Miscellaneous Carriers

Workers’ Compensation and Disability Insurance

Chapter objectives

After completion of this chapter, the student should be able to:

1. Explain the history and purpose of workers’ compensation.

2. Identify legislation that provided benefits for various categories of federal workers.

3. Discuss workers’ compensation eligibility requirements and exemptions.

4. Explain workers’ compensation benefits, denial of benefits, and appeals.

5. Discuss time limits for filing workers’ compensation claims.

6. Summarize the workers’ compensation claim process, including special billing notes.

7. Discuss workers’ compensation and managed care.

8. Explain HIPAA’s connection to workers’ compensation.

9. State methods for preventing workers’ compensation fraud.

11. Differentiate between Social Security Disability Insurance and Supplemental Security Income.

12. Discuss miscellaneous programs, including State Disability, and Disability and Health Team.

13. Describe the Ticket to Work Program, its purpose, and how it works.

Chapter terms

activities of daily living (ADLs)

Americans with Disabilities Act (ADA)

benefit cap

Black Lung Benefits Act

casual employee

coming and going rule

Disability and Health Team

disability income insurance

earned income

egregious

employment network

exemptions

Federal Employment Compensation Act (FECA)

Federal Employment Liability Act (FELA)

financial means test

instrumental activities of daily living (IADLs)

interstate commerce

job deconditioning

Longshore and Harbor Workers’ Compensation Act

long-term disability

Merchant Marine Act (Jones Act)

modified own-occupation policy

no-fault insurance

occupational therapy

ombudsman

own-occupation policy

permanent and stationary

permanent disability

permanent partial disability

permanent total disability

progress or supplemental report

protected health information (PHI)

short-term disability

Social Security Disability Insurance (SSDI)

Supplemental Security Income (SSI)

temporarily disabled

temporary disability

temporary partial disability

temporary total disability

Ticket to Work Program

treating source

vocational rehabilitation

workers’ compensation

Workers’ compensation

Workers’ compensation is a type of insurance regulated by state laws that pays medical expenses and partial loss of wages for workers who are injured on the job or become ill as a result of job-related circumstances. If death results, benefits are payable to the surviving spouse and dependents as defined by law. Most U.S. workers are covered by the Workers’ Compensation Law. In many states, the employer, not the employee, pays the premiums. Each state sets up its own workers’ compensation laws and regulations; however, they are basically the same from state to state.

History

Workers’ compensation began in Germany in the 1800s when it was determined that something needed to be done to take care of injured workers to limit their physical and financial suffering from injuries or illnesses resulting from their jobs. Workers’ compensation became common in the United States in the 1930s and 1940s, and it exists today in all 50 states and territories.

When workers’ compensation was first proposed, U.S. companies were hesitant to accept full responsibility for paying the premiums. Their argument was that on top of the premium expense, they still could be financially liable in a worker-initiated lawsuit. A compromise was reached between businesses and workers: Companies would pay the premiums for the insurance that protected workers, and the workers would give up the right to sue the employer for damages resulting from a job-related illness or injury. This principle continues essentially intact today. Workers’ compensation is not considered a “benefit”; rather, it is a legally mandated right of the worker.

Companies that meet specific state requirements must provide workers’ compensation for all employees. Businesses that do not provide coverage as required by law can incur fines and other penalties. Workers’ compensation can be purchased from several sources—private insurance companies, state funds, insurance pools, and self-insurance programs. Most states require employers to purchase workers’ compensation insurance in the state in which their business operates. State statutes establish the framework and set up the laws for most workers’ compensation insurance. As mentioned earlier, these laws provide benefits not only for workers but also for dependents of workers who are killed or die as a result of job-related accidents or illnesses. Many state laws also protect employers and their fellow workers by limiting the amount an injured employee can recover from an employer and by eliminating the liability of coworkers in most accidents.

For more detailed information on the history of workers’ compensation, visit the Evolve site.

Federal Legislation and Workers’ Compensation

Workers’ compensation programs are offered at the state level. In addition, there are several categories of federal programs for workers who do not fall under the umbrella of covered employees under state laws.

The Federal Employment Compensation Act (FECA) provides workers’ compensation for nonmilitary federal employees. Many of the provisions are similar to state workers’ compensation laws; however, awards are limited to disability or death incurred while in the performance of the employee’s duties but not caused willfully by the employee, by intoxication, or other illegal acts. FECA covers medical expenses resulting from the disability and can require the employee to undergo job retraining. Under this act, a disabled employee receives two thirds of his or her normal monthly salary during the disability period and may receive more for permanent physical injuries or if he or she has dependents. FECA provides compensation for survivors of employees who are killed while on the job or die from a job-related illness or condition. FECA is administered by the Office of Workers’ Compensation Programs.

Although not a workers’ compensation statute, the Federal Employment Liability Act (FELA), states that companies in which railroads are engaged in interstate commerce (trade that involves more than one state) are liable for injuries to their employees if they have been negligent. The Merchant Marine Act (Jones Act) provides seamen (individuals involved in transporting goods by water between U.S. ports) with the same protection from employer negligence that FELA provides railroad workers. Congress enacted the Longshore and Harbor Workers’ Compensation Act to provide workers’ compensation to specified employees of private maritime employers. The Office of Workers’ Compensation Programs administers the act.

The Black Lung Benefits Act provides compensation for miners with black lung (pneumoconiosis, also called anthracosis). The Black Lung Benefits Act requires liable mine operators to award disability payments and establishes a fund administered by the Secretary of Labor providing disability payments to miners in cases in which the mine operator is unknown or unable to pay. The Office of Workers’ Compensation Programs regulates the administration of the act.

Eligibility

In the United States, any employee who is injured on the job or develops an employment-related illness that prevents the employee from working is likely to be eligible to collect workers’ compensation benefits. The benefits also apply to the spouse and dependents of a family member who dies because of a job-related accident or illness. If the disability is permanent or the employee has dependents, benefits include a specific percentage (often two-thirds) of regular wages or salary.

As with many rules and regulations, there are exceptions. Benefits are awarded only for disability or death occurring while the employee was in the process of performing lawful duties. If any horseplay, drunken stumbling, or illegal drugs are involved, workers’ compensation usually does not pay. Workers’ compensation does not pay for self-inflicted injuries and for injuries incurred while a worker is off the job, committing a crime, or violating company policy.

Exemptions

Not all business organizations are required to purchase workers’ compensation insurance for their employees. Criteria for exemptions vary from state to state. The following list presents various exemption classifications (these classifications are not nationwide but vary from state to state):

• Individuals who are business partners (coverage is optional)

• Sole proprietors (most states allow optional coverage)

A casual employee is one who is not entitled to paid holiday or sick leave, has no expectation of ongoing employment, and for whom each engagement with the employer constitutes a separate contract of employment. Casual employees often receive a higher rate of pay to compensate for a lack of job security and benefits.

These categories of employees are typically excluded, but employees can obtain workers’ compensation and employers’ liability insurance coverage by agreement between their employer and an insurance carrier.

The previous list is not all inclusive. For additional information on workers’ compensation exemptions, visit the Evolve site.

Benefits

Workers’ compensation insurance is no-fault insurance. Benefits are paid to the injured (or ill) worker regardless of who is to blame for the accident or injury, barring the exceptions mentioned previously. There are four major benefit components to workers’ compensation:

Because workers’ compensation imposes strict liability without inquiry into fault, an employer could be penalized if the cause of injury or illness was egregious, meaning the employer was conspicuously negligent, such as violating federal or state safety standards, failing to correct known defects, or exhibiting other careless conduct.

Most state workers’ compensation laws exclude coverage for injuries sustained while an employee is commuting to and from work. This exclusion is referred to as the coming and going rule. There are exceptions to this rule, however, such as when the scope of the employee’s duties includes travel or when the employee is running an errand for the employer during the commute. Inquiry as to whether the coming and going rule applies to a particular situation should be made before simply ruling out the possibility of coverage for an accident that occurred during a worker’s commute to or from work. If an employee is injured during a lunch period, it is usually considered outside the scope of the employment relationship. In the case of an automobile accident, workers’ compensation might deny the claim, indicating that the automobile insurance carrier of the at-fault party is the primary payer.

Denial of Benefits and Appeals

Employees who believe they have been wrongly denied workers’ compensation benefits can appeal or resort to litigation. Some states have an ombudsman, who is an individual responsible for investigating and resolving workers’ complaints against the employer or insurance company that is denying the benefits.

Most work injuries result in granted benefits’ because it is usually obvious when an injury is work related. In these cases, if the claim is filed in a timely manner and according to a company’s work rules, benefits are awarded. However, various situations may justify an employer or the insurer contesting a claim for workers’ compensation benefits. It may be believed that an injury or resulting disability does not meet one or more of the legal requirements for entitlement to benefits. In these cases, a notice that the claim has been denied, containing reasons for the denial, must be issued promptly to the worker by the employer or by the employer’s workers’ compensation insurance company.

The appeal process differs from state to state. In many states, if the employee disagrees with the decision to deny the claim, he or she may appeal, but it must be done within a specified time, depending on state statutes. The appeal process can be started by contacting the appropriate state agency or by hiring an attorney. If all attempts at appeal do not reverse the decision and the denial becomes final, the worker is responsible for payment of all medical bills. If the individual has other health insurance, a claim can be submitted to that insurer. Most health insurance companies ask that a copy of the workers’ compensation claim denial be included with the claim.

For more detailed information on workers’ compensation by state, visit the Evolve site.

Time Limits

Each state has rules established under which an employee is required to file a claim within a certain time limit. Usually traumatic claims must be brought within a time frame that runs from the date of the accident, date of last medical treatment, or date of the last payment of benefits. In cases where a job-related disease does not manifest immediately (i.e., lung cancer, toxic disease, or mesothelioma [a type of lung disease caused by asbestos exposure]), the time limit may extend from the date of the last exposure, date of the first symptoms of the disease, or date the diagnosis was determined. The time limits for filing claims and issuing appeals are established by individual state statutes and vary from state to state; the health insurance professional needs to become familiar with the workers’ compensation regulations in the state in which he or she is employed.

Workers’ Compensation Claims Process

The workers’ compensation claims process can be long and arduous. Various steps must be followed, and report forms must be completed. This process can be facilitated if the individual steps are adhered to carefully and the forms are completed correctly and in a timely manner. The following sections discuss the steps for successful workers’ compensation claim processing.

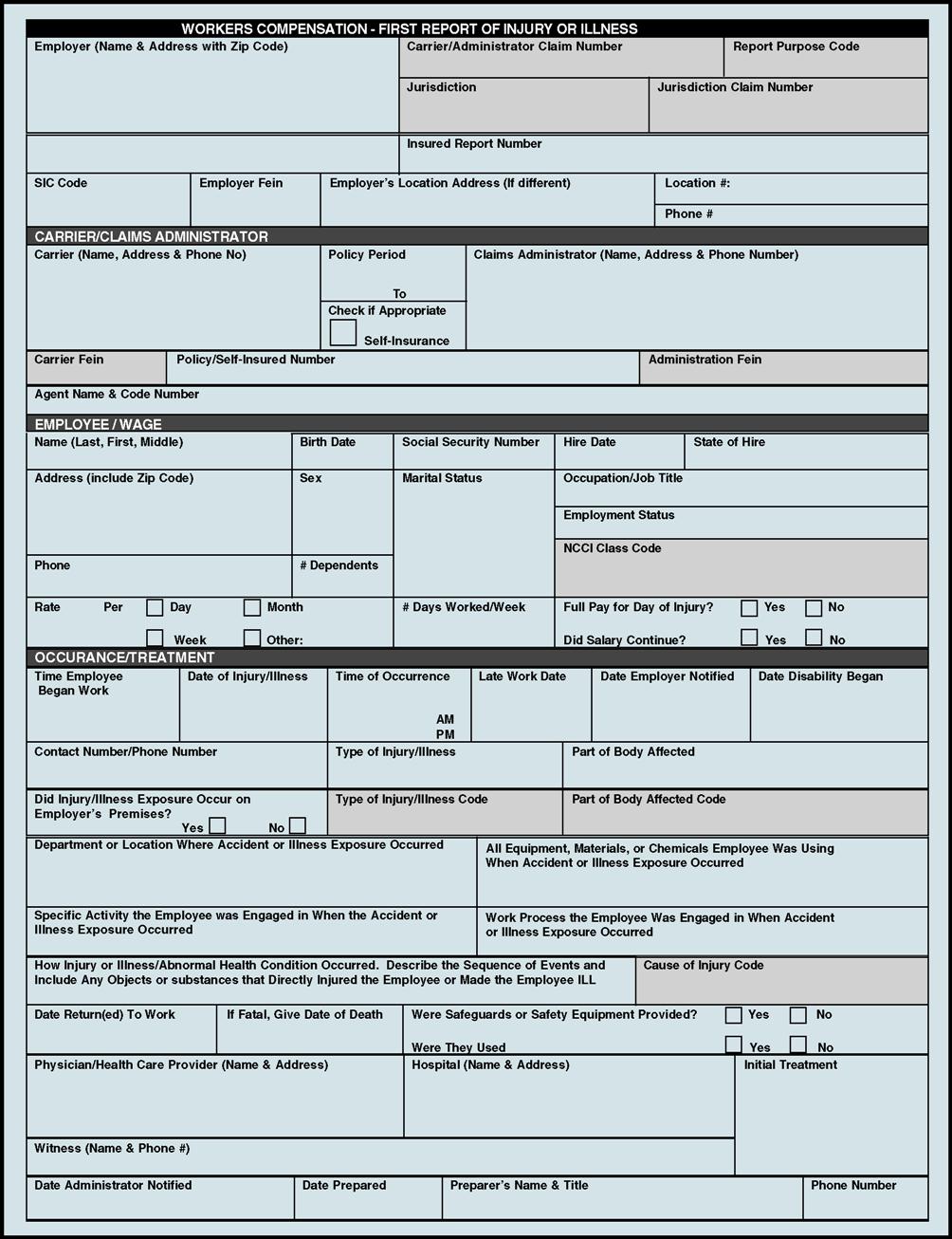

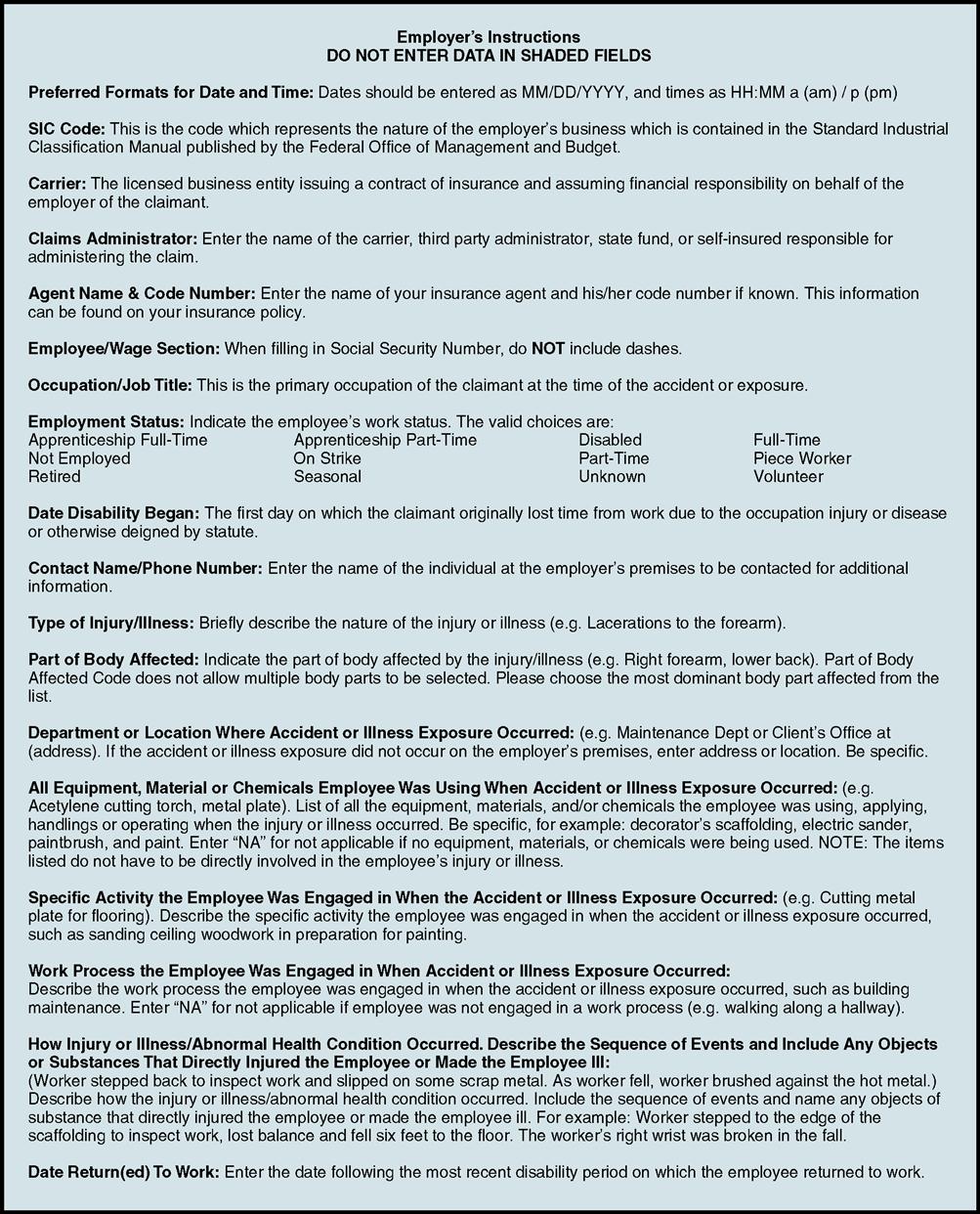

First Report of Injury

Employees who are injured, suspect they have been injured, or have contracted a disease they believe is related to their job should take immediate steps to protect their rights and to ensure that their claim is processed properly. Failure to seek timely medical treatment within the workers’ compensation network may cause a delay in claim processing and perhaps denial of benefits. Injured workers should be transported to a medical treatment facility without delay in the case of an emergency. For nonemergency situations, the employee should take the following steps:

• The injured or ill worker should complete the initial accident report or necessary paperwork. It does not matter whether the injury is severe or minor; it must be documented. The employer should supply the necessary forms (Fig. 11-1).

• The employer should report the incident to his or her workers’ compensation carrier.

The procedure for reporting injuries and filing claims may vary from state to state. Contact the workers’ compensation department in the state in which you reside and request specific guidelines for your state.

Physician’s Role

Physicians have two distinct roles in the workers’ compensation process:

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree