Banking Services and Procedures

Learning Objectives

1. Define, spell, and pronounce the terms listed in the vocabulary.

2. Describe banking procedures.

3. Explain how the Internet has changed traditional banking practices.

4. State the four requirements of a negotiable instrument.

5. Discuss the advantages of using debit cards.

6. Identify the three most common types of bank accounts.

7. Correctly write checks for bill payment.

8. Explain how to handle mistakes made in preparing a check.

9. Discuss precautions for accepting checks.

10. Discuss the actions necessary when a patient’s check is returned.

11. Compare types of endorsements.

13. Accurately reconcile a bank statement for the office checking account.

Vocabulary

disclaimer A denial of responsibility; a denial of a legal claim.

drawee A bank or facility on which a check is drawn or written.

drawer The person who writes a check.

e-banking Electronic banking via computer modem or over the Internet.

holder The person who presents a check for payment.

maker Any individual, corporation, or legal party who signs a check or any type of negotiable instrument.

m-banking Banking through the use of mobile devices, such as cell phones and wireless Internet services.

negotiable Legally transferable to another party.

payee The person named on a draft or check as the recipient of the amount shown.

payer The person who writes a check in favor of the payee.

principal A capital sum of money due as a debt or used as a fund for which interest is either charged or paid.

reconciliation The process of proving that a bank statement and checkbook balance are in agreement.

Scenario

Laura Anderson likes working with figures and has always been interested in bookkeeping. In high school she took all the bookkeeping and accounting courses offered, and during the summer months she helped out in the accounting department of the family business. She also worked part-time at City National Bank. Now, Laura wants to learn all she can about the financial transactions common to a medical practice. She is especially interested in electronic banking and all the possibilities it has to offer. Once her career in medical assisting is launched, Laura hopes to specialize in helping medical offices set up and run electronic medical record systems.

Although Laura has had considerable bookkeeping experience, she realizes that she still has a lot to learn about the daily financial duties in a medical office, including accounts payable, working with the business checkbook, making deposits, reconciling bank statements, and many other banking responsibilities.

Taking on the bookkeeping functions of a medical office involves not only responsibilities to the physician and employer, but also to patients and the vendors from whom the medical office purchases supplies. Laura realizes that to perform well in her upcoming career as a medical assistant, she must learn all she can about the topics pertinent to her special interest areas and stay current with the rapidly changing world of finance.

While studying this chapter, think about the following questions:

Financial transactions in the professional office nearly always involve banking services and the use of checks. A medical assistant, therefore, must understand the responsibilities involved in accepting payments, endorsing and depositing checks, writing checks, and regularly reconciling bank statements. Payments received in the medical office should be deposited as soon as possible; ideally, on the same day. The medical assistant may very well be in charge of these financial responsibilities; therefore he or she must understand each transaction and its function.

Banking in Today’s Business World

With the advent of the Internet, banking as we once knew it has changed. People once had to fight traffic and wait in line at crowded banks; today, they can sit in the comfort of their own homes and do their banking on the computer at any time of day. Banking transactions such as buying supplies, paying bills, and transferring funds between accounts can be done online. In addition, staff members have access to supply companies online and can review costs easily from the office instead of driving to numerous companies to compare prices.

Some banks have traded bricks and mortar to conduct all of their business online. The customers open their account online and deposits are made by using an application (“app”) on a cell phone, tablet, or other electronic device. This type of banking service best fits the person who needs a simple account that can be accessed anytime and needs little maintenance.

In fact, people do not even have to sit in front of a computer terminal to conduct banking transactions. A physician may be sitting on a bus or a train or waiting for a flight and can carry out bank transactions. All this is possible just by turning on a laptop computer or using a mobile phone.

Online Banking

Online banking is a means of performing banking services electronically via the Internet. It also is called personal computer (PC) banking, home banking, electronic banking, e-banking, or Internet banking. Many facilities have this capability, and most of them offer both basic and advanced services. With basic services, a customer usually can do the following:

• Transfer funds between accounts

• Determine whether a check has cleared the bank

• Download account information

Online banking has advantages and disadvantages. One of the most obvious advantages is the ability to bank at one’s own convenience in one’s own home or office at any time. This can save considerable time and expense, especially if banking must be done daily. Many people find online banking a convenient and comprehensive method of money management. Other advantages include ease of use, portability, and availability.

Disadvantages of e-banking include learning to navigate the software. Service options are often more limited. In addition, some experts believe that there may be a slight increase in risk compared with conventional banking, although this has been debated by e-banking proponents. Despite the disadvantages, forecasts show that banking via the Internet is becoming more popular. The cost of online banking varies from bank to bank. Some charge a flat rate ($5 to $10 per month) with varying fees for additional transactions.

Online Convenience

Convenience probably is the number one reason people and businesses use the Internet for financial services. There is no frenzied drive to the bank during rush hour, waiting in line, or working around the confines of banking hours. Online banking is available 24 hours a day, 7 days a week. In addition to Internet banking services, clinic bills can be paid online, without the delay of mailing. Balance inquiries and various other transactions can be monitored easily. Costly fees for financial transactions left until the last minute can be avoided, because online transactions can be accomplished in a matter of seconds. Some banks now offer online transfers between banks, because many people have accounts at different banks.

Customer-Oriented Banking

Americans are becoming more and more mobile. They want to conduct business and take care of personal concerns on laptops or cell phones on their way to and from work. In addition, the rapid pace of life requires rapid or “instant” solutions; convenience has become a basic expectation of consumers where the banking industry is concerned.

Banks no longer consider customers as merely account numbers; to stay competitive, banks must look at the total customer picture. Many banks offer a type of interactive voice response system that operates through speech recognition, allowing customers to conduct business through a combination of talking into the telephone and using the telephone keypad. The call centers of some banks employ customer service personnel to answer questions and fulfill requests for all types of bank transactions.

Mobile banking, or m-banking, is a customer-oriented innovation that is emerging through the wireless technology market. Through the use of wireless devices, such as cell phones and wireless Internet services, customers can conduct a variety of financial transactions, set up alerts and notifications when bills are due, and make electronic transfers to pay these bills. Many banks offer applications (apps) that can be downloaded for free on smart phones and computers that will even let the user deposit checks from any location. Consider the services available through local banks when choosing the best banking facility for the physician’s office.

Electronic Funds Transfers

Electronic funds transfers (EFTs) are electronic payments of payroll, money owed to vendors or business establishments, and payments from government agencies. EFT payments are safe, secure, efficient, and less expensive than paper checks. The biggest advantage to using EFTs is the cost savings. The U.S. government pays $1.03 to issue each check payment, but only 10.5 ¢ to issue an EFT. Many EFTs are processed through an automated clearinghouse (ACH), which is an electronic network for financial transactions in the United States. An ACH processes large volumes of debit and credit transactions in batches. Rules and regulations that govern the ACH network have been established by the National Automated Clearing House Association (NACHA) and the Federal Reserve. The Federal Reserve banks, as a group, are the nation’s largest clearinghouse operator. The Electronic Payments Network (EPN) is the only private-sector ACH in the country. Electronic processing becomes more prevalent each day, and business transactions are processed faster and more efficiently through electronic means. More information about clearinghouses can be found later in this chapter.

Checks

A check is a bank draft or order to pay a certain sum of money, payable on demand, to a specified person or entity. The concept of writing and depositing checks as a method of conducting financial transactions dates back as far as the Roman Empire. The word “check” was coined in England, where serial numbers were marked on these written orders of payment as a way to “check” on them. About 90% of all financial transactions in the United States are said to be accomplished by check.

A check is considered a negotiable instrument. For a check to be negotiable, it must:

• Be written and signed by a maker

• Contain a promise or order to pay a sum of money

• Be payable on demand or at a fixed future date

Debit Cards

The use of debit cards has vastly increased in the United States. Most debit cards are connected to a checking account. When the debit card is used, the amount of the transaction is immediately withdrawn from the available balance in the account. A pin number is assigned to the card for cash withdrawal and point of sale (POS) purchases. The cards usually have a MasterCard or Visa designation and can be used wherever those credit cards are accepted. The account can still be overdrawn, and in most situations, when there are not enough funds in the account to make a purchase, the card will be denied unless there is some type of overdraft protection on the account. Substantial fees may be charged if the bank elects to pay the debit when there are not enough available funds. Some banks now decline debit card charges at the point of sale when there are not sufficient funds in the account to pay the charge and do not charge any insufficient funds fees toward the attempted purchase. Stay abreast of recent banking legislation and always follow office policy when accepting debit cards as payment for medical services. The medical assistant may see various types of debit cards in the physician’s office. Many states issue a debit card to individuals receiving child support payments or some types of state financial assistance.

Types of Checks

Medical assistants probably are familiar with the standard personal check, but many other types of checks also are used in business transactions.

Bank Draft

A bank draft is a check drawn by a bank against funds deposited to its account in another bank.

Cashier’s Check

A cashier’s check is a bank’s own check drawn on itself and signed by the bank cashier or other authorized official. It is also known as an officer’s or treasurer’s check. A cashier’s check is obtained by paying the bank cashier the amount of the check, in cash or by personal check. Many banks charge a fee for this service. Cashier’s checks often are issued to accommodate a savings account customer who does not keep a checking account.

Limited Check

A check may be limited in the amount written on it and the time during which it may be presented for payment (e.g., 30, 60, or 90 days). A limited check often is used for payroll or insurance checks.

Money Order

Domestic money orders are sold by banks, some stores, and the U.S. Postal Service. Money orders often are used to pay bills by mail when a person does not have a checking account. The maximum face value varies, depending on the source. International money orders may be purchased for limited amounts, indicated in U.S. dollars, to send money abroad.

Traveler’s Check

Traveler’s checks, available at most banks, are designed for people who are traveling, because personal checks may not be accepted or carrying a large amount of cash might be inadvisable. Traveler’s checks usually are printed in denominations of $10, $20, $50, and $100 and sometimes $500 and $1,000. They require two signatures from the purchaser, one at the time of purchase and the other at the time of use. The use of traveler’s checks is becoming less common, because debit and credit cards are widely accepted throughout the world. However, the medical assistant may be presented with a traveler’s check if a patient is on vacation or out of town and has a medical emergency. Follow office policy when determining whether this form of payment is acceptable.

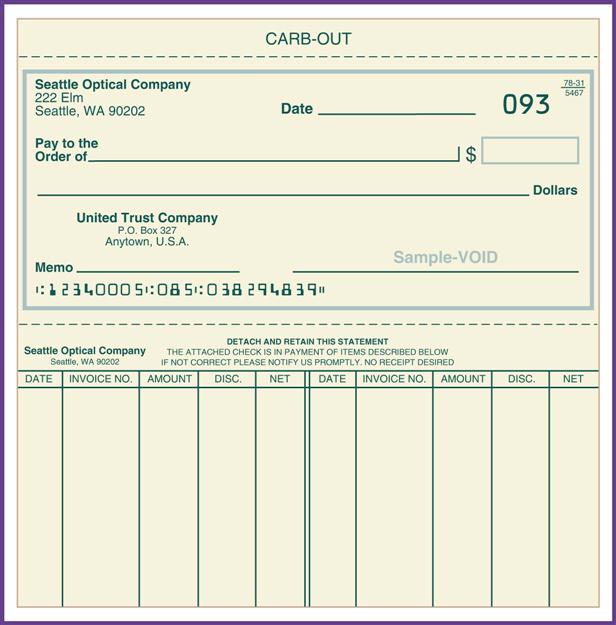

Voucher Check

A voucher check has a detachable voucher form. The voucher portion is used to itemize or specify the purpose for which the check is drawn. It is used for the convenience of the payer and shows discounts and various other itemizations. This portion of the check, which is removed before the check is presented for payment, provides a record for the payee (Figure 23-1). Some government agencies use voucher checks to make various types of payments.

The Banking System

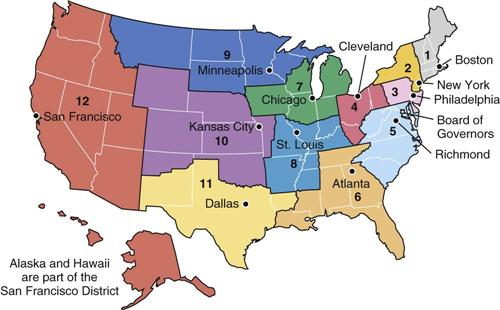

The Federal Reserve

Wanting to provide the nation with a safer, more flexible, and stable monetary and financial system, Congress created the Federal Reserve in 1913 as the central bank of the United States. It consists of a seven-member Board of Governors with headquarters in Washington, D.C., and 12 Federal Reserve banks in major cities throughout the country (Figure 23-2). For additional information on the Federal Reserve System and its regional banks, visit its Web site at www.federalreserve.gov.

Routing and Account Numbers

A routing transit number (RTN) is a nine-digit code printed on the bottom left side of checks or other negotiable instruments. It identifies the bank upon which the check was drawn. Routing numbers also are used for direct deposits and bank wiring. The first two digits indicate the Federal Reserve district where the bank is located. The third digit indicates the particular district office, and the rest of the digits represent the individual bank identification number. Electronic payments can be made using the routing and account numbers and are processed at banks like regular checks.

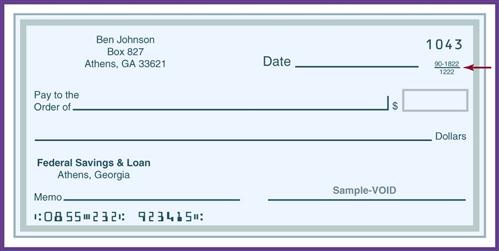

American Bankers Association Number

The American Bankers Association (ABA) number appears in the upper right area of a printed check. The number is used as a simple means of identifying the area location of the bank on which the check is written and the particular bank in that area. The code number is expressed as a fraction (Figure 23-3):

In the top part of the fraction, before the hyphen, the numbers 1 to 49 designate cities in which Federal Reserve banks are located or other key cities; the numbers 50 to 99 refer to states or territories. The part of the number following the hyphen is a number issued to each bank for its own identification purposes. The bottom part of the fraction includes the number of the Federal Reserve district where the bank is located and other identifying information. The ABA number is used to prepare deposit slips and to identify each check.

How Checks Are Processed

When a check is presented for payment, the drawee (the bank or facility on which the check is drawn or written) pays the specified sum of money written on the face of the check to the holder (the person presenting the check for payment). Checks received by the bank are turned over daily to a regional clearinghouse, which cancels each one by stamping, mechanically punching, or embossing them. The identifying code numbers, printed on the face of the check with magnetic ink, enable this “clearing” process to be accomplished quickly and efficiently. Checks due from and to all banks outside a specific region are settled by means of computerized entries. The cancelled check is either kept by the financial institution or returned to the drawer (the person who wrote the check). Many banks no longer provide cancelled checks on a regular basis. If the drawer needs proof of payment, a copy of the check can be requested from the bank if the checks are not returned in the monthly bank statement.

Clearinghouses

As the use of checks increased, the system became confusing, because so many different banks were involved. At first, messengers were used for collection; however, this involved a lot of traveling and carrying a lot of cash. Then, in a London coffee shop, a solution came about when two bank messengers who were discussing the shortcomings of the system realized they had checks for each other. They decided to exchange them and save some time and effort. This practice evolved into a system of check clearinghouses, or networks of banks that exchange checks, which is still in use. Banks in the United States can present checks to the Federal Reserve System or private clearinghouses for regional and national check collection.

Magnetic Ink Character Recognition

As mentioned, characters and numbers printed in magnetic ink are found at the bottom of checks. They represent a common machine language, readable both by machines and humans. When a check is deposited, the amount of the check also can be printed in magnetic ink below the signature. Magnetic ink character recognition (MICR) identification facilitates processing through a high-speed machine that reads the characters, sorts the checks, and does the bookkeeping.

Bank Accounts

Common Types of Accounts

Checking Accounts

By placing an amount of money on deposit in a bank, a depositor can set up a checking account. Simply stated, a checking account is a bank account against which checks can be written. Many variations in checking accounts have been developed over the years. Instead of a straight, non-interest-bearing account, an individual might have an insured money market checking account, which bears interest at the daily money market rate if a certain minimum balance is maintained. However, most banks do not offer interest-bearing checking accounts for businesses.

A physician often requires three different checking accounts:

The medical assistant most likely will deal only with the office checking account.

Savings Accounts

Money that is not needed for current expenses can be deposited in a savings account. In most cases, savings accounts earn interest on the amounts deposited; that is, the bank pays the depositor a certain percentage monthly or quarterly to use the money in the savings account. An ordinary savings account draws interest at the lowest prevailing rate and has no minimum balance requirement and no check-writing privileges. A physician may deposit a certain percentage of income into a savings account each month.

Interest-Bearing Accounts

Interest is a charge (or payment) in exchange for the use of money. It usually is figured as a percentage of the principal. Simple interest is computed annually; compound interest is figured on the principal and on any previous interest that has been added to the original sum of money and can be computed using a variety of time increments (e.g., daily, monthly, quarterly, and so on). Interest-bearing checking accounts draw a small amount of interest, usually 1% or 2%, on the average daily balance. Savings accounts normally pay a higher rate of interest than checking accounts (e.g., 2% to 3%). However, these rates fluctuate with the financial market.

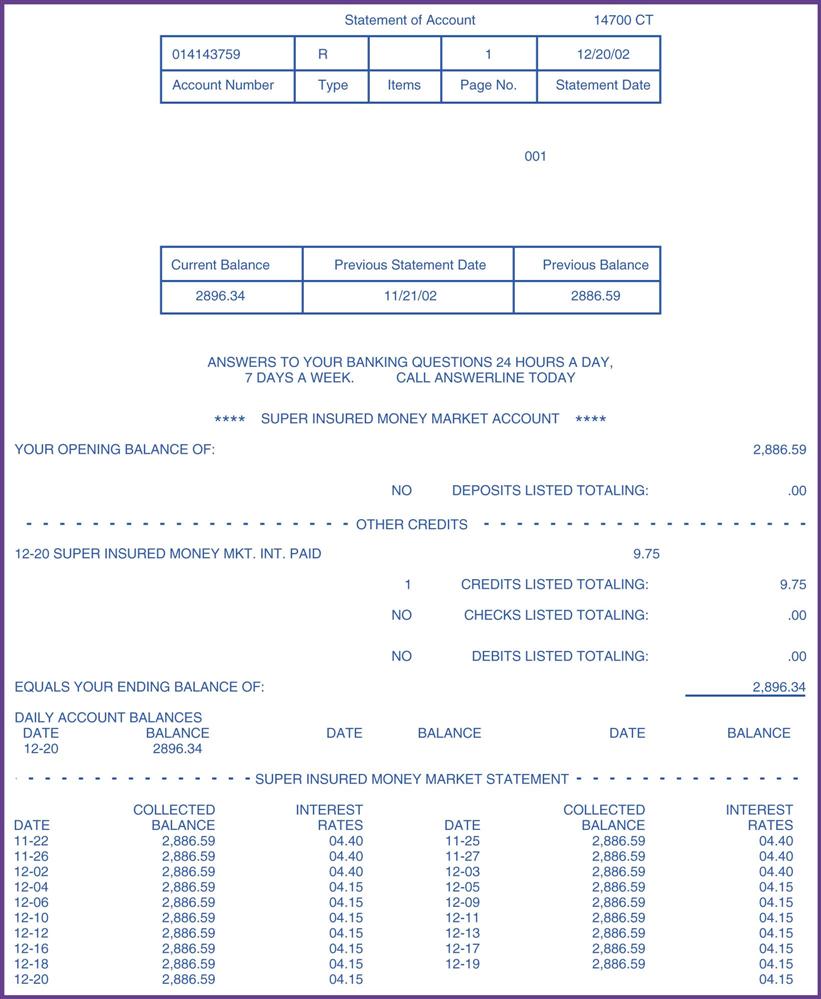

Money Market Savings Account

An insured money market savings account requires a minimum balance, anywhere from $500 to $5,000; it draws interest at money market rates (usually a higher percentage rate than for a regular savings account); and it allows a specified number of checks (frequently three) to be written per month. A minimum fee may be charged for each transaction. Such checks usually are written to transfer funds to a checking account. Some businesses transfer excess funds from the business checking account to a money market account over the weekend or over an extended holiday period to draw interest on the funds (Figure 23-4).

Individual Retirement Accounts

Individual retirement accounts (IRAs) are a type of individual savings plan that are allowed special tax treatment at the federal and sometimes the state level. This tax-favored status distinguishes an IRA from an ordinary savings account; specific rules must be followed to qualify for the tax savings. IRA rules are stricter than those for ordinary savings accounts.

Physicians and healthcare organizations may offer their employees an IRA. Several different types of IRAs are available (e.g., traditional, Roth, and education). For several reasons, IRAs often are used as a means of preparing for retirement:

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree