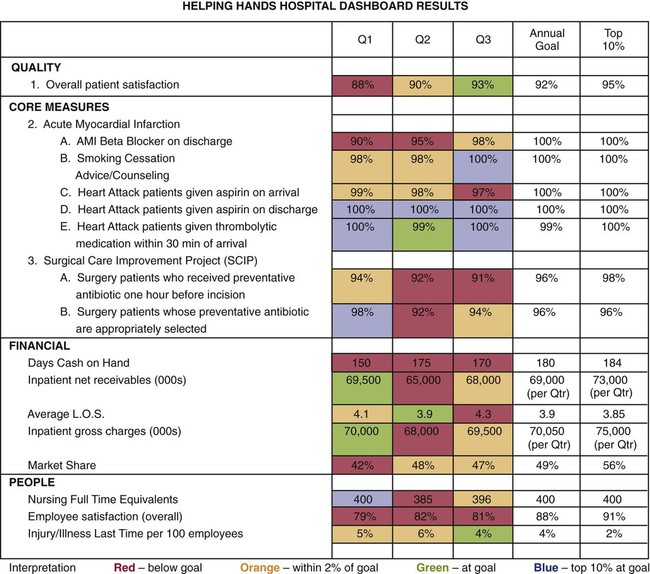

2. Differentiate between types of budgets. 3. Discuss the advantages of various budget processes. 4. Describe the key elements of budget preparation. 5. Identify the responsibilities of the nurse manager in budget preparation. 6. Discuss the responsibilities of the nurse manager in budget review. Budget review and management represent one of the most important responsibilities of the nurse manager in this era of escalating health care costs and decreasing reimbursements. The economic stability of an organization depends on the management of the resources that are required to deliver care in a cost-effective and safe manner. Chapter 6 provided a review of the essentials of health care reimbursement. Health care institutions are businesses, and one of the largest costs is the actual delivery of patient care. The resources required to deliver that patient care are costly and most often managed at the point of service (the unit). Nurses need to understand how to manage the cost of patient care as it relates to their clinical practice as well as to the workings of their particular unit. Also, accrediting agencies require collaborative input from staff in the development of annual budgets (The Joint Commission, 2007). In most institutions, there is a well-defined process for the development, implementation, and evaluation of the budget. The budgeting process is a part of the overall strategic planning process (see Chapter 13). The organizational budget cascades down to individual departments and units. Budgets are usually developed annually for a 12-month period. The budget cycle is based on the organization’s definition of the fiscal year (calendar [January 1–December 31] or fiscal [July 1–June 30]). The budgeting process can be divided into phases (Finkler and Kovner, 2001): • Information gathering and planning • Development of organizational and unit budgets • Development of cash budgets, negotiation, and revision Evaluation of the budget occurs at both the organizational and unit levels. Many organizations have created dashboards that allow for monitoring of progress in meeting department goals. These dashboards provide a quick visual display of the unit’s performance. An example of an organization-wide financial dashboard is shown in Figure 14-1. Evaluation of the budget performance is usually obtained through a process known as variance analysis. A positive variance (favorable) may be seen when the budgeted amount was greater than that which was actually spent. A negative variance may be seen if the budgeted amount was less than the actual spending. Variance analysis is a complex process in which the unit environment is fully investigated. A negative variance may be seen in the number of staff required during a 2-week period. However, on further investigation, it may be determined that the patient acuity was higher than anticipated, and expenses were increased in response to this increased acuity. It is the role of the nurse manager to be aware of the variances related to the unit and the reasons for the alteration in expected performance. These variance data are often used in the preparation of the next year’s budget. Examples of variances seen in unit budgets are:

Financial Management

BUDGETING PROCESS

EVALUATION

![]()

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree

Financial Management

Get Clinical Tree app for offline access