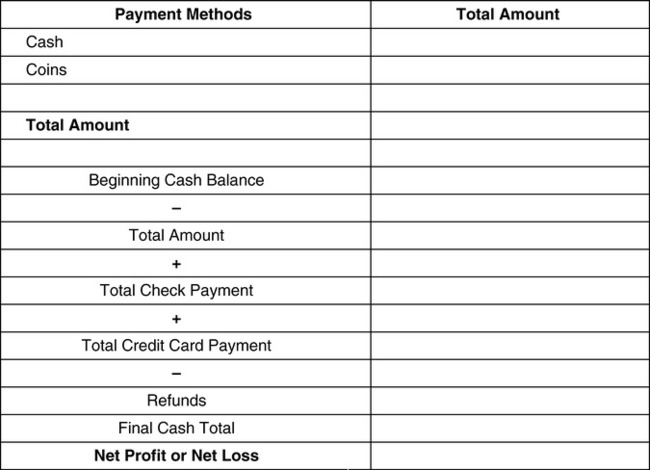

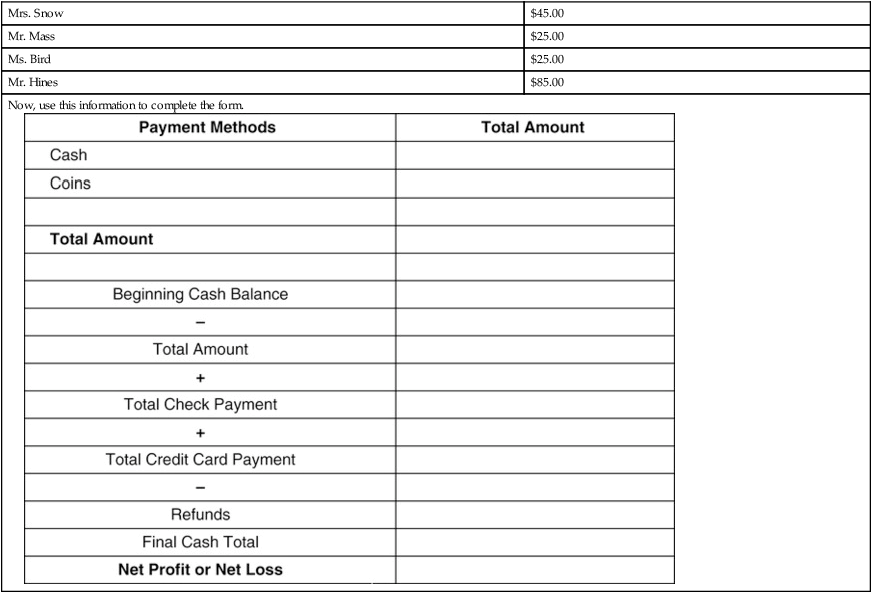

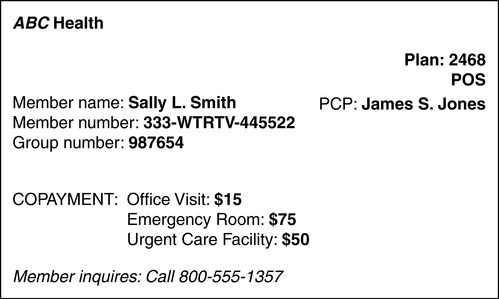

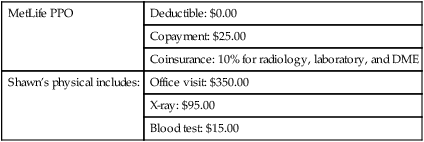

Upon completion of this chapter, the learner will be able to: 1. Define the key terms that relate to the chapter. 2. Identify key terms within a word problem and record information with 100% accuracy. 3. Manipulate word problem information with 100% accuracy. 4. Calculate insurance deductibles and copayments with 100% accuracy. 5. Analyze and balance day sheet information with 100% accuracy. 6. Calculate and record petty cash transactions with 100% accuracy. 7. Manipulate tax information to determine gross and net pay with 100% accuracy. Mr. Ford has insurance from his employer (primary), and he is also covered under his wife’s policy (secondary). When Mr. Ford is seen by the physician, the primary insurance company will pay 90% for the usual and customary services. Then, instead of Mr. Ford paying the remaining 10%, it is submitted to his wife’s insurance company for payment. Mr. Ryan’s insurance policy has a $250.00 per year deductible. On January 13, 20XX, Mr. Ryan is seen in the physician’s office. His bill totals $185.00. This is the first time he has used his health insurance this year. Answer the following questions based on this scenario. 1. What is the total amount of Mr. Ryan’s yearly deductible? ___________________ 2. How much has been met this year toward the deductible? ____________________ 3. How much should you collect from Mr. Ryan toward his deductible? __________________ 4. Has Mr. Ryan met his deductible for the year? ________________________ If not, how much will he need to pay before his insurance becomes active? ________________________________ Many facilities use a cash drawer worksheet similar to the one on p. 131. The purpose of this worksheet is to accurately document all currencytransactions involving the cash drawer throughout the day. It is essential to have documentation of the beginning balance of your cash drawer at the start of each day. At the start of business, your cash drawer has a total of $375.00. At 3:30 p.m., your shift is ending and you must balance the cash drawer. Based on the following information, complete the form below and determine the total net profit for your shift. At the end of your shift, the following is in your cash drawer: Denomination Number of bills and coins $50.00 bills 2 $20.00 bills 17 $10.00 bills 4 $5.00 bills 25 $1.00 bills 40 $1.00 coins 0 Half dollars 0 Quarters 13 Dimes 17 Nickels 5 Pennies 13 Finally, the office manager authorized the following refunds to be paid from your drawer:

General Accounting

Objectives 1, 2

Insurance

Objectives 3, 4

Collecting Copayment, Deductibles, and Coinsurance

Objectives 5, 6

Cash drawer, day sheets, ledger cards, and petty cash

Cash Drawer

Credit cards:

$135.00

Checks:

$1030.62

Mrs. Snow

$45.00

Mr. Mass

$25.00

Ms. Bird

$25.00

Mr. Hines

$85.00

Now, use this information to complete the form.

MATH IN THE REAL WORLD 6-1

MATH IN THE REAL WORLD 6-1 MATH IN THE REAL WORLD 6-2

MATH IN THE REAL WORLD 6-2 MATH ETIQUETTE 6-1

MATH ETIQUETTE 6-1 PRACTICE THE SKILL 6-1

PRACTICE THE SKILL 6-1 STRATEGY 6-1

STRATEGY 6-1

PRACTICE THE SKILL 6-2

PRACTICE THE SKILL 6-2 STRATEGY 6-2

STRATEGY 6-2 STRATEGY 6-3

STRATEGY 6-3 PRACTICE THE SKILL 6-3

PRACTICE THE SKILL 6-3 STRATEGY 6-4

STRATEGY 6-4 STRATEGY 6-5

STRATEGY 6-5 MATH IN THE REAL WORLD 6-3

MATH IN THE REAL WORLD 6-3 PRACTICE THE SKILL 6-4

PRACTICE THE SKILL 6-4

BUILDING CONFIDENCE WITH THE SKILL 6-1

BUILDING CONFIDENCE WITH THE SKILL 6-1 Look over your answers. Do they make sense? Most errors occur because of inaccurate math computations.

Look over your answers. Do they make sense? Most errors occur because of inaccurate math computations. STRATEGY 6-6

STRATEGY 6-6 PRACTICE THE SKILL 6-5

PRACTICE THE SKILL 6-5