Unraveling the Mysteries of Managed Care

Chapter objectives

After completion of this chapter, the student should be able to:

1. Explain the concept of managed care.

2. List and briefly explain the common types of managed care organizations.

3. Evaluate the advantages and disadvantages of managed care.

4. Identify and explain the role of managed care accrediting organizations.

5. Explain the function of preauthorization, precertification, and referral.

6. Discuss HIPAA’s influence on managed care.

7. Describe the impact of Managed Care on the Patient/Provider relationship.

8. Determine Healthcare Reform’s effect on Managed Care Organizations.

Chapter terms

capitation

closed-panel

consultation

copayment

direct contract model

enrollees

grievance

group model

health maintenance organization (HMO)

iatrogenic effects

individual practice association (IPA)

managed care

network

network model

open-panel plan

point-of-service (POS)

preauthorization

precertification

predetermination

preferred provider organization (PPO)

primary care physician (PCP)

referral

specialist

staff model

utilization review

What is managed care?

No doubt you have heard the term managed care. It became the “buzz word” in healthcare after the enactment of the Health Maintenance Organization Act of 1973. But what exactly is managed care, and why do some find the term so mysterious? According to the United States National Library of Medicine, the term managed care encompasses programs that are intended to reduce unnecessary health care costs through a variety of mechanisms, including: economic incentives for physicians and patients to select less costly forms of care; programs for reviewing the medical necessity of specific services; increased beneficiary cost sharing; controls on inpatient admissions and lengths of stay; the establishment of cost-sharing incentives for outpatient surgery; selective contracting with health care providers; and the intensive management of high-cost health care cases. The programs may be provided in a variety of settings, such as Health Maintenance Organizations and Preferred Provider Organizations.

We learned what traditional fee-for-service (indemnity) insurance was in Chapter 6. In this chapter, we will attempt to unravel the mysteries of managed care.

The cost of healthcare is increasing rapidly. In the 1970s, there was a growing concern within the general population about how much individuals in the United States had to pay for good healthcare. Experts came up with some ideas for controlling, or “managing,” these costs. Managed care has changed the face of healthcare in the United States today, and it looks as if it is here to stay.

Managed care is a complex healthcare system in which physicians, hospitals, and other healthcare professionals organize an interrelated system of people and facilities that communicate with one another and work together as a unit, commonly referred to as a network. This network coordinates and arranges healthcare services and benefits for a specific group of individuals, referred to as enrollees, for the purpose of managing cost, quality, and access to healthcare. Managed care organizations (MCOs) typically perform three main functions:

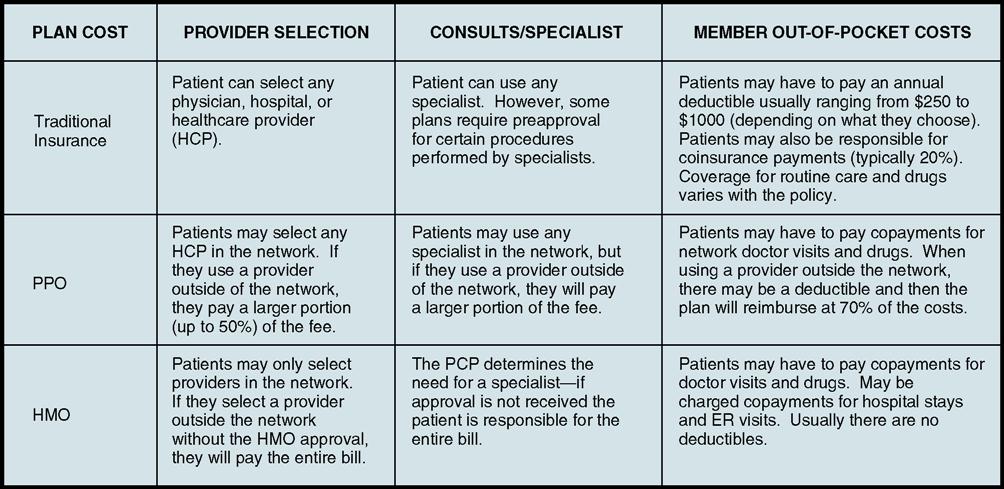

Managed care has strongly influenced the practice of medicine. The principles of managed healthcare shown in Fig. 7-1 represent key components in promoting effective managed care techniques that are fair and equitable to physicians in ensuring that high-quality healthcare services are delivered to patients. MCOs and third-party payers are strongly encouraged to use these guidelines in developing their own policies and procedures. In addition, any public or private entities that evaluate managed care organizations or their contracted entities for purposes of certification or accreditation are encouraged to use these principles in conducting their evaluations.

Common types of managed care organizations

Although there are many forms of managed healthcare, we are going to concentrate on the two most common types:

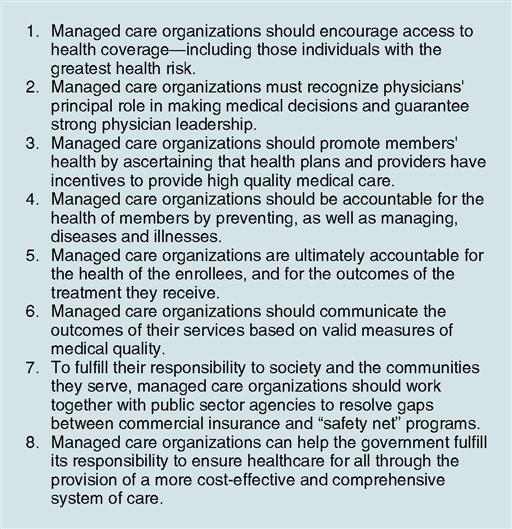

These two common types of MCOs are compared with traditional (fee-for-service) insurance in Fig. 7-2.

Table 7-1 summarizes the types of Medicare managed care organizations.

Table 7-1

Summary Charts of Types of Medicare Managed Care Organizations

| Type of Managed Care Organization (MCO) | Description |

| Health maintenance organization (HMO) | Insurers contract with groups of physicians, hospitals, and other providers to provide medical care to its members. Members must use only network providers and are required to select a primary care physician (PCP). Access to specialists requires referral from the PCP. Most services require small or no copayments. |

| Preferred provider organization (PPO) | Insurers contract with groups of physicians, hospitals, and other providers to provide medical care to its members. Members are not required to select a PCP. Plan’s permission is not required for a member to see a specialist for a Medicare-covered service. A small co-payment is associated with use of a network provider. Costs are higher for use of a non-network provider. |

| Point-of-service (POS) plan | Allows members to use medical providers at an additional fee that are not part of the managed care plan’s provider network. Plan will pay a percentage of cost for use of services of a health care provider outside the network. Member may need plan’s approval to receive out-of-network services. |

| Provider-sponsored organization (PSO) | A plan owned by physicians and hospital(s). Physicians and hospital(s) agree to provide the majority of Medicare-covered services. If unable to provide services directly, they must arrange with other medical providers to furnish needed care. |

| Private fee-for-service plan | Private insurance companies, approved by CMS, to offer their fee-for-service plans to Medicare beneficiaries. Members may use any provider who agrees to the payment terms of the plan or may use other providers and pay the difference between the provider charges and the plan fees. |

| Medicare Medical Savings Accounts (MSAs) | Two parts: High-deductible health insurance plan. Members must satisfy the annual deductible through the MSA or personal savings before the health plan pays for medical expenses. CMS will contribute money to the savings account every year. The funds collect interest and carry over each year. The money may be used to pay for medical expenses to satisfy the annual deductible or to cover medical expenses not covered by original Medicare, such as prescription drugs. Either a managed care plan or a fee-for-service plan. Members may not end enrollment until December 31st of each year. |

Preferred Provider Organization

Preferred provider organizations (PPOs) are popular throughout the United States. PPOs typically provide a high level of healthcare and offer a variety of medical facilities to everyone who chooses to participate in them.

Here’s how a PPO functions: A group of healthcare providers works under one umbrella, the PPO, to provide medical services at a discount to the individuals who participate in the PPO. The PPO contracts with this network of providers, who agree to offer medical services to the PPO members at lower rates (smaller and lower coinsurance limits) in exchange for being part of the network. This agreement allows the PPO to reduce overall healthcare costs. Two things about PPOs make them popular:

Plan members can visit physicians and hospitals outside the network. Visits to healthcare providers who do not belong to the PPO network do not have the same coverage, however, as visits to providers within the network, and the amount of money the patient has to pay out of his or her own pocket, the copayment, is higher. The deductible normally does not change if and when a PPO member sees a provider outside the network.

Other advantages of PPOs include the following:

• PPO networks are not as tightly controlled by laws and regulations as HMOs.

• Many PPOs offer a wider choice of treatments to members with fewer restrictions than HMOs.

Disadvantages include the following:

Health Maintenance Organization

Under the federal HMO Act, an entity must have the following three characteristics to call itself a health maintenance organization (HMO):

HMOs provide members with basic healthcare services for a fixed price and for a given period. In return, the participant receives medical services, including physician visits, hospitalization, and surgery, at no additional cost other than a small per-encounter copayment, which is typically less than $25 per visit and sometimes only $5.

Each HMO has a network of physicians who participate in the HMO system. When an individual first enrolls in the HMO, he or she chooses a PCP from the HMO network. This PCP serves as caretaker for the enrollee’s future medical needs and is the first person the patient calls when he or she needs medical care. PCPs are usually physicians who practice family medicine, internal medicine, or pediatrics. The PCP determines whether or not the patient’s problem warrants a referral to a specialist, a physician who is trained in a certain area of medicine (e.g., a cardiologist, who specializes in diseases and conditions of the heart). If an enrollee sees a specialist without the PCP’s approval, the HMO normally does not pay the specialist’s fees, even if the specialist practices within the network.

HMOs are more tightly controlled by government regulations than PPOs. Members must use the HMO’s healthcare providers and facilities, and medical care outside the system usually is not covered except in emergencies. HMOs typically have no deductibles or plan limits. As mentioned earlier, the member pays only a small fee, called a copayment, for each visit or sometimes nothing at all. Because the HMO provides all of a member’s healthcare for one set monthly premium, it is considered in everyone’s best interest to emphasize preventive healthcare.

Some HMOs operate their own facilities, staffed with salaried physicians; others contract with individual physicians and hospitals to be part of the HMO. A few do both. An HMO can be a good choice for some individuals; however, there are many restrictions. If its facilities are convenient and the individual wants to avoid most out-of-pocket expenses and paperwork, an HMO might be a good healthcare option. One problem exists, however. Some states, especially those that are predominantly rural, offer few HMO choices. Iowa, for instance, had only 37 functioning HMOs in 2009, compared with 101 in California. At that time, there were a total of 441 HMOs in the entire United States.

Several types of managed care come under the HMO umbrella. We’ll look at some of the more common types in the following paragraphs.

Staff Model

A staff model HMO is a multispecialty group practice in which all healthcare services are provided within the buildings owned by the HMO. The staff model is a closed-panel HMO, meaning that other healthcare providers in the community generally cannot participate. Participating providers are salaried employees of the HMO who spend their time providing services only to the HMO enrollees. All routine medical care is furnished, or authorized, by a member’s PCP. Preauthorization is necessary for referrals to specialists. In a staff model HMO, the HMO bears the financial risk for the entire cost of healthcare services furnished to the HMO’s members.

Group Model

In a group model, the HMO contracts with independent, multispecialty physician groups who provide all healthcare services to its members. Physician groups usually share the same facility, support staff, medical records, and equipment. Providers within a group model do not see patients outside the HMO. Group physicians receive reimbursement in the form of capitation, a reimbursement system in which healthcare providers receive a fixed fee for every patient enrolled in the plan, regardless of how many or few services the patient uses. (The word “capitation” comes from the Latin phrase per capita, meaning “each head.”) For example, the managed care insurer negotiates with the provider and agrees to pay him or her $100 a month to care for each of its subscribers, regardless of the amount of services each subscriber uses. The HMO pays the group, which in turn decides how to distribute the money among each of its members.

Network Model

The network model HMO allows multiple provider arrangements, including staff, group, and IPA structures. It is similar to the group model HMO, but services are provided at multiple sites by multiple groups so that a wider geographic area is served.

This model usually allows the healthcare provider to be paid on a fee-for-service basis, whereas the group practices in the network might receive a capitation payment from the healthcare plan.

Mixed Model

“Mixed model” describes certain HMO plans in which the provider network is a combination of delivery systems. In general, a mixed model HMO offers the widest variety of choices and the broadest geographic coverage to its members. Patients often have choices of clinics, laboratories, pharmacies, and hospitals as their providers of care.

Direct Contract Model

The direct contract model HMO is similar to an individual practice association (see later) except the HMO contracts directly with the individual physicians. The HMO recruits a variety of community healthcare providers, including PCPs and specialists.

Individual Practice Association

In an individual practice association (IPA), services are provided by outpatient networks composed of individual healthcare providers (the IPA) who provide all the needed healthcare services for the HMO. The providers maintain their own offices and identities and see both patients who belong to the HMO and patients who do not. This is an open-panel plan because healthcare providers in the community may participate, if they meet certain HMO/IPA standards. IPA reimbursement methods vary from plan to plan.

Other Types of MCOs

Point of Service

The point-of-service (POS) model is a “hybrid” type of managed care (also referred to as an open-ended HMO) that allows patients to use the HMO provider or go outside the plan and use any provider they choose. When individuals enroll in a POS plan, they are required to choose a PCP to monitor their healthcare. This PCP must be chosen from within the healthcare network and becomes the person’s “point of service.” The primary POS physician may make referrals outside the network; however, this practice is discouraged because copayments and deductibles are higher for the patients.

Provider-Sponsored Organization (PSO)

A PSO is a type of managed care organization that falls under the Medicare Part C (formerly Medicare + Choice) provision of the Balanced Budget Act of 1997. Now referred to as Medicare Advantage plans, PSOs provide Medicare beneficiaries with alternatives to original Medicare. The PSO receives a fixed monthly payment from the federal government to provide care for Medicare beneficiaries enrolled in the plan and accepts full risk for the lives of these patients. PSOs may be developed as for-profit or not-for-profit entities, of which at least 51% must be owned and governed by healthcare providers (physicians, hospitals, or allied health professionals), and may be organized as either public or private companies. A PSO must supply at least 70% of all medical services required by Medicare law and must do so primarily through its network. The remaining services may come from contracts with other providers if necessary.

To read more about the different types of HMOs, visit the Evolve site.