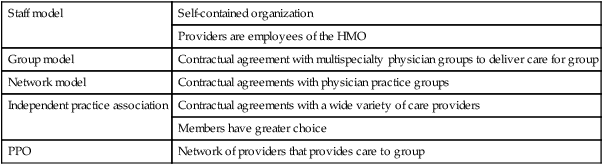

2. Identify factors influencing today’s health care system. 3. Discuss the economic realities of U.S. health care. 4. Identify the major forms of reimbursement for health care. Health Maintenance Organization (HMO) Geographically organized system that provides an agreed-on package of health maintenance and treatment services Preferred provider organization (PPO) Managed care company that contracts with health care providers (both physicians and hospitals) and payers (self-insured employers, insurance companies, or managed care organizations) to provide health care services to a defined population for predetermined fixed fees Centers for Medicare & Medicaid Services (CMS) Formerly known as the Health Care Financing Administration, the federal agency that administers Medicare, Medicaid, State Children’s Health Insurance Program (SCHIP), and several other health-related programs Veterans Health Administration The mission of the Veterans Healthcare System is to serve the needs of America’s veterans by providing primary care, specialized care, and related medical and social support services. To accomplish this mission, the VHA needs to be a comprehensive, integrated health care system that provides excellence in health care value, excellence in service as defined by its customers, and excellence in education and research, and needs to be an organization characterized by exceptional accountability and by being an employer of choice World Health Organization (WHO) Specialized agency of the United Nations (UN) that acts as a coordinating authority on international public health. Established in April 1948 and headquartered in Geneva, Switzerland, the agency inherited the mandate and resources of its predecessor, the Health Organization, which had been an agency of the League of Nations. With the advent of health care delivery services organized under hospitals and care-giving facilities in the early nineteenth century, there has been movement toward standardizing care and financial practices within these institutions. It was not until the early twentieth century that hospitals began a pay-for-service financial plan. In this arrangement, the patient pays for services received. Insurance companies paid for the services rendered by most institutions. As the cost of health care in the United States rose exponentially, insurers began exploring more cost-effective ways to pay for health care. This has resulted in the health care plans, insurance plans, and federal plans that exist today. This change in reimbursement for health care services has dramatically affected all aspects of health care delivery in the United States driven by changes in Medicare reimbursement. The United States is culturally diverse. There is a continuous influx of people from all countries of the world. It is crucial for the U.S. health care system to deliver culturally competent care. The United States spends more on health care per capita than any other industrialized Western nation, but the United States has disproportionately more people without access to appropriate health care (Yoder-Wise, 2006, p. 277). Steep population growth and an aging population will increase the need for health care services. The U.S. population aged 65 years and over is predicted to reach 82 million in 2050, a 137% increase over 1999. Between 2011 and 2030, the number of elderly could rise from 40.4 million (13% of the population) to 70.3 million (20% of the population) as “baby boomers” begin turning 65 (U.S. Census Bureau, 2000; http://www.census.gov/). Economic interests shape the evolution of technology and health care. The types of healthcare services delivered continue to be limited by multiple factors, most notably cost constraints (Wywialowski, 2004, p. 33). There are rising expectations about the value of health care services in the United States. It is the cultural norm in America that we will all receive the highest quality of health care at all times. To this end, the United States spends a great deal of money on health care services. The people of the United States are covered by Medicare, Medicaid, insurance companies, and managed care companies, and 16.3% of the U.S. population is not insured (Kelly-Heidenthal, 2003, p. 5). The United States continues to rely on a free-market approach to health care with the private sector providing insurance coverage (through employers) and the federal sector providing for some individuals who are unable to pay. Health care is paid for by four sources: government (36%), private insurance companies (41%), individuals (19%), and other, primarily philanthropy (4%) (Yoder-Wise, 2007, p. 222). • Traditional insurance companies, which includes Blue Cross Blue Shield for profit commercial insurance companies • Preferred provider organizations (PPOs), which act as brokers between insurers and health care providers • Health maintenance organizations (HMOs), which are independent prepayment plans • Point of service (POS) plans, which combined features of classic HMOs with client choice characteristics of PPOs • Self-funded plans in which the employer takes on the role of insurer HMOs deliver comprehensive health maintenance and treatment services for a group of enrolled individuals. Several models of the HMO structure have evolved. The group model is where practitioners employed by the insurer spend all their time caring for patients of that particular HMO. An example of this model is the Kaiser-Permanente Health Care System. Another model is Independent Practice Associations (IPAs) where independent practitioners (not employed by the HMO) provide care for HMO members and are reimbursed for that care. Practitioners in an IPA contract may be restricted to caring only for members enrolled in that IPA, but some contracts allow practitioners to provide for nonmembers as well. In a network model, HMOs contract with individual practitioners and practitioner groups for both primary and specialty services. In a capitation system, each provider receives a flat annual fee for each patient regardless of how often services are used. Box 6-1 provides various types of HMOs.

Health Care

HEALTH

FACTORS THAT INFLUENCE THE FINANCIAL BURDEN OF HEALTH CARE IN THE UNITED STATES

DEMOGRAPHIC INFLUENCES

HEALTH CARE PAYMENT SOURCES

PRIVATE INSURANCE

Nurse Key

Fastest Nurse Insight Engine

Get Clinical Tree app for offline access