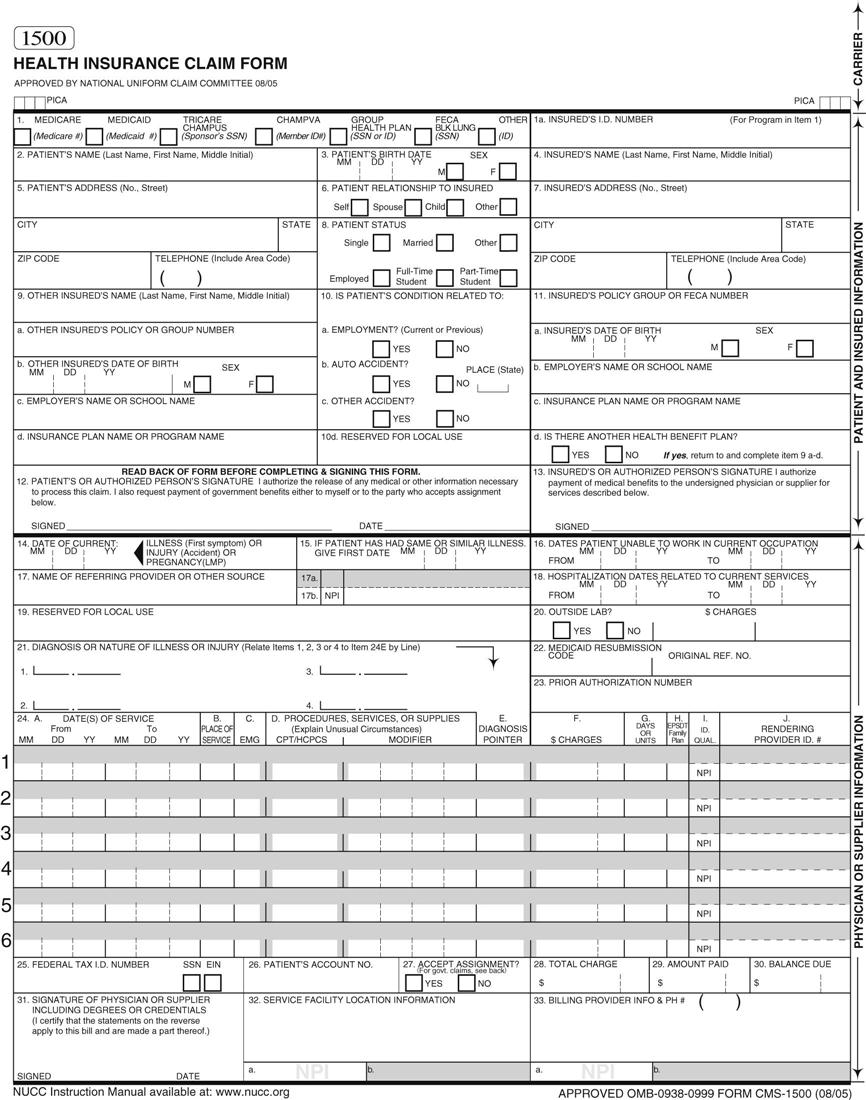

Carline A. Dalgleish, Sharon Oliver and Alexandra Patricia Adams 1. Define, spell, and pronounce the terms listed in the vocabulary. 2. Discuss the differences between paper claims and electronic claims. 3. Understand the guidelines for completing the CMS-1500 Health Insurance Claim Form. 4. Explain how to complete each of the blocks of the CMS-1500 claim form. 5. Gather information for use on insurance claim forms. 7. Differentiate between “clean” and “dirty” claims. 8. Discuss methods of preventing claims rejections. assignment of benefits The transfer of the patient’s legal right to collect benefits for medical expenses to the provider of those services, authorizing the payment to be sent directly to the provider. electronic data interchange (EDI) The transfer of data back and forth between two or more entities using an electronic medium. electronic (or digital) signature A scanned signature or other such mark that is accepted as proof of approval of and/or responsibility for the content of an electronic document. Employer Identification Number (EIN) The number used by the Internal Revenue Service that identifies a business or individual functioning as a business entity for income tax reporting. incomplete claim A claim that is missing information and is returned to the provider for correction and resubmission. Also called an invalid claim. intelligent character recognition (ICR) The electronic scanning of printed blocks as images and the use of special software to recognize these images (or characters) as ASCII text for uploading into a computer database. paper (hard copy) claims Insurance claims that have been completed manually, on paper, and sent by surface mail. provider identification number (PIN) Numbers assigned to providers by a carrier for use in the submission of claims. rejected claims Claims returned unpaid to the provider for clarification of any question; these claims must be corrected before resubmission. Unique Provider Identification Number (UPIN) A number assigned by fiscal intermediaries to identify providers on claims for services. The school where Machelle Van Cleve receives her medical assistant training offers an optional job-shadowing module. For her assignment she chose a nearby health center, where she observed the administrative responsibilities of the medical assistants employed in this multispecialty practice. Machelle found that some of the offices were organized and efficient, whereas others lacked a structured routine, especially in the insurance department. Machelle, a detail-oriented person who enjoyed her studies related to billing and coding, heard numerous comments from employees in the administrative area related to the volumes of work in the billing offices. Her office manager explained that the mountainous paperwork was created as a result of managed care requirements, rejected claims needing further research, and inconsistencies in the demands of the various insurance companies. Machelle agreed that keeping up with the requirements and regulations of the many third-party payers and government entitlement programs must be an overwhelming task. She concluded that billing and reimbursement are at the heart of the medical facility, and the correct completion of insurance claim forms is central to the success of the practice. She realized that becoming familiar with the complexities of the insurance claims process would be challenging, but she was convinced that through education, organization, and dedication she could become a valuable employee and an advocate for the patients who needed her assistance in resolving issues related to their claims for reimbursement. While studying this chapter, think about the following questions: Medical insurance means many things to many people. To some, it is a mound of paperwork. To others, it is a mass of confusion and regulations that seem to constantly change. To a patient with an illness or injury, health insurance helps defray the high costs associated with healthcare. The universal claim form, originally called the HCFA-1500, was first developed in 1988 by the Health Care Financing Administration (HCFA) and approved for use by physicians and providers of outpatient services when submitting Medicare Part B claims for reimbursement. In 2001 the HCFA was renamed the Centers for Medicare and Medicaid Services (CMS), and the claim form was renamed the CMS-1500 Health Insurance Claim Form, commonly known as the CMS-1500. The form was subsequently adopted by almost all health insurance companies and third-party payers for use in the submission of physicians’ claims for reimbursement. The current version of the CMS-1500 was adopted in August, 2005. As of May, 2008, only the CMS-1500 (08-05) claim form may be used to submit insurance claims. A medical assistant may submit insurance claims to a third-party payer or an insurance carrier either on hard copy (paper) or electronically. Hard copy claims are insurance claims submitted manually, on paper, by surface mail (i.e., the U.S. Postal Service). Electronic claims are insurance claims that are submitted to an insurance carrier via electronic media, such as the Internet. Most of today’s computer programs generate claims internally from the information entered into the database. Paper (hard copy) claims have advantages and disadvantages. The advantages include minimal start-up costs (because the forms are readily available through many vendors) and the ability to attach documentation explaining unusual circumstances that might affect reimbursement. The cost in time, labor, and postage is higher with paper claim submission, and reimbursement is much slower. Paper claims also require a lot of storage space. Insurance claims created on paper (hard copy) are processed at the insurance payer using intelligent character recognition (ICR). ICR is a system that scans documents and captures claims information directly from the CMS-1500 form. Medicare, Medicaid, TRICARE (formerly CHAMPUS), and many other insurance carriers have adopted the ICR system. The ICR system has replaced the optical character recognition (OCR) process, which had been in use until the early twenty-first century. At the insurance carrier, ICR scanners transfer the information on claim forms into computers. This transfer is done using a red bulb scanner, which causes the red preprinted portion of the CMS-1500 form to appear invisible to the computer. The scanner “captures” only characters printed in black ink on the form and transfers them to the computer’s memory. The resulting image allows for “clean” recognition of the data entered on the CMS-1500 form; that is, the data characters are not obstructed by the lines and text of the form. The benefits of ICR scanning include greater efficiency in processing claims, improved accuracy, more control over the data input, and reduced data entry cost for the insurance carrier. The medical assistant should use the following rules to complete the paper CMS-1500 form correctly so that the insurance carrier can scan the claim: • Entries should be clear and sharp; carbon copies are not acceptable. • Use pica type (10 characters per inch). The equivalent computer font is Courier 10 or OCR 10. • All uppercase letters should be used. • All punctuation should be omitted. • All birth dates should be in this format: MM DD YYYY (with a space between each set of digits). • A blank space should be substituted for the following: • When the charge is expressed in whole dollars, two zeros should be used in the “cents” column. • Do not enter the alpha character “O” for a zero (0). • If a typewriter is used, do not use lift-off tape, correction tape, or correction fluid. • No handwritten data (other than signatures) may be included on the form. • Nothing should be stapled to the form. As mentioned, electronic claims are insurance claims that are transmitted over the Internet from the provider to the health insurance company. Most claims-processing software is designed to permit electronic claims generation. A mandate included in the Health Insurance Portability and Accountability Act (HIPAA) required the development of “transaction and code sets” for all insurance-related information sent electronically, including claim form submissions, claim status requests, and remittance (payment) processing. The transaction and code set for CMS-1500 electronic claims submission is the ASC X12N 837P (HIPAA 837 Health Care Claim: Professional [837P]). All insurance billing data entered into the computer software program (i.e., patient, provider, charge, diagnosis, and procedure) is reformatted by the software program to conform with the transaction and code sets format and guidelines. For more information on implementation guides for transaction and code sets, refer to the Evolve site at evolve.elsevier.com/kinn). Electronic claims can be submitted in several ways. Claims can be transmitted directly to the insurance carrier, also known as direct billing, or to a claims clearinghouse, which then submits the claims to the insurance carrier. Direct billing is the process by which an insurance carrier allows a provider to submit insurance claims directly to the carrier electronically. Most major insurance carriers, including Medicare and Medicaid, provide small computer programs to providers that are used to enter patient and insured information, charges, and provider detail directly into the program. These data are then transmitted electronically directly to the insurance carrier. Many carrier-direct systems are supplied free of charge to the provider, but the direct system can transmit only to specific carriers. A clearinghouse is a vendor that allows a provider to submit all the insurance claims generated by the provider to the clearinghouse using special software. The clearinghouse then audits and sorts the claims and sends them in batches electronically to each of the different insurance carriers. A clearinghouse charges the healthcare provider a small fee for the service of receiving claim transmissions, checking and preparing the claims for processing, consolidating claims so that one transmission can be sent to each carrier, and submitting claims in correct data format to the applicable insurance payer. Other services that clearinghouses typically provide include: • Auditing claims to make sure all required fields are completed and the data are correct • Reporting the number of claims submitted and the number of errors and their specifics • Keeping provider offices updated as new carriers are added to the database Clearinghouses are also called third-party administrators (TPAs), and they are designed to receive electronic claims from any provider. Typically, with electronic claims processing, payments are received in less than half the time required for turnaround of paper claims. Very soon after claims have been transmitted, the clearinghouse sends the provider tracking reports that describe which claims were received, audited, and forwarded to the insurance carrier. These tracking reports also provide information regarding rejected claims and those needing additional information. Electronic claims processing reduces payment turnaround time by shortening the payment cycle and can reduce average error rates to less than 1% or 2%. Some insurance companies even waive the attachment requirements for many procedures when claims are submitted electronically. For additional information on advantages and disadvantages, visit the Evolve site at evolve.elsevier.com/kinn). When the first appointment is made for a patient, it is routine to ask the patient for all pertinent insurance information. Much of this information is on the Patient Registration form that is completed when the patient comes to the medical office for the initial visit; it is inserted into the medical chart and entered into the computer’s patient database. This information should always be collected from every new patient seen by the provider. Returning or established patients should be asked during each visit whether their insurance information is complete and current. Many offices use a form that allows the patient to provide address and phone number updates, in addition to new insurance information. The information needed to complete an insurance form (Table 21-1) is gathered from several sources: (1) the Patient Registration form, (2) the completed Verification of Eligibility and Benefits form, (3) referral and authorization information (when required by the insurance carrier), (4) the patient’s medical record, (5) the encounter form or charge ticket, and (6) a photocopy of the patient’s insurance card or cards, driver’s license or state-issued ID card, and student ID (if applicable and available). The Current Procedural Terminology (CPT), Health Care Common Procedural Coding System (HCPCS), and International Classification of Diseases, Ninth Revision, Clinical Modification (ICD-9-CM) coding manuals and the individual insurance payer’s claims processing manual or guidelines are also necessary resources for preparing insurance claims. Procedure 21-1 presents the steps for gathering patient and other information needed prior to completing the insurance claim form. TABLE 21-1 Information Required for Completion of CMS-1500 Form *Only required if a secondary insurance exists and is to be submitted to the insurance carrier. Once the patient’s and the insured’s demographic and insurance information has been collected, the next step is to verify the patient’s eligibility and benefits. This usually is done by phone, by calling the insurance carrier or carriers for the patient and confirming that the patient is covered by the insurance; this also provides an overview of the benefits available for the patient from the insurance policy. The information obtained over the phone should be verified by either fax or e-mail confirmation from the insurance carrier. For more information about verification of benefits and to see an example of a verification form, visit the Evolve site at evolve.elsevier.com/kinn. If any diagnostic or therapeutic services or procedures are to be rendered by the provider that require preauthorization approval, perform a preauthorization to obtain an authorization number. The authorization number, which confirms that precertification was performed, is placed in Block 23 on the CMS-1500 form. For more information about preauthorization and to see an example of the form, refer to the Evolve site at evolve.elsevier.com/kinn. The CMS-1500 Health Insurance Claim Form (Figure 21-1) is used by most health insurance payers for claims submitted by physicians and suppliers. The information needed to complete an insurance claim form includes the patient’s and the guarantor’s demographic and insurance information; the name, address, and phone number of the insurance company; the diagnostic, treatment, and procedures and services information; and the provider’s billing information, including name, address, phone number, place of service, and the tax and provider identification numbers. There are 33 blocks, or items, on the CMS-1500 form. These blocks are divided into three sections: • Section 1: Carrier Block. The first section contains the address of the insurance carrier and is located at the top of the form (Figure 21-2). In the following guidelines, each of the 33 blocks contains the block title, description, and instructions for completing that block. Where applicable, special instructions are given for Medicare, Medicaid, TRICARE, group health plan, Federal Employees Compensation Act (FECA) and black lung (FECA/Black Lung) insurance, and other types of insurance. Procedure 21-2 provides detailed instructions on completing each section and block of the CMS-1500 claim form. (For hints on creating a work-friendly routine for completing insurance claims, refer to the Evolve site at evolve.elsevier.com/kinn).

The Health Insurance Claim Form

Learning Objectives

Vocabulary

Scenario

Types of Claims

Hard Copy (Paper) Claims

Advantages and Disadvantages of Paper Claims

Intelligent Character Recognition

Dollar signs and decimal points in charges and in ICD-9-CM codes

Dollar signs and decimal points in charges and in ICD-9-CM codes

Dashes preceding procedure code modifiers

Dashes preceding procedure code modifiers

Parentheses around telephone area codes

Parentheses around telephone area codes

Hyphens in Social Security numbers

Hyphens in Social Security numbers

Electronic Claims

Electronic Claims Submission

Direct Billing.

Clearinghouse Submission.

Advantages of Electronic Submission

Data Gathering Guidelines

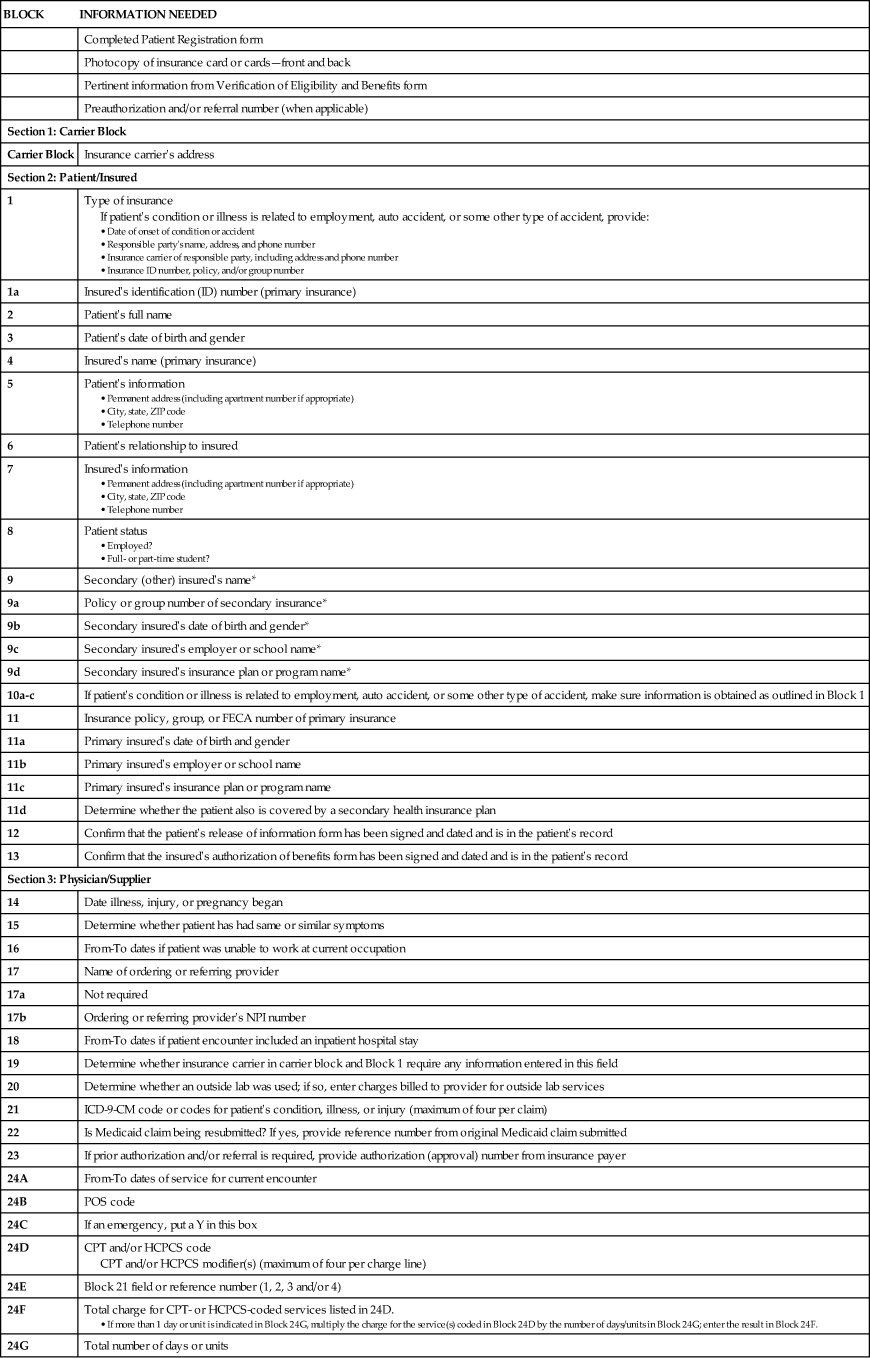

BLOCK

INFORMATION NEEDED

Completed Patient Registration form

Photocopy of insurance card or cards—front and back

Pertinent information from Verification of Eligibility and Benefits form

Preauthorization and/or referral number (when applicable)

Section 1: Carrier Block

Carrier Block

Insurance carrier’s address

Section 2: Patient/Insured

1

Type of insurance

If patient’s condition or illness is related to employment, auto accident, or some other type of accident, provide:

1a

Insured’s identification (ID) number (primary insurance)

2

Patient’s full name

3

Patient’s date of birth and gender

4

Insured’s name (primary insurance)

5

Patient’s information

6

Patient’s relationship to insured

7

Insured’s information

8

Patient status

9

Secondary (other) insured’s name*

9a

Policy or group number of secondary insurance*

9b

Secondary insured’s date of birth and gender*

9c

Secondary insured’s employer or school name*

9d

Secondary insured’s insurance plan or program name*

10a-c

If patient’s condition or illness is related to employment, auto accident, or some other type of accident, make sure information is obtained as outlined in Block 1

11

Insurance policy, group, or FECA number of primary insurance

11a

Primary insured’s date of birth and gender

11b

Primary insured’s employer or school name

11c

Primary insured’s insurance plan or program name

11d

Determine whether the patient also is covered by a secondary health insurance plan

12

Confirm that the patient’s release of information form has been signed and dated and is in the patient’s record

13

Confirm that the insured’s authorization of benefits form has been signed and dated and is in the patient’s record

Section 3: Physician/Supplier

14

Date illness, injury, or pregnancy began

15

Determine whether patient has had same or similar symptoms

16

From-To dates if patient was unable to work at current occupation

17

Name of ordering or referring provider

17a

Not required

17b

Ordering or referring provider’s NPI number

18

From-To dates if patient encounter included an inpatient hospital stay

19

Determine whether insurance carrier in carrier block and Block 1 require any information entered in this field

20

Determine whether an outside lab was used; if so, enter charges billed to provider for outside lab services

21

ICD-9-CM code or codes for patient’s condition, illness, or injury (maximum of four per claim)

22

Is Medicaid claim being resubmitted? If yes, provide reference number from original Medicaid claim submitted

23

If prior authorization and/or referral is required, provide authorization (approval) number from insurance payer

24A

From-To dates of service for current encounter

24B

POS code

24C

If an emergency, put a Y in this box

24D

CPT and/or HCPCS code

CPT and/or HCPCS modifier(s) (maximum of four per charge line)

24E

Block 21 field or reference number (1, 2, 3 and/or 4)

24F

Total charge for CPT- or HCPCS-coded services listed in 24D.

24G

Total number of days or units

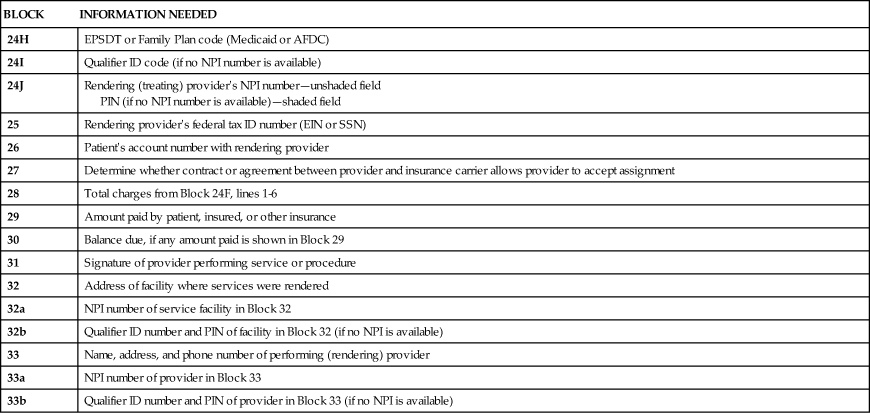

24H

EPSDT or Family Plan code (Medicaid or AFDC)

24I

Qualifier ID code (if no NPI number is available)

24J

Rendering (treating) provider’s NPI number—unshaded field

PIN (if no NPI number is available)—shaded field

25

Rendering provider’s federal tax ID number (EIN or SSN)

26

Patient’s account number with rendering provider

27

Determine whether contract or agreement between provider and insurance carrier allows provider to accept assignment

28

Total charges from Block 24F, lines 1-6

29

Amount paid by patient, insured, or other insurance

30

Balance due, if any amount paid is shown in Block 29

31

Signature of provider performing service or procedure

32

Address of facility where services were rendered

32a

NPI number of service facility in Block 32

32b

Qualifier ID number and PIN of facility in Block 32 (if no NPI is available)

33

Name, address, and phone number of performing (rendering) provider

33a

NPI number of provider in Block 33

33b

Qualifier ID number and PIN of provider in Block 33 (if no NPI is available)

Verification of Eligibility and Benefits

Preauthorization and/or Referral

Completing the CMS-1500 Form

The Health Insurance Claim Form

Get Clinical Tree app for offline access