Medicare billing process.

6. Summarize the basics for filing Medicare claims electronically.

7. Establish guidelines for using the CMS-1500 paper form.

8. Compare and contrast MSNs and ERAs and the information each contains.

9. Discuss the purpose of Medicare audits and explain the five-level appeal process.

10. Explain the purpose of quality review studies.

11. Identify methods for detecting and reporting Medicare billing fraud.

12. Discuss the function of CLIA as it pertains to claims processing.

Chapter terms

adjudicated

advanced beneficiary notice (ABN)

allowable charges

beneficiary

Beneficiary Complaint Response Program

Beneficiary Notices Initiative

benefit period

claims adjustment reason codes

Clinical Laboratory Improvement Amendments (CLIA)

coordination of benefits contractor (COBC)

credible coverage

demand bills

disproportionate share

donut hole

downcoding

dual eligibles

electronic funds transfer (EFT)

electronic remittance advice (ERA)

end-stage renal disease (ESRD)

Federal Insurance Contribution Act (FICA)

fiscal intermediary (FI)

health insurance claim number (HICN)

HMO with point-of-service (POS) option

initial claims

lifetime (one-time) release of information form

local coverage determinations (LCDs)

mandated Medigap transfer

Medicare

Medicare Administrative Contractors (MACs)

Medicare gaps

Medicare HMOs

Medicare limiting charge

Medicare managed care plan

Medicare nonparticipating provider (nonPAR)

Medicare Part A

Medicare Part B

Medicare Part C (Medicare Advantage Plans)

Medicare Part D (Prescriptions Drug Plan)

Medicare participating provider (PAR)

Medicare Physician Fee Schedule

Medicare Secondary Payer (MSP)

Medicare Summary Notice (MSN)

Medicare supplement policy

network

noncovered services

open enrollment period

peer review organization (PRO)

Physician Quality Reporting System (PQRS)

Programs of All-inclusive Care for the Elderly (PACE)

quality improvement organizations (QIOs)

quality review study

Recovery Audit Contractor (RAC)

relative value unit

remittance advice (RA)

remittance remark codes

resource-based relative value system (RBRVS)

self-referring

small provider

special needs plan (SNP)

standard paper remittance (SPR)

Medicare program

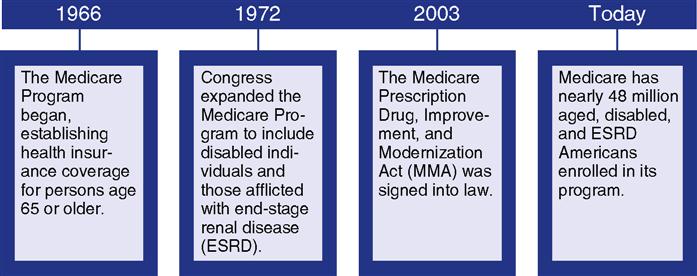

Medicare, a comprehensive federal insurance program, was established by Congress in 1966 to give individuals age 65 years and older financial assistance with medical expenses. In 1972 the Medicare program was expanded to include certain categories of disabled individuals younger than age 65 and individuals of any age who have end-stage renal disease (ESRD), a group of permanent kidney disorders requiring dialysis or transplant. Fig. 9-1 shows important transitions in the Medicare program from its inception to 2010 enrollment.) Medicare is administered by the Center for Medicare and Medicaid Services (CMS), formerly called the

Healthcare Financing Administration (HCFA). CMS is a federal agency within the U. S. Department of Health and Human Services (DHHS) that administers the Medicare program and works in partnership with state governments to administer Medicaid, the State Children’s Health Insurance Program (SCHIP), and health insurance portability standards. To study a timeline of key developments in the Medicare Program, visit the Evolve site.

Medicare Fact: In 2010 the first “baby boomers” turned 65 and became eligible for Medicare. In the coming years, the number of patients depending on Medicare will rise from 48 million to more than 90 million Americans.

The Federal Insurance Contributions Act (FICA) provides for a federal system of old age, survivor, disability, and hospital insurance. The old age, survivor, and disability insurance part is financed by Social Security taxes. The hospital insurance part of Medicare is funded through taxes withheld from employees’ wages and matched by employer contributions. In 2011 the FICA tax rate was lowered to 5.65% for employees. The employer rate remained unchanged, while the Social Security rate for employees was lowered to 4.20%. The Medicare contribution rate is 1.45% (amount withheld from wages). Employers must contribute a matching percentage for a total Medicare contribution of 2.9%. All wages are subject to the Medicare tax; there is no wage base limit.

Medicare is not provided free of charge; beneficiaries must meet certain conditions to qualify for benefits. Additionally, Medicare requires cost sharing in the form of premiums, deductibles, and coinsurance, all of which are discussed in this chapter.

Medicare Program Structure

Medicare is composed of four parts:

Medicare Part A—hospital insurance

Medicare Part C—Medicare Advantage (managed care–type plans, formerly Medicare + Choice)

Medicare Part A

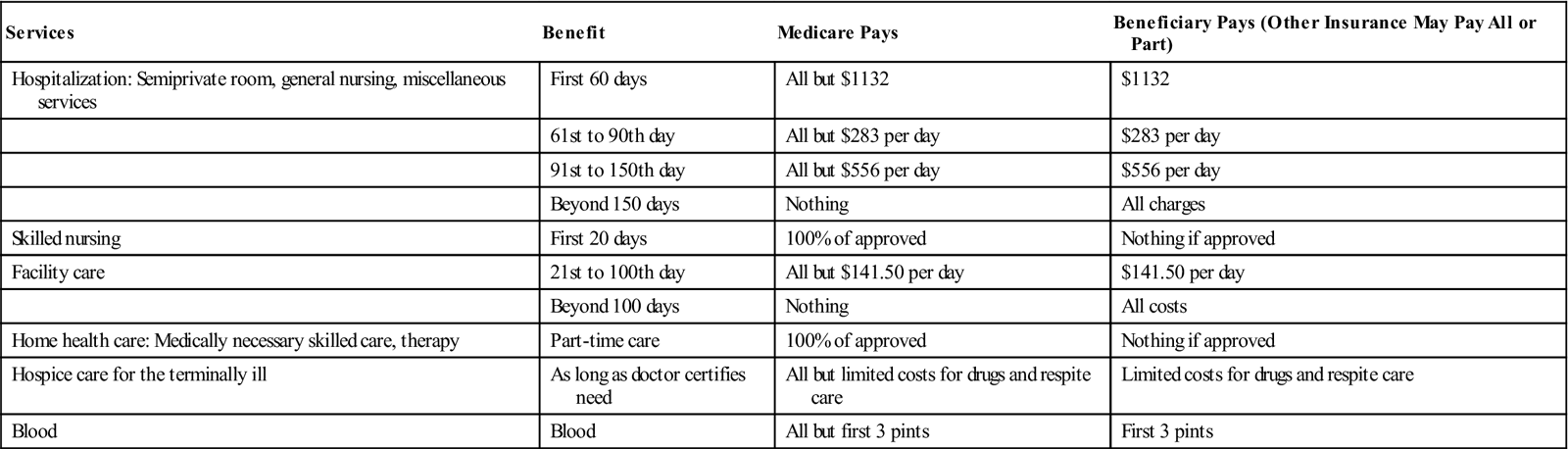

Medicare Part A (hospital insurance) helps pay for services for the following types of healthcare (Table 9-1):

• Inpatient hospital care (including critical access hospitals)

• Inpatient care in a skilled nursing facility (SNF)

• Blood

Table 9-1

2011 Medicare Hospital Insurance (Part A) Covered Services*

| Services | Benefit | Medicare Pays | Beneficiary Pays (Other Insurance May Pay All or Part) |

| Hospitalization: Semiprivate room, general nursing, miscellaneous services | First 60 days | All but $1132 | $1132 |

| 61st to 90th day | All but $283 per day | $283 per day | |

| 91st to 150th day | All but $556 per day | $556 per day | |

| Beyond 150 days | Nothing | All charges | |

| Skilled nursing | First 20 days | 100% of approved | Nothing if approved |

| Facility care | 21st to 100th day | All but $141.50 per day | $141.50 per day |

| Beyond 100 days | Nothing | All costs | |

| Home health care: Medically necessary skilled care, therapy | Part-time care | 100% of approved | Nothing if approved |

| Hospice care for the terminally ill | As long as doctor certifies need | All but limited costs for drugs and respite care | Limited costs for drugs and respite care |

| Blood | Blood | All but first 3 pints | First 3 pints |

*Hospital deductibles and coinsurance amounts change each year. The numbers shown in this chart are effective for 2011.

From http://www.insurance.wa.gov/publications/consumer/Medicare_Chart_A_B.pdf/.

Medicare Part A does not cover custodial or long-term (nursing home) care.

Coverage requirements under Medicare state that for a service to be covered, it must be considered medically necessary—reasonable and necessary for the diagnosis or treatment of an illness or injury or to improve the functioning of a malformed body part.

Noncovered services are items or services that are not paid for by Medicare. See Table 9-2 for a list of noncovered services.

Table 9-2

Medicare Part A Noncovered Services

Medical devices or biologicals (drugs or medicinal preparations obtained from animal tissue or other organic sources) that have not been approved by the U.S. Food and Drug Administration

Items and services that are determined to be investigational in nature: alternative medicine, including experimental procedures and treatments, acupuncture, and chiropractic services (except when manipulation of the spine is medically necessary to fix a subluxation of the spine—when one or more of the bones of the spine move out of position)

Most care received outside of the United States

Cosmetic surgery (unless it is needed to improve the function of a malformed part of the body)

Most dental care

Hearing aids or the examinations for prescribing or fitting hearing aids (except for implants to treat severe hearing loss in some cases)

Personal care or custodial care, such as help with bathing, toileting, and dressing (unless patient is homebound and receiving skilled care), and nursing home care (except in a skilled nursing facility if eligible)

Housekeeping services to help patient stay at home, such as shopping, meal preparation, and cleaning (unless patient is receiving hospice care)

Nonmedical services, including hospital television and telephone, a private hospital room, canceled or missed appointments, and copies of x-rays

Most non-emergency transportation, including ambulance services

Some preventive care, including routine foot care

Most vision (eye) care, including eyeglasses (except when following cataract surgery) and examinations for prescribing or fitting eyeglasses or contact lenses

Medicare Part A is free to any individual age 65 or older who is

Medicare Part A is also free to any disabled individual younger than age 65 who has

Medicare Fact: If an individual is diagnosed with amyotrophic lateral sclerosis (ALS or Lou Gehrig’s disease), he or she automatically qualifies for both Parts A and B the month that disability benefits begin.

A beneficiary (an individual who has health insurance through the Medicare or Medicaid program) automatically qualifies for Part A if he or she was a federal employee on January 1, 1983.

Application for Medicare Part A is automatic when an individual applies for Social Security benefits. A husband or wife may also qualify for Part A coverage at age 65 on the basis of the spouse’s eligibility for Social Security. If an individual is not eligible for free Part A, he or she may purchase this coverage. In most cases, if a person chooses to buy Part A, he or she must also have Part B and pay monthly premiums for both. Those who have limited income and resources may apply to their state for help in paying premiums.

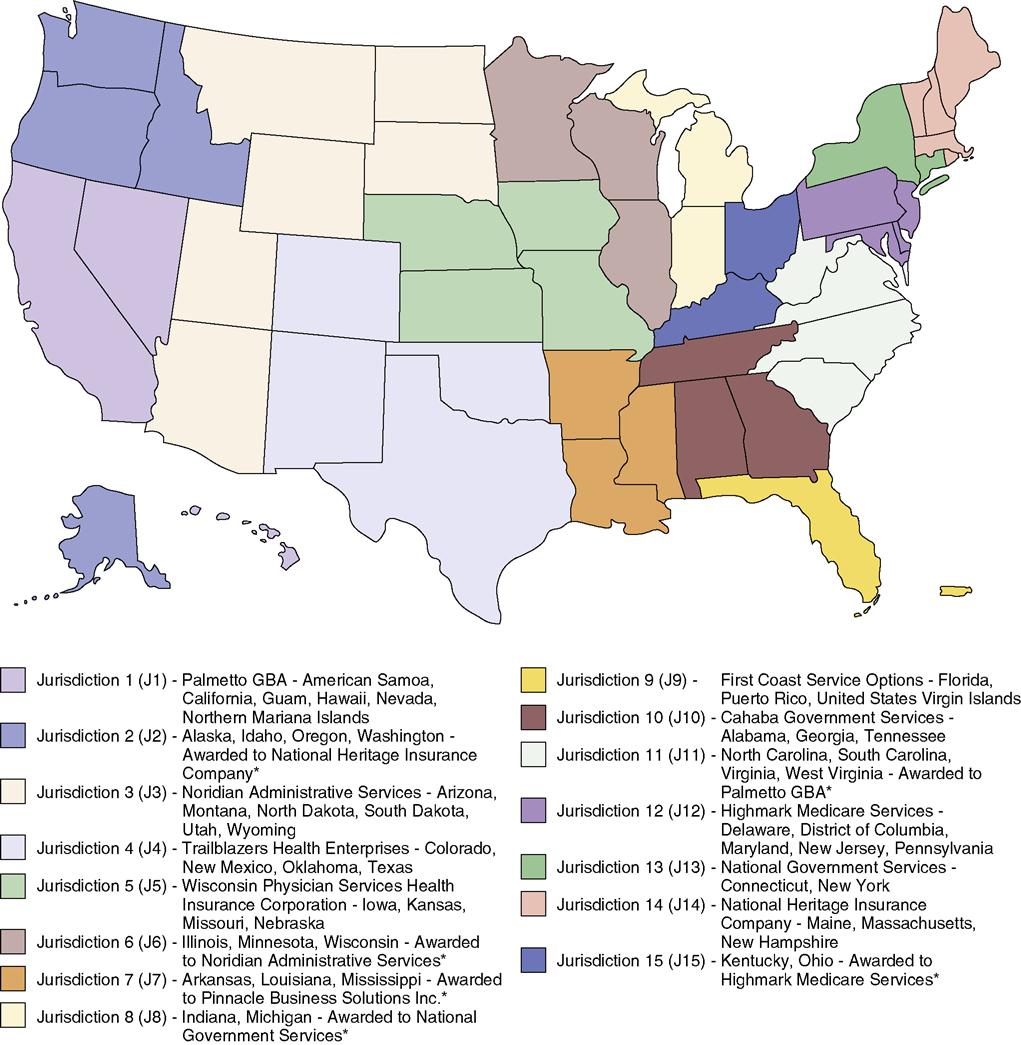

Medicare Administrative Contractors (MACs), also referred to as Medicare Carriers and Fiscal Intermediaries (FIs), are private insurance companies that serve as the federal government’s agents in the administration of the Medicare program, including the payment of claims. In the past, carriers made Medicare payments to providers including doctors and equipment suppliers, and FIs made Medicare payments to facilities such as hospitals and nursing facilities. Railroad Retirement Board Carriers (RRBC) administer Medicare benefits for railroad retirees. With the new MAC structure, there are 15 contractors by jurisdiction responsible for processing Part A and B claims. Four of the A/B MAC providers will overlap responsibility for handling Home Health and Hospice claims. The final four MAC plans will be the Durable Medical Equipment (DME) contractors. Fig. 9-2 shows a map of these MAC jurisdictions along with the name of each MAC and the states they will cover.

For updates on Medicare Parts A and B administrative contractors and MACs, visit the Evolve site.

Medicare Part B

Medicare Part B is medical insurance financed by a combination of federal government funds and beneficiary premiums that help pay for the following:

• Medically necessary physicians’ services

• Outpatient hospital services

• Clinical laboratory services

For a complete list of covered and noncovered Part B services, type “Medicare & You” along with the appropriate year in your Internet search engine, e.g., “Medicare & You 2013.”

For a beneficiary who became eligible for Medicare on or after January 1, 2005, Medicare covers a “Welcome to Medicare” physical examination if it is performed within the first 12 months of coverage, if that individual has Part B coverage. Beginning January 2011, Part B also covers a yearly “wellness” examination for those who have had Part B for longer than 12 months in order to develop or update a personalized prevention plan based on current health and risk factors. This yearly exam is free if the healthcare provider accepts assignment. Medicare covers “wellness” exams for healthy beneficiaries every year. Part B also can help pay for many other medical services and supplies that are not covered by Medicare Part A and for home healthcare if the beneficiary is not enrolled in Part A. Medicare covers other preventive healthcare services, such as

Table 9-3 lists additional services and supplies that Medicare Part B helps pay for and services that are not covered by Part B.

Table 9-3

Services and Supplies Medicare Part B Helps Pay for and Services Not Covered by Part B

| Items Medicare part B helps pay for* | Abdominal aortic aneurysm screening Ambulance services Ambulatory surgical centers Blood Bone mass measurements (bone density) (every 2 yr) Cardiovascular screenings (every 5 yr) Chiropractic services (limited) Clinical laboratory services Clinical research studies Colorectal cancer screenings Defibrillator (implantable automatic) Diabetes screenings Diabetes self-management training Diabetes supplies Doctor services Durable medical equipment Emergency room services Eye examinations for people with diabetes Eyeglasses (limited) Federally qualified health center services Flu shots Foot examinations and treatment Glaucoma tests Hearing and balance examinations Hepatitis B shots Home health services Kidney dialysis services and supplies Mammograms (screening) Medical nutrition therapy services Mental health care (outpatient) Occupational therapy Outpatient hospital services Outpatient medical/surgical services/supplies Pap tests, pelvic examinations, and clinical breast examinations Physical examination (one-time “Welcome to Medicare” examination) Physical therapy Pneumococcal vaccine Practitioner services (non-doctor) Prescription drugs (limited) Prostate cancer screenings Prosthetic/orthotic items Rural health clinical services Second surgical opinions Smoking cessation (counseling to stop smoking) Speech-language pathology services Surgical dressing services Telemedicine Tests (e.g., x-rays, MRI, CT scans, electrocardiograms) Transplants and immunosuppressive drugs Travel (emergencies when traveling outside the United States) Urgently needed care |

| Services not covered by Medicare part B† | Acupuncture Chiropractic services Cosmetic surgery Custodial care Deductibles, coinsurance, copayments Dental care and dentures Eye examinations (routine) and refractions Foot care (routine) Hearing aids and examinations Hearing tests not ordered by doctor Laboratory tests (screenings) Long-term care (custodial care in nursing homes) Orthopedic shoes Physical examinations (yearly or routine) Prescription drugs (refer to Medicare Part D) Shots to prevent illness Surgical procedures in ambulatory surgical centers not covered by Medicare Part B Syringes or insulin (some diabetic supplies) Travel to foreign countries |

*Limitations, deductibles, and copayments may apply.

All Medicare Part B beneficiaries pay for Part B coverage. Most beneficiaries enrolled in “original” Medicare paid a monthly premium of $96.40 in 2011 and $99.90 in 2012. Medicare Part B monthly premiums are subject to an increase every year.

Medicare Fact: Part B premiums are higher for those beneficiaries whose yearly income is in excess of $85,000 (single) or $170,000 (joint).

The health insurance professional should become familiar with Medicare’s guidelines to determine whether a specific procedure or service is covered. If coverage is questioned, the professional should contact Medicare by phone at 1-800-MEDICARE (1-800-633-4227) or on the Internet at www.medicare.gov/.

In addition, the Websites to Explore at the end of this chapter provide several Internet links to follow for additional help and information.

The Part B MAC determines payment of Part B–covered items and services. As mentioned earlier, a MAC is a private company that contracts with CMS to provide claims processing and payment for Medicare Part B services. The local MAC also has the ability and authority to designate an item or service as noncovered for its service area or jurisdiction. For a complete list of all noncovered items or services for his or her state, the health insurance professional should contact the local MAC. (MACs and FIs are subject to periodic change.)

Enrollment

Before an individual reaches age 65, he or she must decide whether to enroll in Medicare Part A or Part B or both. If eligible beneficiaries want Medicare coverage to start the month they reach age 65, they should contact their local Social Security office 3 months before their 65th birthday. If they decide not to sign up for Medicare until after their 65th birthday, the Medicare Part B effective date is delayed. For each 12-month period an individual delays enrollment in Medicare Part B, he or she will have to pay a 10% Part B premium penalty.

An eligible beneficiary may delay enrollment without a penalty or a waiting period, however, if the individual (or spouse) was still employed and covered by an employer’s group health plan at the time of eligibility. Individuals who do not enroll within the 3-month period before becoming age 65 must wait and enroll during the general enrollment period, which is January 1 through March 31 of each year. Medicare Part B coverage becomes effective on July 1 of that year. Unless an eligible person has an employer-provided group health plan, declining Medicare may not be a good idea. If Medicare coverage is declined when the individual first becomes eligible, “late enrollment” carries two penalties. (See next section on Premiums and Cost-Sharing Requirements.)

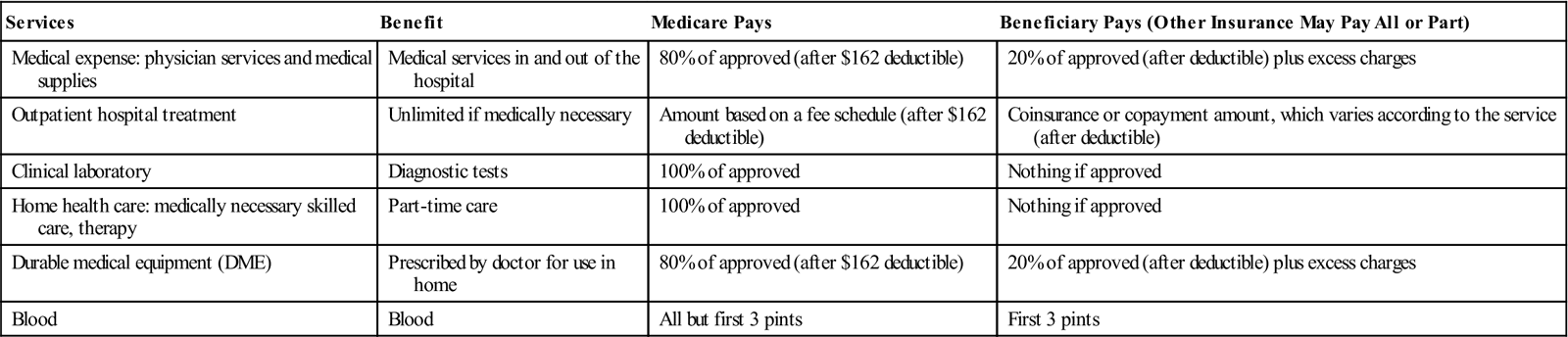

Premiums and Cost-Sharing Requirements

Medicare Part B (medical insurance) cost-sharing requirements include a monthly premium, discussed in a previous section. This premium, which is automatically deducted from the beneficiary’s monthly Social Security check, is subject to change every year. The second cost-sharing requirement in original Medicare Part B is an annual deductible of $162 (2011). After the deductible is met, Medicare pays 80% of allowable charges. Allowable charges are the fees Medicare permits for a particular service or supply. Table 9-4 summarizes the Medicare Part B cost-sharing amounts for various types of covered services.

Table 9-4

Services Covered by Medicare Medical Insurance (Part B) for 2011

| Services | Benefit | Medicare Pays | Beneficiary Pays (Other Insurance May Pay All or Part) |

| Medical expense: physician services and medical supplies | Medical services in and out of the hospital | 80% of approved (after $162 deductible) | 20% of approved (after deductible) plus excess charges |

| Outpatient hospital treatment | Unlimited if medically necessary | Amount based on a fee schedule (after $162 deductible) | Coinsurance or copayment amount, which varies according to the service (after deductible) |

| Clinical laboratory | Diagnostic tests | 100% of approved | Nothing if approved |

| Home health care: medically necessary skilled care, therapy | Part-time care | 100% of approved | Nothing if approved |

| Durable medical equipment (DME) | Prescribed by doctor for use in home | 80% of approved (after $162 deductible) | 20% of approved (after deductible) plus excess charges |

| Blood | Blood | All but first 3 pints | First 3 pints |

From http://www.insurance.wa.gov/publications/consumer/Medicare_Chart_A_B.pdf.

A benefit period is the duration of time during which a Medicare beneficiary is eligible for Part A benefits for services incurred in a hospital or skilled nursing facility (SNF) or both. A benefit period begins the day an individual is admitted to a hospital or SNF. The benefit period ends when the beneficiary has not received care in a hospital or SNF for 60 days in a row. If the beneficiary is readmitted to the hospital or SNF before the 60 days elapse, it is considered to be in the same benefit period. If the beneficiary is admitted to a hospital or SNF after the initial 60-day benefit period has ended, a new benefit period begins. The inpatient hospital deductible must be paid for each benefit period, but there is no limit to the number of benefit periods allowed.

As mentioned previously, Part A is free for individuals who have worked enough quarters to qualify (40 or more). Penalties may be assessed for failing to enroll at appropriate times. For Part A, the penalty applies only to those who pay for Part A coverage. If an individual does not enroll in Part A when first eligible, the monthly premium may go up 10% unless he or she is eligible for a special enrollment period. If a person is not covered by an employer-sponsored group health plan, a premium penalty is charged if he or she fails to enroll in Medicare Part B during the Initial Enrollment Period or Special Enrollment Period. The monthly premium for Part B may go up 10% for each full 12-month period that the individual was eligible for Part B but did not sign up for it. For example, a 2-year delay would be 20%; a 3-year delay would be a 30% penalty, and so on. This penalty is paid for the remainder of the individual’s life.

Medicare Fact: Premiums, deductibles, and penalty amounts are subject to change every year.

Medicare Part C (Medicare Advantage Plans)

The Balanced Budget Act of 1997, which went into effect in January 1999, expanded the role of private plans under what was originally called Medicare + Choice to include managed care plans such as preferred provider organizations (PPOs), provider-sponsored organizations (PSOs), private fee-for-service (PFFS) plans, and medical savings accounts (MSAs) coupled with high-deductible insurance plans. The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 renamed the program “Medicare Advantage” and created another option: regional PPOs.

Medicare Advantage is an alternative to traditional (original) Medicare that allows the government to pay insurers to manage benefits to seniors. These prepaid healthcare plans offer regular Medicare Parts A and B coverage in addition to coverage for other services. Medicare Advantage plans are run by private companies approved by Medicare. Under Medicare Part C, individuals who are eligible for Medicare Parts A and B can choose to get their Medicare benefits through a variety of plans (see previously), with the exception of individuals with ESRD, who must remain on original Medicare. The primary Medicare Part C plans include the following:

Medicare Part C coverage not only includes Part A and Part B coverage but also pays for services not covered under the original Medicare plan, such as preventive care, prescription drugs, eyeglasses, dental care, and hearing aids.

For a Medicare beneficiary to qualify for one of these Medicare Advantage options, he or she must be eligible for Medicare Parts A and B and must live in the service area of the plan. As mentioned, an individual is generally not eligible to elect a Medicare Advantage plan if he or she has been diagnosed with ESRD. There are exceptions to this eligibility rule, however, such as individuals who are already members of a Medicare Advantage plan when they are diagnosed with ESRD and individuals who received a kidney transplant and no longer require a regular course of dialysis treatments.

Medicare Fact: If a beneficiary enrolls in a Medicare Part C plan, he or she does not need a supplemental plan (Medigap).

Healthcare Reform’s Impact on Medicare Advantage Plans

The changes introduced in the healthcare reform bill will be phased in gradually after they began in 2011. Medicare Advantage plans were designed to save money for the government by operating like HMOs. Because Congress (in 2003) believed that subsidies would encourage providers to expand the plans into rural and less profitable markets, Medicare Advantage plans receive more federal dollars than what is paid to providers through traditional Medicare. The provisions in the healthcare reform bill are designed to bring payments to these plans more in alignment with payments to traditional Medicare. These changes will be phased in over 3 years, ideally making the transition easier for Medicare Advantage customers and insurance providers.

How will this change affect seniors? Premiums may rise, some plans may reduce the extra benefits they provide as they adjust to lower payments from the government, and some insurance companies may stop offering Medicare Advantage altogether. It is important to remember, however, that no one currently enrolled in a Medicare Advantage plan will lose his or her coverage. Under Medicare guidelines, a beneficiary can always switch to another plan if he or she prefers to stay in an Advantage plan or to have the option of enrolling in traditional Medicare.

Other Medicare Health Plans

Plans that are not Medicare Advantage Plans but are still part of Medicare are

Some plans provide both Parts A and B coverage and some also provide prescription drug coverage (Part D). Details of the Medicare Cost Plans and Demonstration/Pilot Programs are explained on page 83 respectively of the Medicare and You handbook for 2012.

The PACE program is discussed later in this chapter.

Medicare Part D (Medicare Prescription Drug Benefit Plan)

Medicare Part D offers prescription drug coverage to all seniors eligible for Medicare. These plans are run by insurance companies or other private organizations approved by Medicare. The cost of drugs within each plan can vary.

There are two ways to get prescription drug coverage:

When beneficiaries enroll in Medicare Part D, they pay an additional premium, which can be deducted from their monthly Social Security check or paid separately. Premiums vary depending on the plan, with a national average of $32.34 in 2011. Individual plans, such as group health insurance plans, that include prescription coverage must, however, offer no less than the standard Medicare benefit, referred to as credible coverage. Medicare’s standard benefits under Part D are shown in Table 9-5. These figures are subject to change every year. It should be noted here that many plans offer more comprehensive coverage than Medicare’s basic coverage.

Table 9-5

Medicare Part D Standard Benefit Table

| 2010 | 2011 | |

| Deductible | $310.00 | $310.00 |

| Initial coverage limit | $2830.00 | $2840.00 |

| Out-of-pocket threshold | $4550.00 | $4550.00 |

| Minimum copays (catastrophic portion of benefit): | ||

| Generic preferred drug | 2.50 | 2.50 |

| All other | 6.30 | 6.30 |

Owing to the new healthcare reform law, the Standard Part D benefit now provides some coverage in the “donut hole”—between the point at which Medicare Part D stops paying for prescriptions and the point at which catastrophic coverage for drugs becomes effective. Although Part D does not provide a benefit for brand name drugs in the donut hole until 2013, the manufacturers of the brand-named drugs will provide a 50% discount to most Part D enrollees. By 2020, the Part D donut hole will be completely phased out through the combination of the additional Part D benefit and brand discount.

Individuals qualifying for both Medicare and Medicaid benefits (dual eligibles, sometimes referred to as Medi-Medi) who receive the full Medicaid benefits package no longer have prescription drug coverage under Medicaid but can enroll in Medicare Part D. Medicare pays the Part D deductible for all dual eligibles and for their monthly premiums, if they enroll in an average or low-cost Part D plan. These subsidies eliminate the gap in coverage (donut hole) for dual eligibles that Medicare beneficiaries who do not qualify for Medicare and Medicaid face. Dual eligibles are responsible, however, for small copays ranging from $2.50 to $6.30. Dual eligibles residing in nursing homes or other institutions are exempt from copays because they already are contributing all but a small portion of their income to the cost of their nursing home care.

Changing Medicare Health or Prescription Drug Coverage

Beneficiaries can change their Medicare health or prescription drug coverage during the annual open enrollment period. Beginning in the fall of 2011, the annual enrollment period dates changed, giving enrollees more time to join or switch their Medicare health or prescription drug plan. Rather than November 15 to December 31, the new enrollment period is between October 15 and December 7. Therefore, if a change was made during this period in 2011, new coverage will began on January 1, 2012.

Programs of All-Inclusive Care for the Elderly (PACE)

Programs of All-Inclusive Care for the Elderly (PACE) is a combination Medicare/Medicaid program that provides community-based long-term care services to eligible recipients. If an individual qualifies for Medicare, all Medicare-covered services are paid for by Medicare. If he or she also qualifies for Medicaid, he or she must pay either a small monthly payment or pay nothing for the long-term care portion of the PACE benefit. Those who are not Medicaid-eligible must pay a monthly premium to cover the long-term care portion of the PACE benefit and a premium for Medicare Part D drugs. However, there is no deductible or copayment for any drug, service, or care approved by the PACE team.

PACE is available only in areas where a PACE organization is under contract to deliver services. To be eligible for the program, an individual must meet the following criteria:

• Meets the medical need criteria

• Lives in an area serviced by a PACE organization

• Can be safely served in the community according to the PACE organization

To view the fact sheet “Quick Facts about Programs of All-Inclusive Care for the Elderly (PACE),” visit the Evolve site.

Medicare combination coverages

Because Medicare does not cover some services and there are deductibles and copayments that patients must pay out of pocket for most services, beneficiaries often have added health insurance coverage to help with the gaps in Medicare’s coverage. This extra coverage can be one of the following:

The following sections explain each of these supplemental types of healthcare coverage.

Medicare/Medicaid Dual Eligibility

Dual eligibility, as stated earlier, refers to the status of individuals who qualify for benefits under both the Medicare and Medicaid programs. Most dual eligibles are low-income elderly or individuals younger than 65 years with disabilities. Medicare does not pay for all health services, just basic physician and hospital care. In addition, Medicare beneficiaries have to meet a yearly deductible and pay a monthly premium and a 20% copayment (cost sharing) for all covered services. Dual eligibles rely on Medicaid to pay Medicare premiums and cost-sharing (deductibles and copays) expenses and to pay for the needed benefits Medicare does not cover such as long-term care.

Medicare Supplement Policies

The traditional Medicare program provides valuable coverage of healthcare needs, but it leaves uninsured areas with which elderly and disabled Americans need additional help. To ensure that they are adequately protected, many seniors purchase a Medicare supplement policy (also referred to as a Medigap policy). A Medicare supplement policy is a health insurance plan sold by a private insurance company to help pay for healthcare expenses not covered by Medicare and Medicare’s deductibles and coinsurance. An individual may qualify for supplemental insurance through an employer-sponsored retirement plan or, more commonly, through a Medigap plan.

Medigap Insurance

Medigap insurance is designed specifically to supplement Medicare benefits and is regulated by federal and state law. A Medigap policy must be clearly identified as Medicare supplemental insurance, and it must provide specific benefits that help fill the gaps in Medicare coverage. Other kinds of insurance may help with out-of-pocket healthcare costs, but they do not qualify as Medigap plans.

In June of 2010, the types of Medigap plans available changed. There are two new Medigap Plans, Plans M and N. Plans E, H, I, and J are no longer available to buy. Beneficiaries who purchased one of these discontinued plans before June 1, 2010, can keep that plan, however. Each plan has a different set of benefits. Plan A is the basic plan, and it has the least amount of benefits. Plan F, the most comprehensive, provides 100% of the gaps in Medicare; there are no deductibles, no copays, and no coinsurance with any healthcare provider who accepts Medicare.

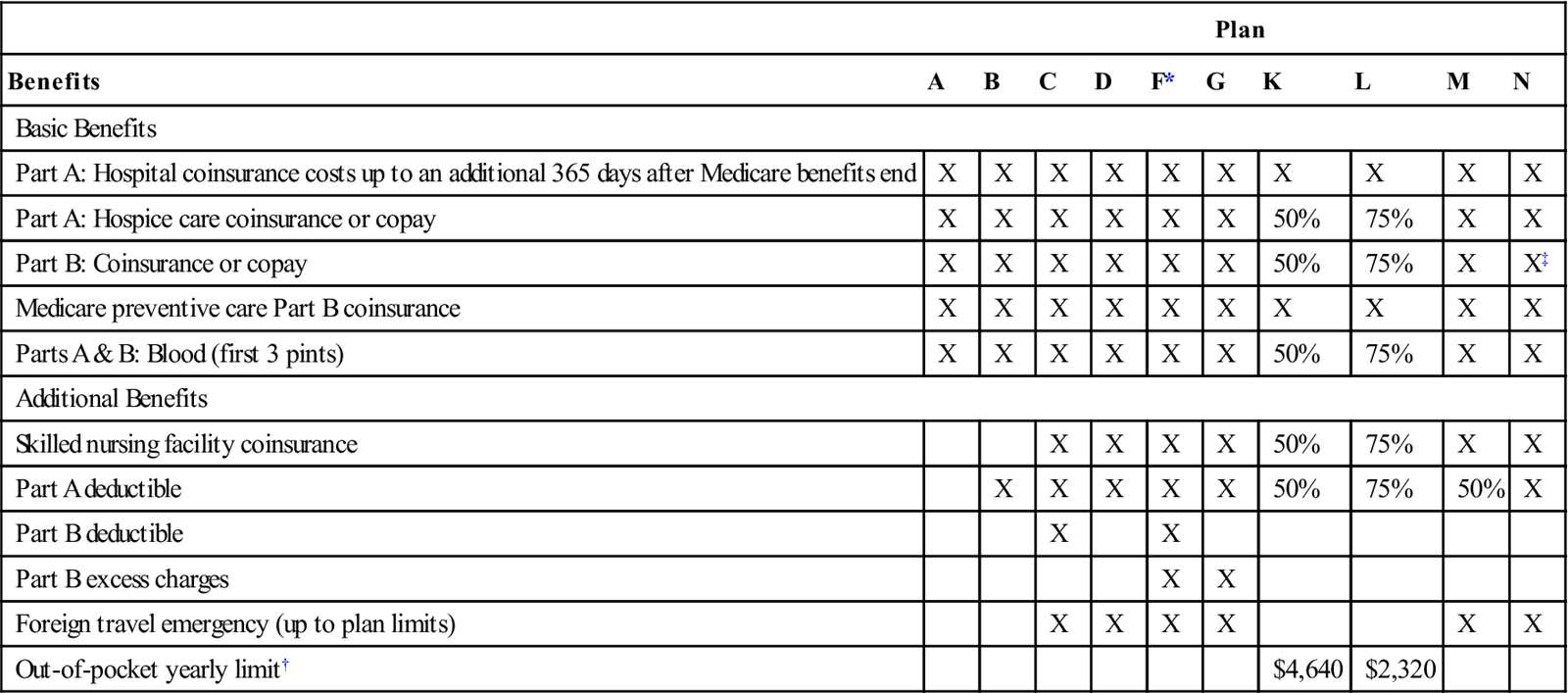

Table 9-6 shows the 10 Medigap plans currently available and what each covers.

Table 9-6

Ten Standard Medicare Supplemental Plans

| Plan | ||||||||||

| Benefits | A | B | C | D | F* | G | K | L | M | N |

| Basic Benefits | ||||||||||

| Part A: Hospital coinsurance costs up to an additional 365 days after Medicare benefits end | X | X | X | X | X | X | X | X | X | X |

| Part A: Hospice care coinsurance or copay | X | X | X | X | X | X | 50% | 75% | X | X |

| Part B: Coinsurance or copay | X | X | X | X | X | X | 50% | 75% | X | X‡ |

| Medicare preventive care Part B coinsurance | X | X | X | X | X | X | X | X | X | X |

| Parts A & B: Blood (first 3 pints) | X | X | X | X | X | X | 50% | 75% | X | X |

| Additional Benefits | ||||||||||

| Skilled nursing facility coinsurance | X | X | X | X | 50% | 75% | X | X | ||

| Part A deductible | X | X | X | X | X | 50% | 75% | 50% | X | |

| Part B deductible | X | X | ||||||||

| Part B excess charges | X | X | ||||||||

| Foreign travel emergency (up to plan limits) | X | X | X | X | X | X | ||||

| Out-of-pocket yearly limit† | $4,640 | $2,320 | ||||||||

Note: Out-of-pocket annual limit for Plans K and L increases each year with inflation.

*Plan F also offers a high-deductible plan. This means beneficiary pays for Medicare covered costs up to the deductible amount ($2,000 in 2011) before the Medicare Supplement plan pays anything.

†After beneficiary meets the out-of-pocket yearly limit and the yearly Part B deductible ($162 in 2011), the Medicare Supplement plan pays 100% of covered services for the rest of the calendar year. Out-of-pocket limit is the maximum amount beneficiary would pay for coinsurance and copays.

‡Plan N pays 100% of the Part B coinsurance except up to $20 copays for office visits and up to $50 copays for emergency room visits (if the hospital admits the patient, the plan waives the emergency room copays).

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree