The Claim

Chapter objectives

After completion of this chapter, the student should be able to:

1. Explain the rationale for understanding both paper and electronic claims submission.

2. Summarize the general guidelines for completing the CMS-1500 paper claim form.

3. List and explain the six keys to successful claims.

4. Determine the role of the National Standard Employer Identifier Number (EIN) in claims processing.

5. Identify and briefly explain the six steps of the claims process.

6. Outline the process for submitting secondary claims.

7. Discuss the process for appealing incorrect payments and denied claims.

Chapter terms

adjudication

appeal

birthday rule

clean claim

coordination of benefits

correct code initiative

downcoding

employer identification number (EIN)

explanation of benefits (EOB)

insurance claims register (log)

Medicare Secondary Payer claims

real-time claims adjudication (RTCA)

secondary claim

suspension file

Introduction

We learned in Chapter 5 that there are two basic methods for submitting health insurance claims—paper and electronic. We also learned that claims must be electronically submitted to a Medicare Administrative contractor, Durable Medical Equipment Medicare Administrative Contractor, or a fiscal intermediary from a provider’s office or institution using a computer with software that meets electronic filing requirements as established by the Health Insurance Portability and Accountability Act (HIPAA) claim standard and by meeting Centers for Medicare and Medicaid Services (CMS) requirements. We also learned that there are limited exceptions to this mandate (see Chapter 5). In addition, more and more nongovernment payers are requiring claims to be submitted electronically.

Do these changes mean that the CMS-1500 (08/05) paper claim form will become obsolete and the health insurance professional does not need to learn the guidelines for completing it? This author doesn’t think so. The National Uniform Claim Committee (NUCC) is proposing revisions to the CMS-1500 (08/05) paper claim form that would accommodate data reporting changes in the Version 005010 837 professional electronic claim transaction and other business needs. The time frame for when a revised form would be required is unknown as of this writing. Because some healthcare providers still use the CMS-1500 form, this chapter integrates information that applies to paper and electronic claim processing.

General guidelines for completing CMS-1500 form

Steps for completing the universal CMS-1500 claim form for generic commercial carriers and the major payers—Medicaid, Medicare, and TRICARE/CHAMPVA—are available in Appendix B in the back of this textbook and on the  Evolve site. Box 15-1 lists some general guidelines for preparing all paper claims. Earlier chapters also stressed the importance of strict adherence to payer-specific guidelines when preparing claims. In addition, the NUCC “1500 Health Insurance Claim Form Reference Instruction Manual for Version 08/05” provides detailed instructions, is updated periodically, and is available on the Evolve site. The NUCC

Evolve site. Box 15-1 lists some general guidelines for preparing all paper claims. Earlier chapters also stressed the importance of strict adherence to payer-specific guidelines when preparing claims. In addition, the NUCC “1500 Health Insurance Claim Form Reference Instruction Manual for Version 08/05” provides detailed instructions, is updated periodically, and is available on the Evolve site. The NUCC  instructions are intended to be a guide only, and the health insurance professional should follow specific federal, state, or other payer guidelines for more definitive claims completion instructions.

instructions are intended to be a guide only, and the health insurance professional should follow specific federal, state, or other payer guidelines for more definitive claims completion instructions.

Keys to successful claims

Claims processing involves many steps, and each step must be performed thoroughly and accurately to receive the maximum payment that the health record documentation substantiates. This process begins with the patient appointment and ends with the subsequent payment by the carrier. Understanding how this process works allows the health insurance professional to file claims properly, resulting in full and timely reimbursement. Fig. 15-1 illustrates the six “keys” to successful claims processing. Although these “keys” may appear applicable only to paper claims, most of them also apply to the electronic claims process.

First Key: Collect and Verify Patient Information

Unless a patient visits the healthcare facility on a regular basis (e.g., weekly allergy shots or blood pressure checks), the health insurance professional should verify the patient’s information each time he or she visits the office. New patients must complete a patient information form on the first visit. Established patients should be required to update the form at least annually because within a year’s time the patient could have remarried, moved to a new address, changed jobs, or, most important to the health insurance professional, changed insurance companies. In addition to demographic data (e.g., name, address, age, gender), the patient information form should include basic items such as the insurance carrier’s name, policy and group numbers (if applicable), the insured’s name (if different from the patient), effective date of coverage, and any secondary insurance information. Some practices with a high volume of Medicare patients have a separate information form for Medicare patients.

After the patient information form is completed, the health insurance professional should check it over to ensure that the correct information has been entered in the required blanks and all information is legible. One key to successful claims submission is to have the patient provide as much information as possible, and the health insurance professional should verify this information.

In some situations, more than one insurer is involved. Such cases might occur when the patient and his or her spouse are covered under separate employer group plans or when the parents of a minor patient are divorced, and each parent has his or her own insurance policy. In the case of the latter, if the primary carrier is not designated on the information form, the health insurance professional should obtain this information from the parent who accompanies the child to the office.

In addition to the standard demographic and insurance questions asked on the patient information form, many healthcare practices include a section (often at the bottom of the form) for the patient to sign a release of information and an assignment of benefits. Other practices use separate forms for these functions. Although HIPAA law says it is unnecessary for treatment, payment, or (healthcare) operations (TPO), most healthcare facilities request that patients sign and date a valid release of information before they submit an insurance claim. Most facilities also require that patients sign an assignment of benefits, authorizing the insurance carrier to send payment directly to the healthcare provider.

Verifying a patient’s current insurance coverage (e.g., enrollment and copays) is one of the most important administrative duties of the health insurance professional. Accurate verification has a direct impact on the promptness and correctness of claim payments. Many third-party payment delays are caused by inaccurate verification on the part of the practitioner’s office or missed information at the time of the verification. Many insurance companies offer online services for providers to exchange eligibility and benefits information on their patients electronically. After obtaining a complete and accurate patient information form, the health insurance professional should make a photocopy of the patient’s insurance identification (ID) card and place it in an easily accessible location in the patient’s health record, such as inside the front cover. Many insurance ID cards also have information on the back. The health insurance professional should always check the back of the card for information and make a photocopy of it as well.

Second Key: Obtain Necessary Preauthorization and Precertification

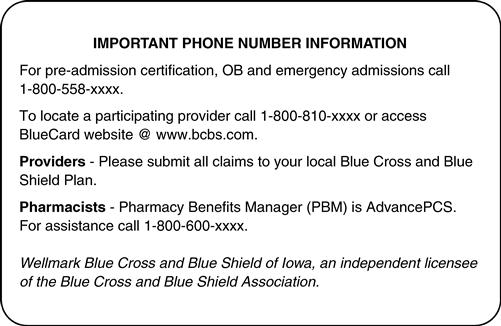

The health insurance professional should be familiar with the rules regarding preauthorization and precertification. Some third-party payers reject certain types of claims if they do not know about and approve the services beforehand. Services that most often require preauthorization or precertification include inpatient hospitalizations, new or experimental procedures, and certain diagnostic studies. Emergency services typically do not need prior authorization, but they often require some type of follow-up with the insurance company—typically within 24 to 48 hours. Although the front office staff of the provider often provides this service, it is ultimately the patient’s responsibility to know when and how to notify the insurance company for preauthorization or precertification; however, the health insurance professional should advise the patient when this process is necessary to avoid rejected claims. Also, if the patient is incapacitated in any way, the health insurance professional or a member of the healthcare staff should notify the patient’s insurer to acquire the necessary preauthorization. Telephone numbers for contacting the carrier are usually on the back of the patient’s ID card. Fig. 15-2 shows the back of an insurance ID card with a toll-free number to call when precertification is necessary. Some carriers issue a “prior authorization” number, which should be indicated in Block 23 of the CMS-1500 form.

Reminder: Medicare (fee-for-service) does not need prior authorization to provide services.

Third Key: Documentation

It is the healthcare provider’s responsibility to document appropriate comments in the patient’s health record. Each entry must indicate clearly the history, physical examination, and medical decision making for the patient. The provider also fills out an encounter form, indicating the proper procedure codes (CPT or HCPCS level II) and diagnosis codes (ICD-10-CM) to describe the patient’s condition and the services that were rendered. These codes should be checked before transferring to the claim because some practitioners when in a hurry may indicate the wrong ones. The health insurance professional places the appropriate diagnosis codes, procedure codes, charges, and any other pertinent information in the proper boxes on the claim. Whether claims are submitted on paper or in electronic format, each required field on the claim helps to determine if it is “clean.” Claims that are not clean are returned for more information or are denied. It is important that the claim show the exact diagnosis that is documented in the health record.

Fourth Key: Follow Payer Guidelines

As pointed out in previous chapters, some major payers (Medicaid, Medicare, Blue Cross and Blue Shield, TRICARE/CHAMPVA) have slightly differing guidelines for completing the CMS-1500 claim form. The health insurance professional must obtain the most recent guidelines from each of these major payers to complete the claim exactly to their specifications.

Fifth Key: Proofread Claim to Avoid Errors

Claims are frequently rejected or denied. Being aware of some common mistakes can help the health insurance professional avoid delays, denials, or rejections. With paper claims, it is good practice first to proofread the claim carefully when it is completed, paying particular attention to code entries and dollar amounts. Make sure the claim is dated and the proper signature is affixed. When the claim is completed and signed, make a photocopy for the file. Box 15-2 lists some common errors that cause a claim to be rejected or denied.

Sixth Key: Submit a Clean Claim

The most important process in the healthcare insurance cycle is submitting a clean claim to the third party payer. A clean claim means that all of the information necessary for processing the claim has been entered on the claim form, and the information is correct. Clean claims are usually paid in a timely manner. Paying careful attention to what information should be entered in each field helps produce clean claims. Refer to Appendix B at the back of the book for examples of completed claims.

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree