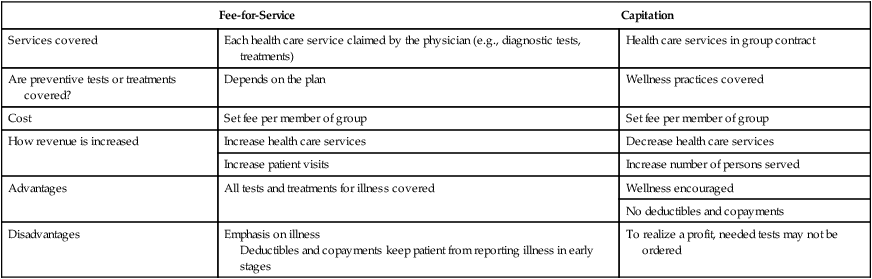

On completing this chapter, you will be able to do the following: 1. Discuss the provisions of the Affordable Care Act. 2. Describe two general methods of financing health care costs, as follows: 3. Explain the following methods of payment options for patients: a. Personal payment (private pay) b. Private health insurance (nongovernment) c. Public health insurance (government-sponsored) 4. Identify sources of funding for public (government) health programs and private health insurance. 5. Discuss the following issues and trends that affect the direction of health care: 6. Explain how the practical/vocational nurse participates in increasing the quality and safety of health care and decreasing the cost of care. 7. Discuss the effect of the restructuring of the health care system on health care and employment opportunities for licensed practical/vocational nurses (LPNs/LVNs). 8. Identify your reaction to change involving your nursing career and personal life. 9. Develop a personal plan to help you adapt to change in your nursing career and personal life. continuous quality improvement (CQI) (kŏn-TĬN-ū-ŭs KWĂL-ĭ-tē ĭm-PROOV-mĕnt, p. 246) (ĭn-TĪ-tĕl-mĕnt PRŌ-grăm, p. 242) (hĕlth kār pră-VĪ-dĕr, p. 240) health maintenance organization (HMO) National Patient Safety Foundation (NPSF) preferred provider organizations (PPOs) prospective payment system (PPS) (pră-SPĔK-tĭv pā-mĕnt, p. 244) The two most common ways to finance health care services are fee-for-service and capitation. • Physicians are directly reimbursed for most ordered diagnostic tests and treatments for illness. • Some insurance companies do not reimburse the tests and treatments that could keep patients healthy or could identify illnesses in their early stages when they are less expensive to treat. • To improve their margins of profit, insurance companies charge deductibles, copayments, and coinsurance. • Capitation is an alternative to the traditional fee-for-service method of payment. • Capitation involves a set monthly fee charged by the provider of health care services for each member of the insurance group for a specific set of services. • Managed care plans that use the capitation method of payment include health maintenance organizations (HMOs), preferred provider organizations (PPOs), and open access plans. • If health care services cost more than the monthly fee, the provider absorbs the cost of those services. • At the end of the year, if any money is left over, the health care provider keeps it as a profit. • Suddenly, if a provider of health care services can keep a member of the insurance group healthy, that provider will make a profit! Before continuing, review Table 19-1 for a comparison of the fee-for-service and capitation methods of payment for health care services and Box 19-1 for health insurance terms. See Box 19-2 for different types of managed care plans. Table 19-1 Comparison of Methods of Payment for Health Care Services • In 1965, Medicare was added to the Social Security Act. • This federally sponsored entitlement program and public health insurance plan helps finance health care for all persons older than age 65 (and their spouses) who have at least a 10-year record in Medicare-covered employment and are a citizen or permanent resident of the United States. • Coverage is also given to persons younger than age 65 who are permanently and totally disabled, persons with end-stage renal disease, and persons with Lou Gehrig’s disease. • No person is denied coverage based on past medical history. Approximately 48 million elderly and disabled U.S. citizens are on Medicare. • Approximately 10,000 baby boomers each day become eligible for retirement benefits, placing huge demands on Social Security, including Medicare. • A current Medicare handbook can be accessed by typing “Medicare Handbook” into Google. • The Original Medicare Plan (Traditional Plan/Parts A and B). This fee-for-service plan allows the beneficiary to go to health care providers or hospitals that accept Medicare patients. The health care provider gets paid for each Medicare-covered service provided. Medicare pays its share and patients pay their share (Boxes 19-3 and19-4).

The Health Care System

Financing, Issues, and Trends

http://evolve.elsevier.com/Hill/success

http://evolve.elsevier.com/Hill/success

Financing health care costs

Fee-for-service

Capitation

Fee-for-Service

Capitation

Services covered

Each health care service claimed by the physician (e.g., diagnostic tests, treatments)

Health care services in group contract

Are preventive tests or treatments covered?

Depends on the plan

Wellness practices covered

Cost

Set fee per member of group

Set fee per member of group

How revenue is increased

Increase health care services

Decrease health care services

Increase patient visits

Increase number of persons served

Advantages

All tests and treatments for illness covered

Wellness encouraged

No deductibles and copayments

Disadvantages

Emphasis on illness

Deductibles and copayments keep patient from reporting illness in early stages

To realize a profit, needed tests may not be ordered

How patients pay for health care services

Personal payment

Public health insurance

Medicare: A Program of Social Security

Medicare Health Care Plans

The Health Care System: Financing, Issues, and Trends

Get Clinical Tree app for offline access

Keep in Mind

Keep in Mind See Evolve: Payroll Deductions.) Do you have health insurance? If you do not, who pays for your health care?

See Evolve: Payroll Deductions.) Do you have health insurance? If you do not, who pays for your health care? Critical Thinking

Critical Thinking Try This

Try This